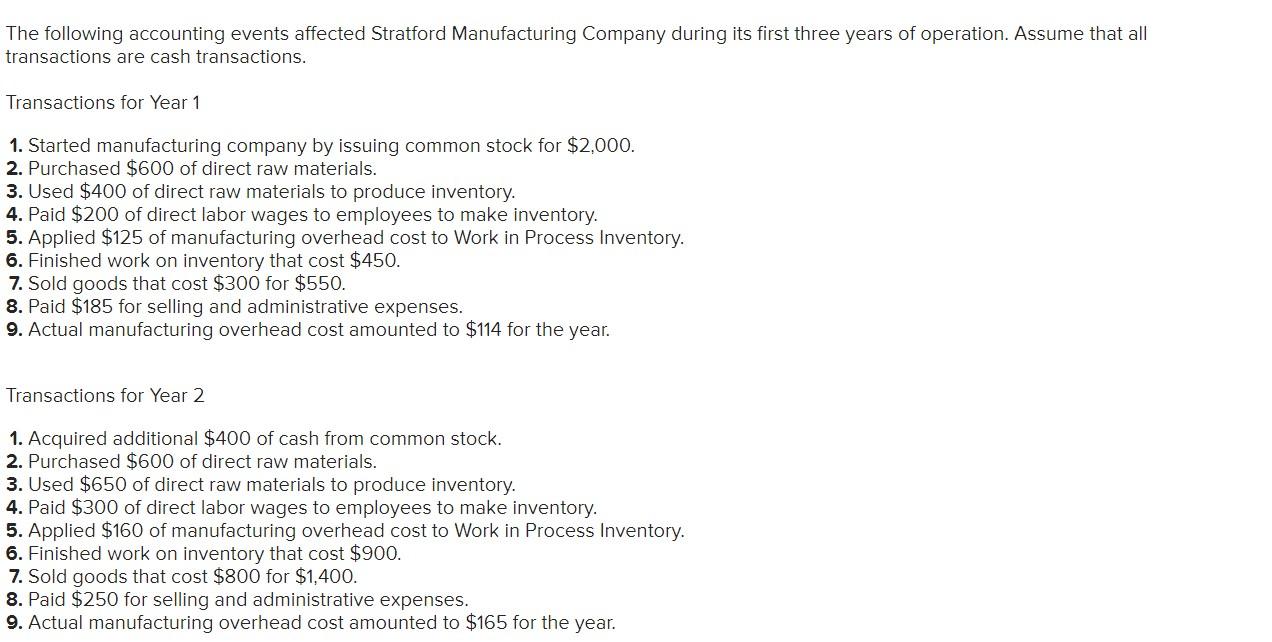

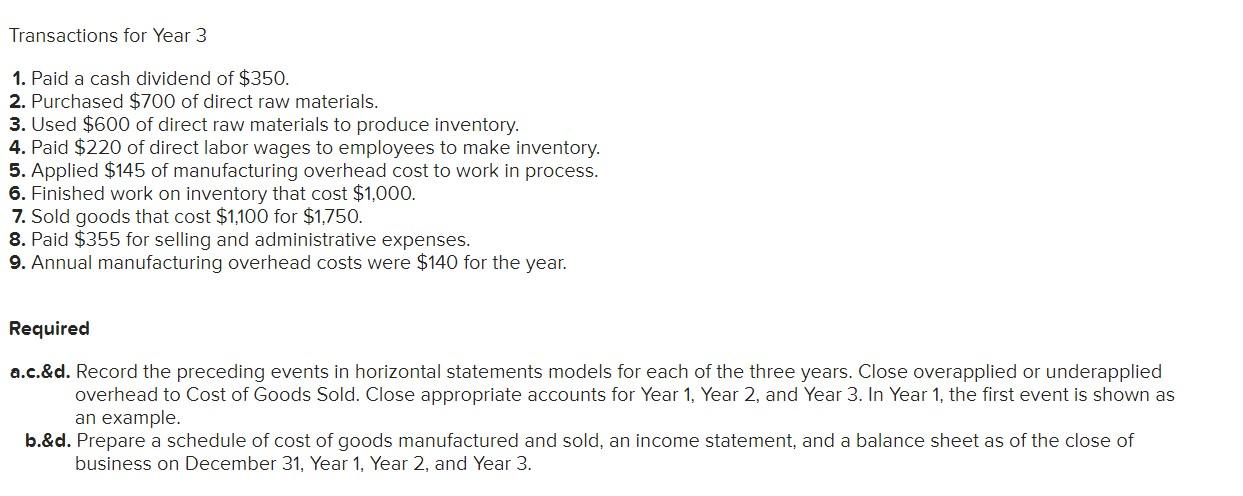

