Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following accounting events affected Solomon Manufacturing Company during its first three years of operation. Assume that all transactions are cash transactions. Transactions for Year

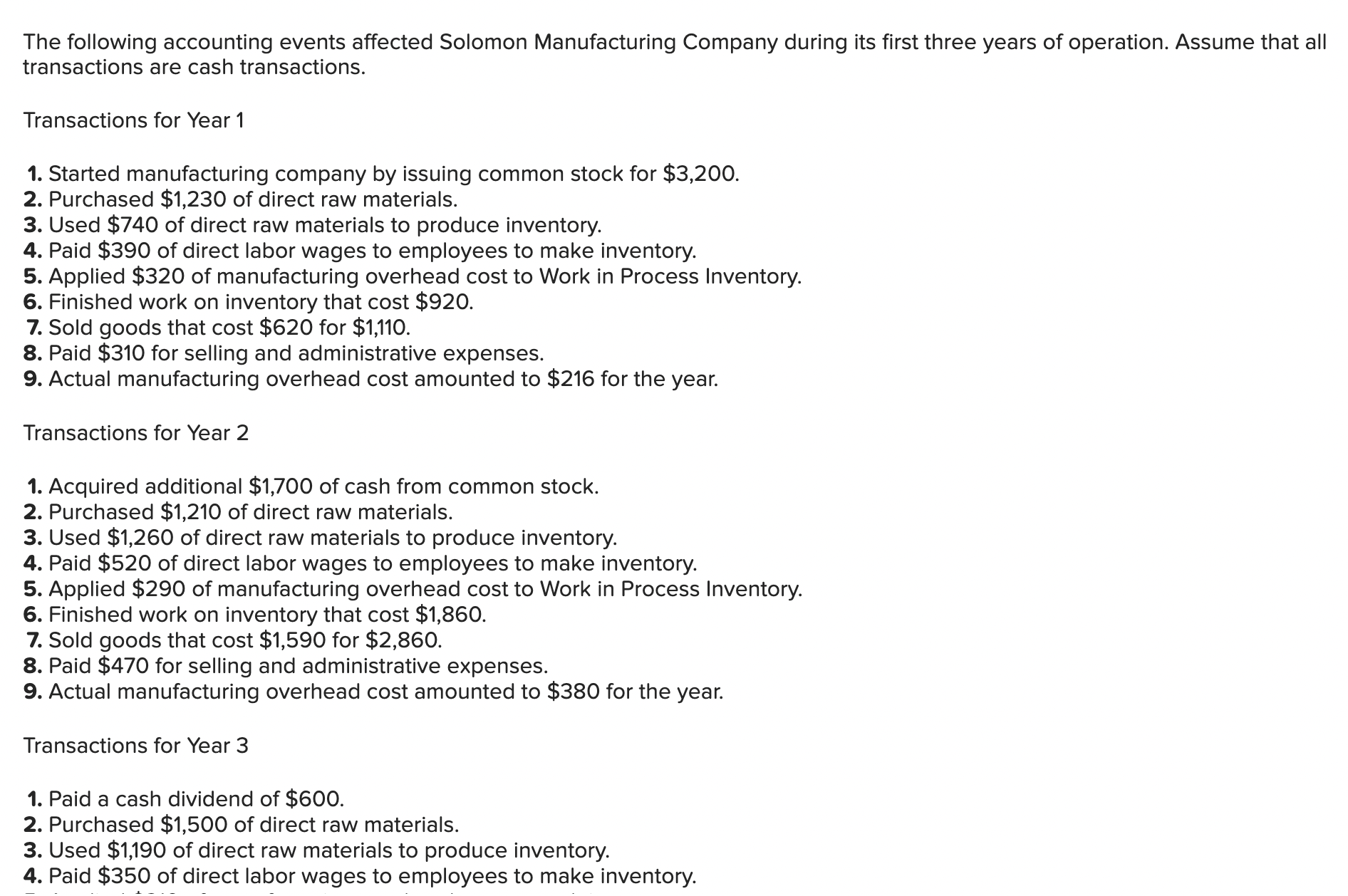

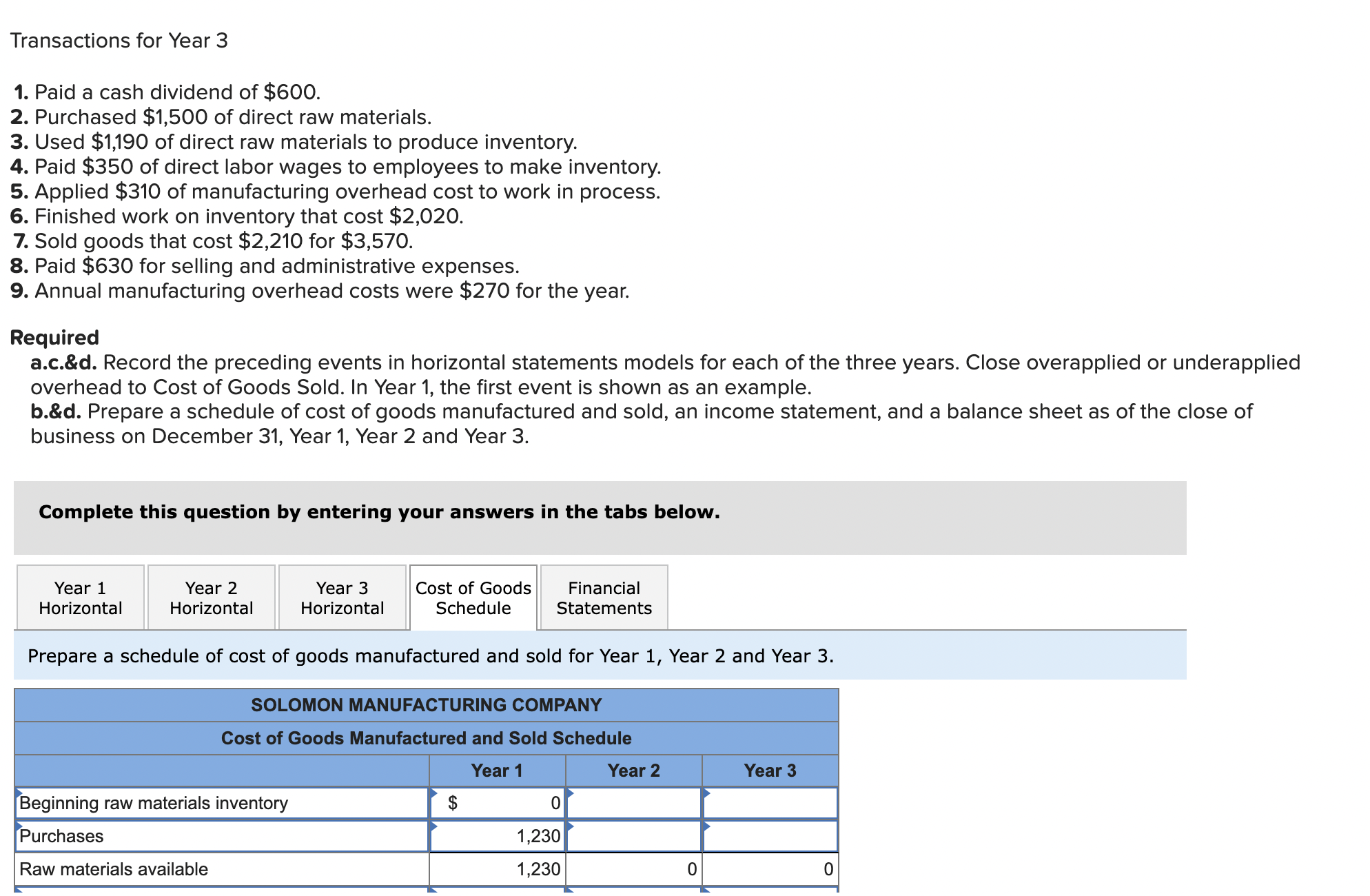

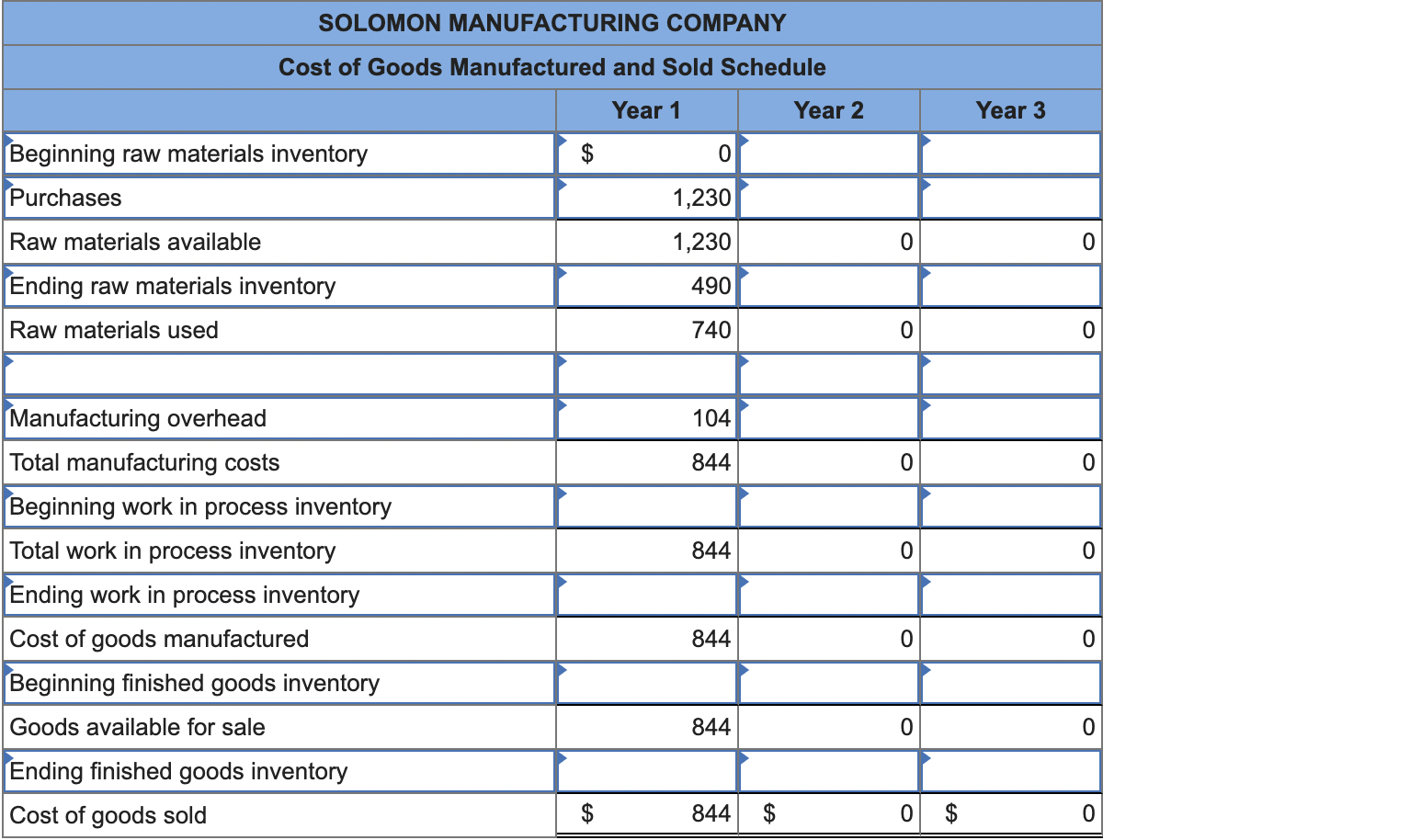

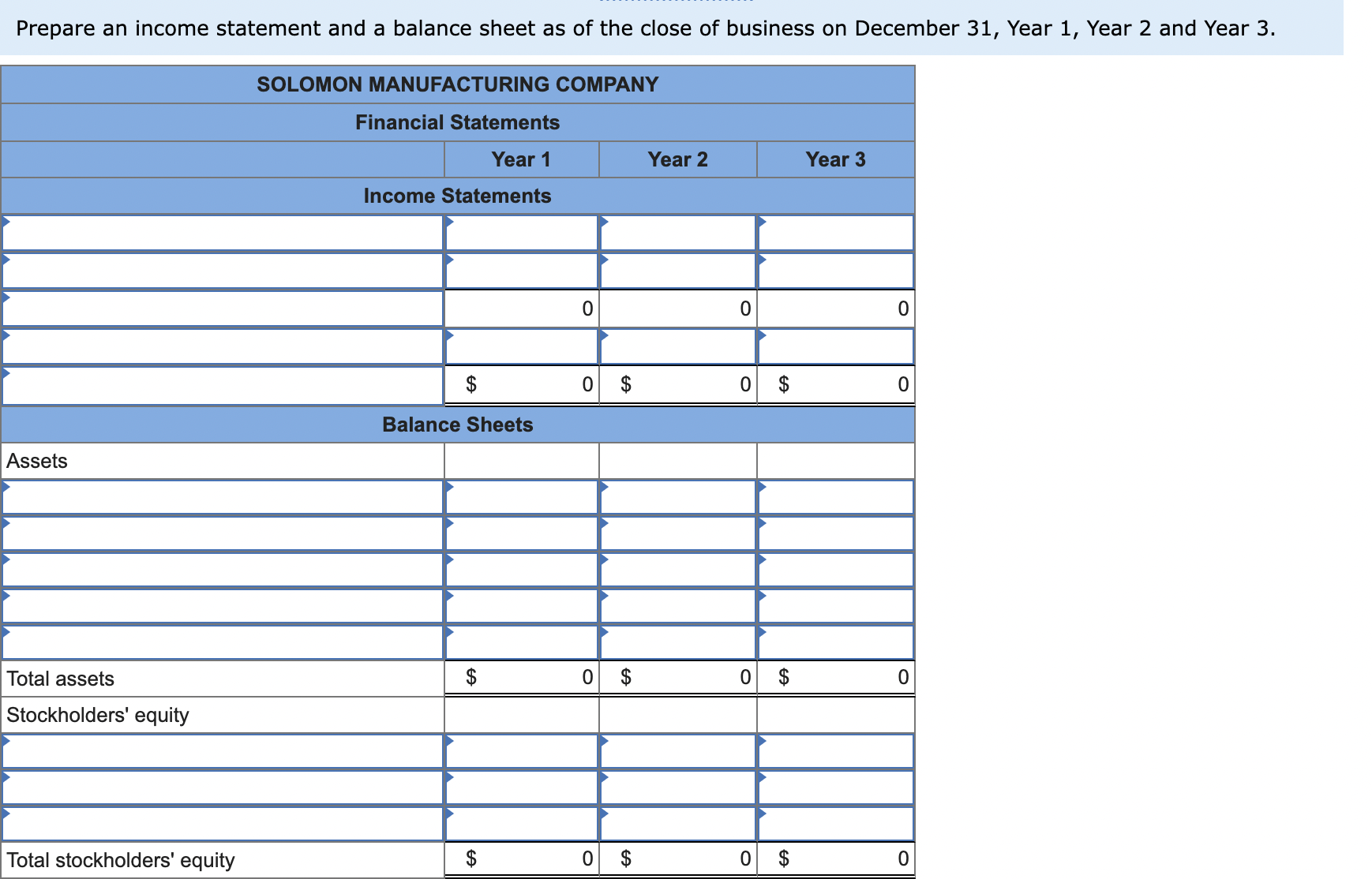

The following accounting events affected Solomon Manufacturing Company during its first three years of operation. Assume that all transactions are cash transactions. Transactions for Year 1 1. Started manufacturing company by issuing common stock for $3,200. 2. Purchased $1,230 of direct raw materials. 3. Used $740 of direct raw materials to produce inventory. 4. Paid $390 of direct labor wages to employees to make inventory. 5. Applied $320 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $920. 7. Sold goods that cost $620 for $1,110. 8. Paid $310 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $216 for the year. Transactions for Year 2 1. Acquired additional $1,700 of cash from common stock. 