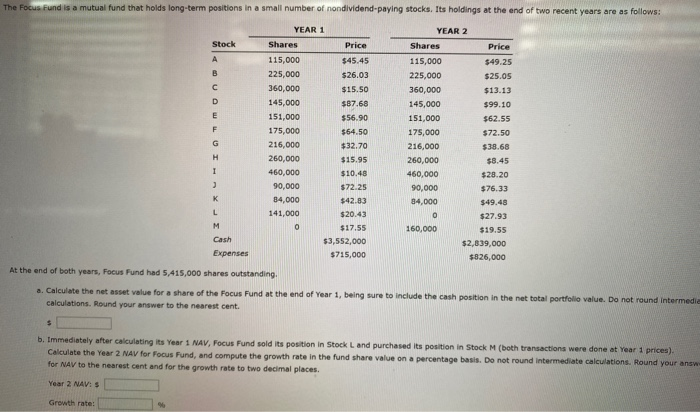

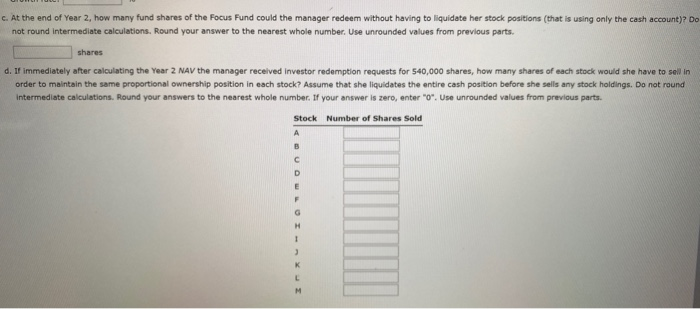

The Focus fund is a mutual fund that holds long-term positions in a small number of nondividend paying stocks. Its holdings at the end of two recent years are as follows: Stock YEAR 1 Shares Price 115,000 $45.45 225,000 $26.03 360,000 $15.50 145,000 $87.68 151,000 $56.90 175,000 $54.50 216,000 $32.70 260,000 $15.95 460,000 $10.48 90,000 $72.25 84,000 $42.83 141,000 $20.43 $17.55 $3,552,000 $715,000 YEAR 2 Shares Price 115,000 $49.25 225,000 $25.05 360,000 $13.13 145,000 $99.10 151,000 $62.55 175,000 $72.50 216,000 $38.68 260,000 $8.45 460,000 $20.20 90,000 $76,33 84,000 $49.48 $27.93 160,000 $19.55 $2,639,000 $826,000 Cash Expenses At the end of both years, Focus Fund had 5,415,000 shares outstanding . Calculate the net asset value for a share of the Focus Fund at the end of Year 1, being sure to include the cash position in the net total portfolio value. Do not round intermedia calculations. Round your answer to the nearest cent. b. Immediately after calculating its Year 1 NAV, Focus Fund sold its position in Stock Land purchased its position in Stock M (both transactions were done at Year 1 prices). Calculate the Year 2 NAV for Focus Fund, and compute the growth rate in the fund share value on a percentage basis. Do not round Intermediate calculations. Round your answ for NAV to the nearest cent and for the growth rate to two decimal places Year 2 NAV Growth rate: c. At the end of Year 2, how many fund shares of the Focus Fund could the manager redeem without having to liquidate her stock positions (that is using only the cash account)? Do not round Intermediate calculations. Round your answer to the nearest whole number. Use unrounded values from previous parts. shares d. If immediately after calculating the Year 2 NAV the manager received investor redemption requests for 540,000 shares, how many shares of each stock would she have to sell in order to maintain the same proportional ownership position in each stock? Assume that she liquidates the entire cash position before she sells any stock holdings. Do not round Intermediate calculations. Round your answers to the nearest whole number. If your answer is zero, enter "0". Use unrounded values from previous parts. Stock Number of shares Sold