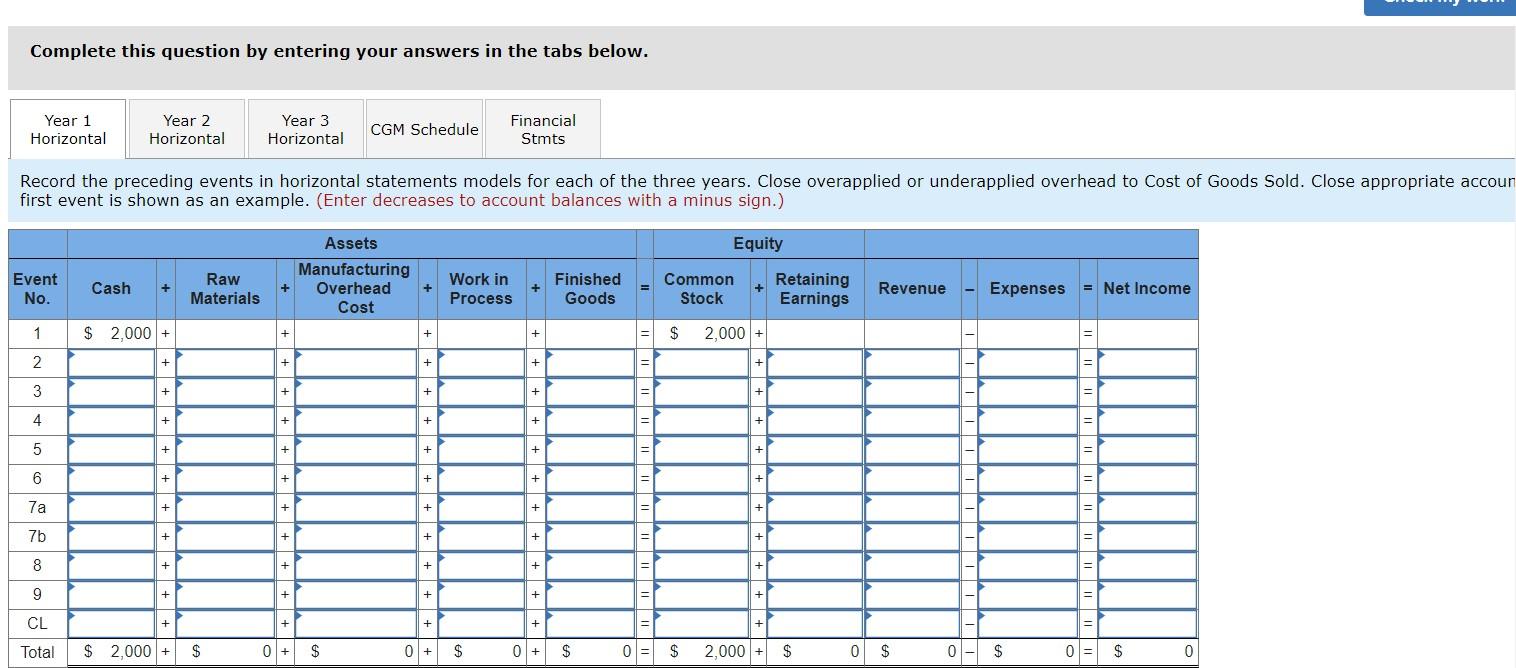