2. Purchased $1,210 of direct raw materials. 3. Used $1,260 of direct raw materials to produce inventory. 4. Paid $520 of direct labor wages to employees to make inventory. 5. Applied $290 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $1,860. 7. Sold goods that cost $1,590 for $2,860. 8. Paid $470 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $380 for the year. Transactions for Year 3 1. Paid a cash dividend of $600. 2. Purchased $1,500 of direct raw materials. 3. Used $1,190 of direct raw materials to produce inventory. 4. Paid $350 of direct labor wages to employees to make inventory. Transactions for Year 3 1. Paid a cash dividend of $600. 2. Purchased $1,500 of direct raw materials. 3. Used $1,190 of direct raw materials to produce inventory. 4. Paid $350 of direct labor wages to employees to make inventory. 5. Applied $310 of manufacturing overhead cost to work in process. 6. Finished work on inventory that cost $2,020. 7. Sold goods that cost $2,210 for $3,570. 8. Paid $630 for selling and administrative expenses. 9. Annual manufacturing overhead costs were $270 for the year. Required a.c.\&d. Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods Sold. In Year 1, the first event is shown as an example. b.\&d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet as of the close of business on December 31, Year 1, Year 2 and Year 3. Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods manufactured and sold for Year 1, Year 2 and Year 3. SOLOMON MANUFACTURING COMPANY Cost of Goods Manufactured and Sold Schedule Prepare an income statement and a balance sheet as of the close of business on December 31, Year 1 , Year 2 and Year 3. SOLOMON MANUFACTURING COMPANY Financial Statements Year 1 Year 2 Year 3 Income Statements

The following accounting events affected Solomon Manufacturing Company during its first three years of operation. Assume that all transactions are cash transactions. Transactions for Year 1 1. Started manufacturing company by issuing common stock for $3,200. 2. Purchased $1,230 of direct raw materials. 3. Used $740 of direct raw materials to produce inventory. 