Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The followinf transactions occured The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per

The followinf transactions occured

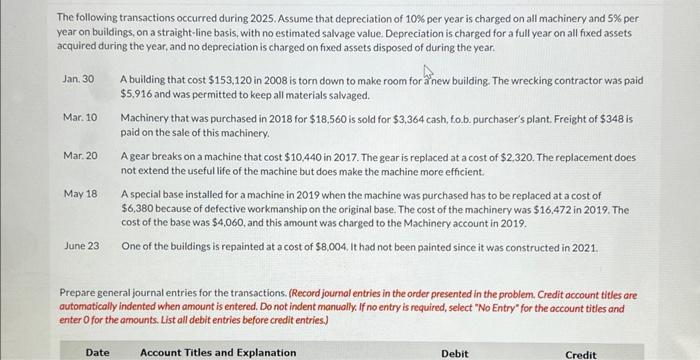

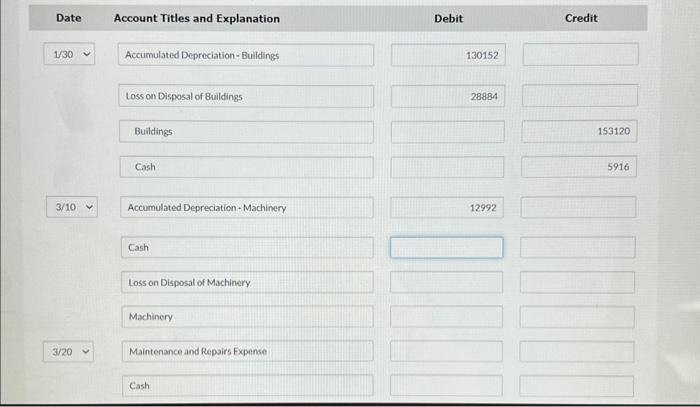

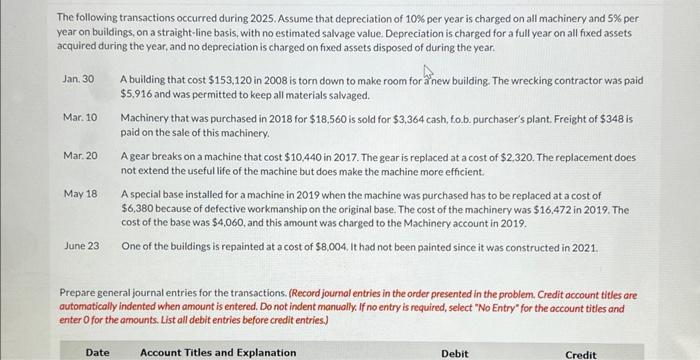

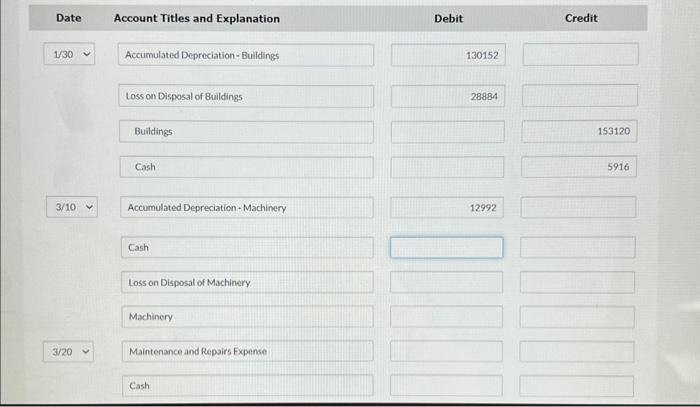

The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all fixed assets acquired during the year, and no depreciation is charged on fixed assets disposed of during the year. Jan.30 A building that cost $153,120 in 2008 is torn down to make room for annew building. The wrecking contractor was paid $5,916 and was permitted to keep all materials salvaged. Mar. 10 Machinery that was purchased in 2018 for $18.560 is sold for $3,364 cash, fo.b. purchaser's plant. Freight of $348 is paid on the sale of this machinery. Mar. 20 A gear breaks on a machine that cost $10,440 in 2017. The gear is replaced at a cost of $2,320. The replacement does not extend the useful life of the machine but does make the machine more efficient. May 18 A special base installed for a machine in 2019 when the machine was purchased has to be replaced at a cost of $6,380 because of defective workmanship on the original base. The cost of the machinery was $16,472 in 2019 . The cost of the base was $4,060, and this amount was charged to the Machinery account in 2019. June 23 One of the buildings is repainted at a cost of $8.004, It had not been painted since it was constructed in 2021. Prepare general journal entries for the transactions. (Record joumol entries in the order presented in the problem. Credit occount titles are automatically indented when amount is entered. Do not indent manuolly. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Debit 130152 Loss on Disposal of Buildings Buildings C.ash \begin{tabular}{|l|} \hline 28884 \\ \hline 10 \\ \hline 12992 \\ \hline \end{tabular} Cash Loss on Disposal of Machinery Machinery Maintenance and Repairs Expenset Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started