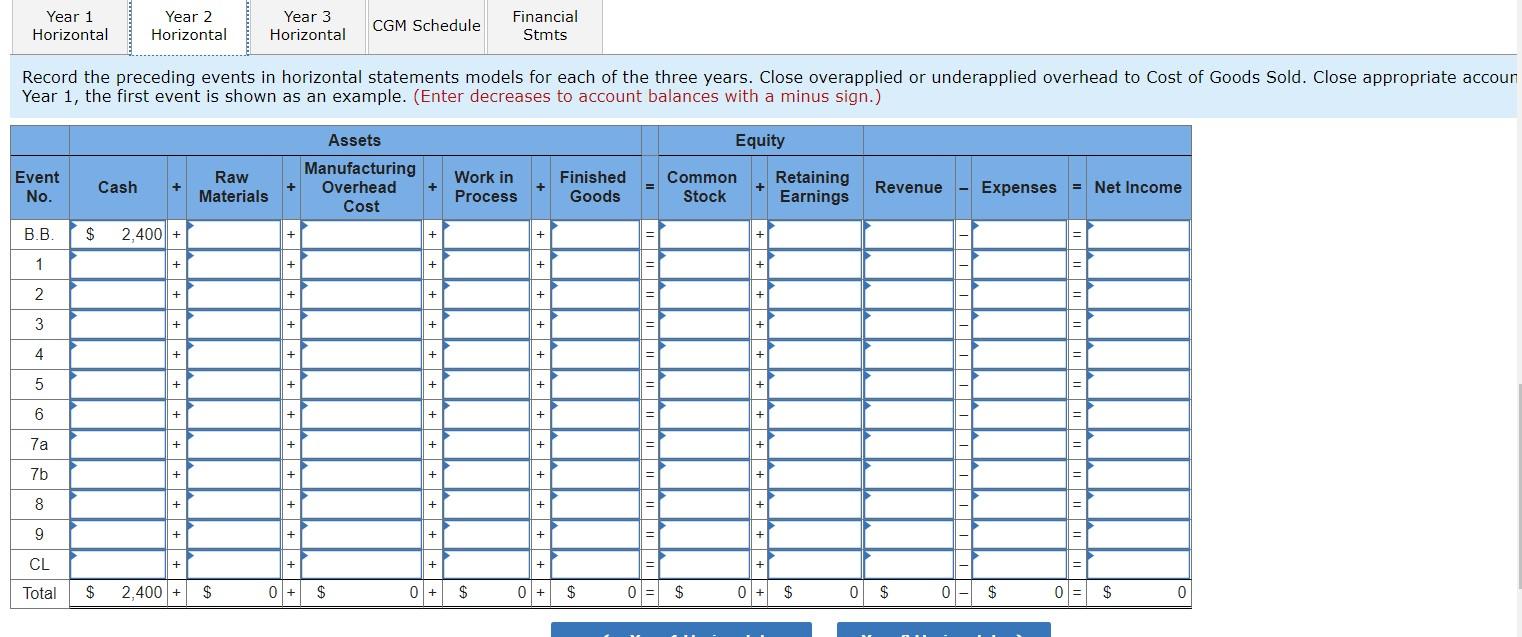

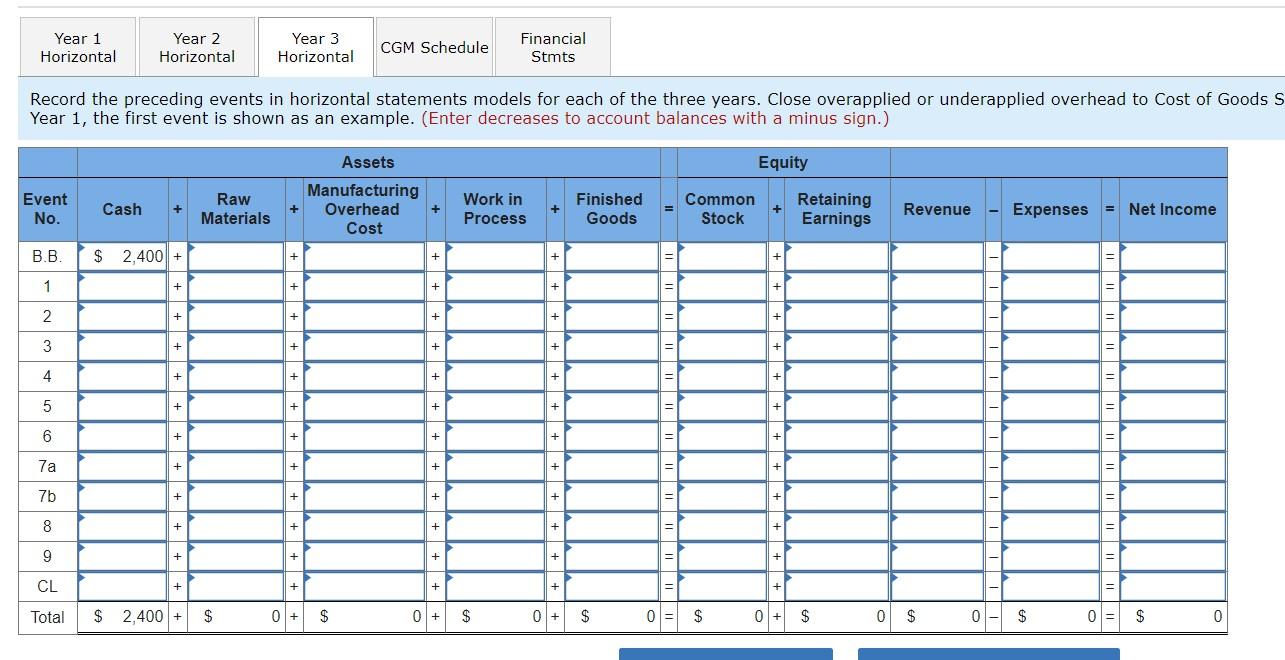