4. Paid $390 of direct labor wages to employees to make inventory. 5. Applied $320 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $920. 7. Sold goods that cost $620 for $1,110. 8. Paid $310 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $216 for the year. Transactions for Year 2 1. Acquired additional $1,700 of cash from common stock. 2. Purchased $1,210 of direct raw materials. 3. Used $1,260 of direct raw materials to produce inventory. 4. Paid $520 of direct labor wages to employees to make inventory. 5. Applied $290 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $1,860. 7. Sold goods that cost $1,590 for $2,860. 8. Paid $470 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $380 for the year. Transactions for Year 3 1. Paid a cash dividend of $600. 2. Purchased $1,500 of direct raw materials. 3. Used $1,190 of direct raw materials to produce inventory. 4. Paid $350 of direct labor wages to employees to make inventory. Transactions for Year 3 1. Paid a cash dividend of $600. 2. Purchased $1,500 of direct raw materials. 3. Used $1,190 of direct raw materials to produce inventory. 4. Paid $350 of direct labor wages to employees to make inventory. 5. Applied $310 of manufacturing overhead cost to work in process. 6. Finished work on inventory that cost $2,020. 7. Sold goods that cost $2,210 for $3,570. 8. Paid $630 for selling and administrative expenses. 9. Annual manufacturing overhead costs were $270 for the year. Required a.c.\&d. Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods Sold. In Year 1, the first event is shown as an example. b.\&d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet as of the close of business on December 31, Year 1, Year 2 and Year 3. Complete this question by entering your answers in the tabs below. Prepare a schedule of cost of goods manufactured and sold for Year 1, Year 2 and Year 3. SOLOMON MANUFACTURING COMPANY Cost of Goods Manufactured and Sold Schedule Prepare an income statement and a balance sheet as of the close of business on December 31, Year 1 , Year 2 and Year 3. SOLOMON MANUFACTURING COMPANY Financial Statements Year 1 Year 2 Year 3 Income Statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started