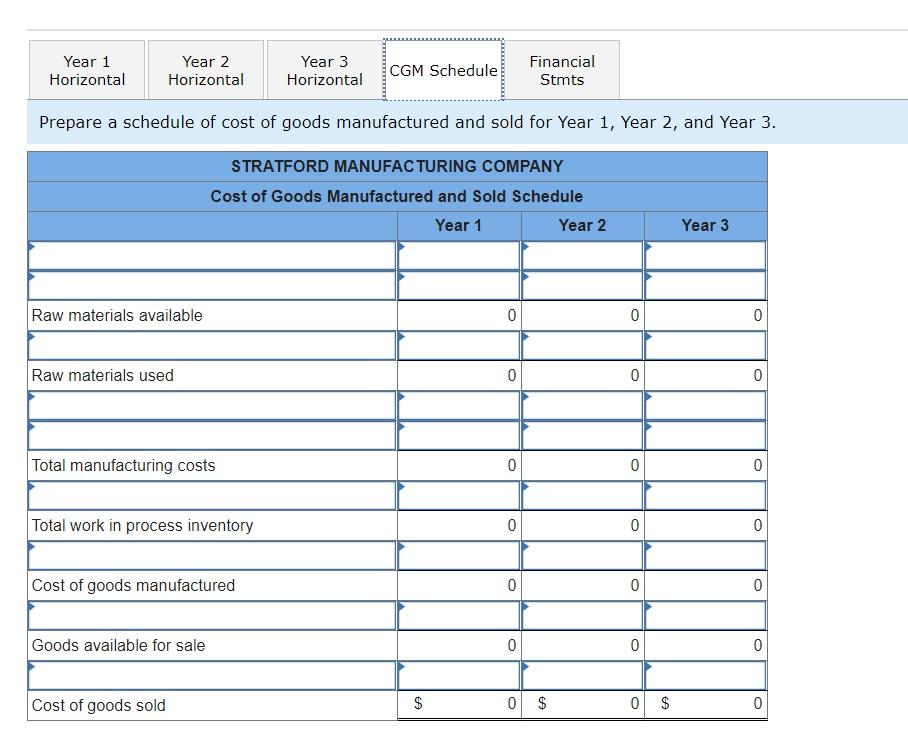

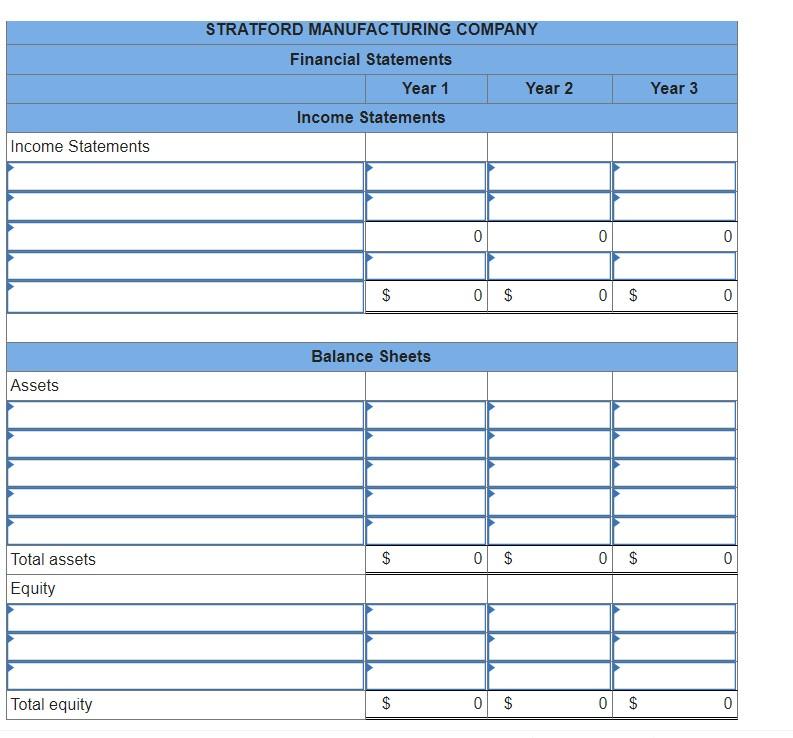

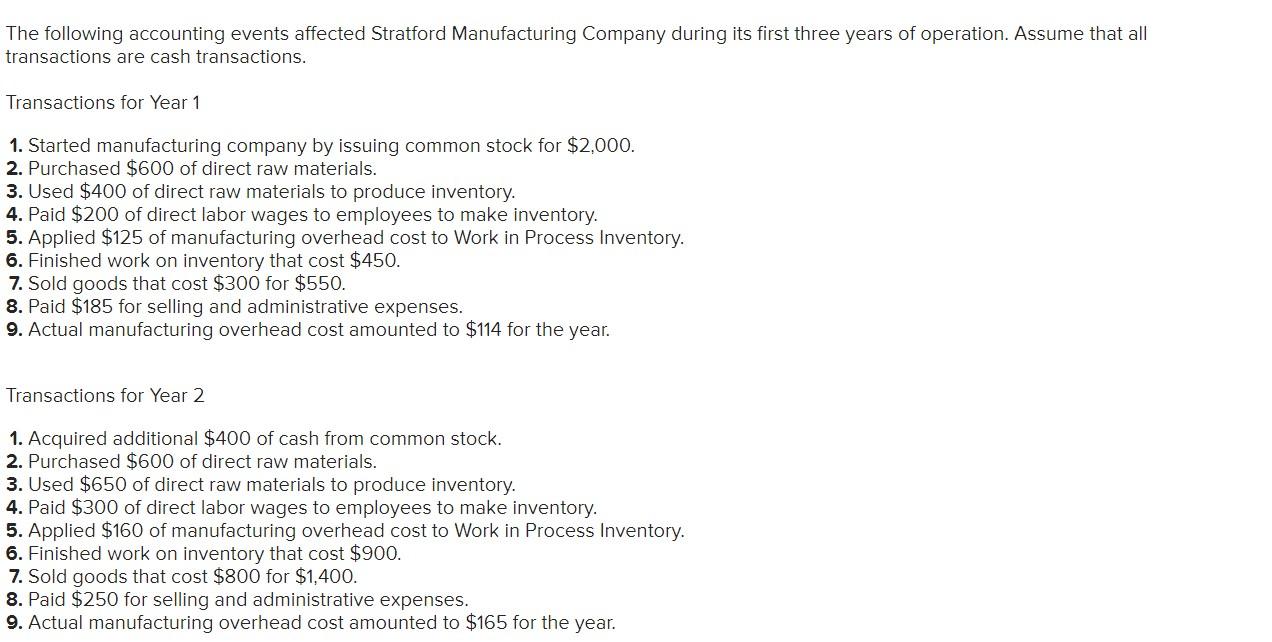

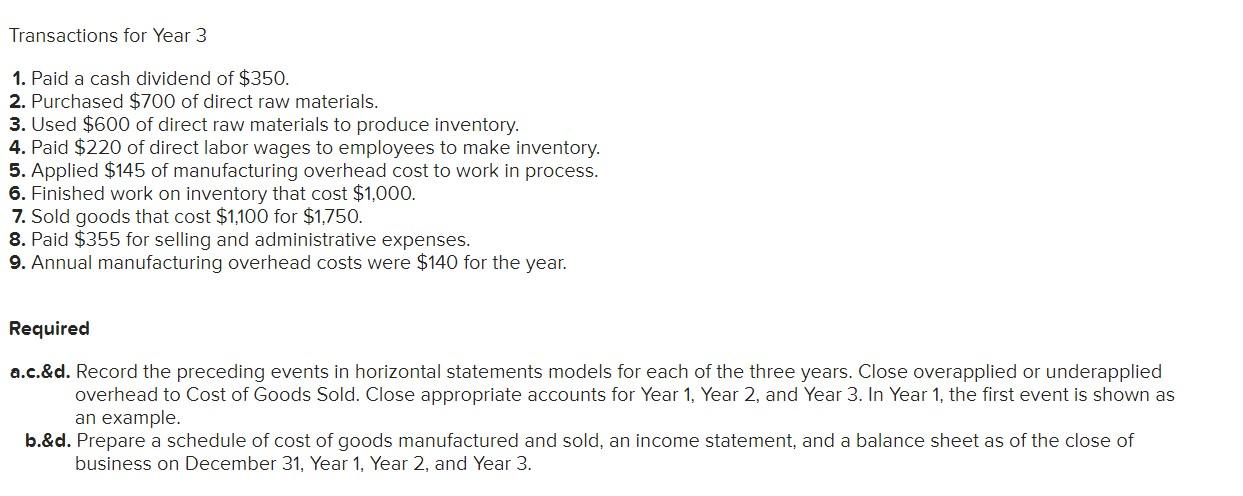

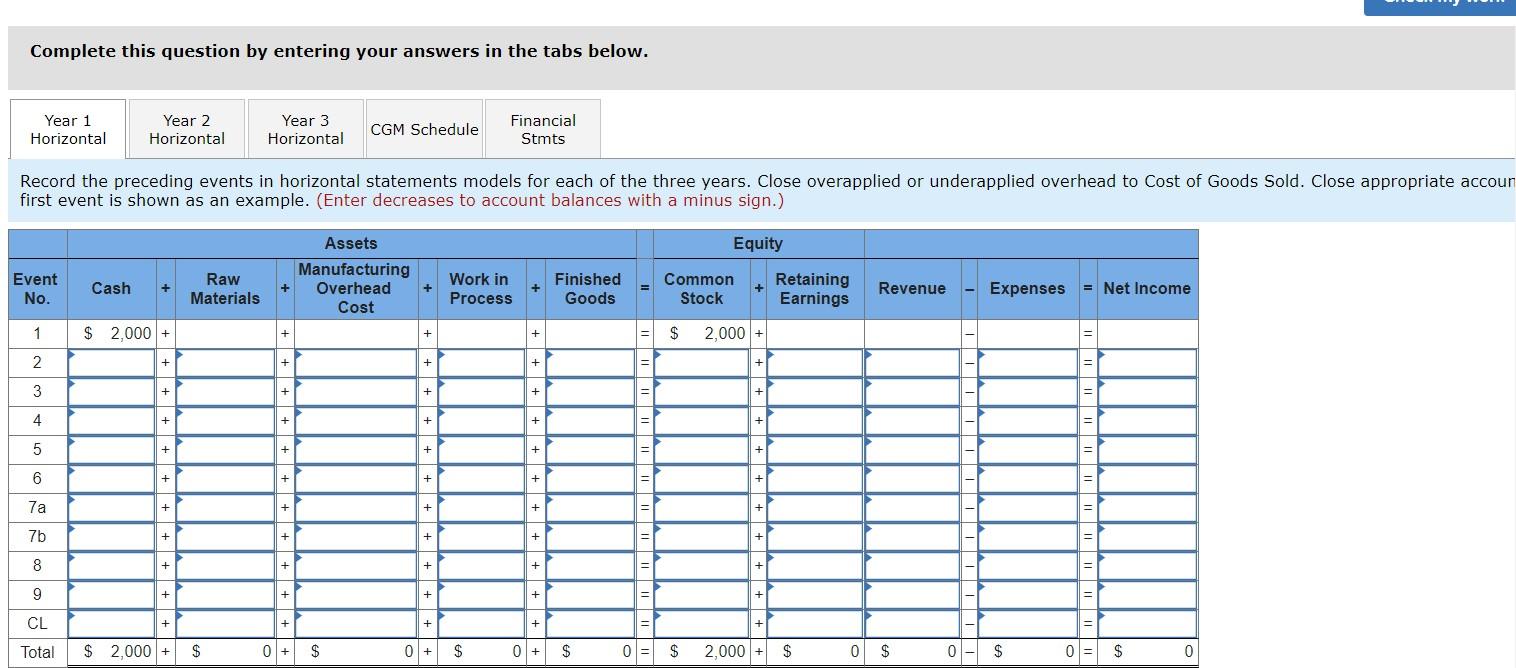

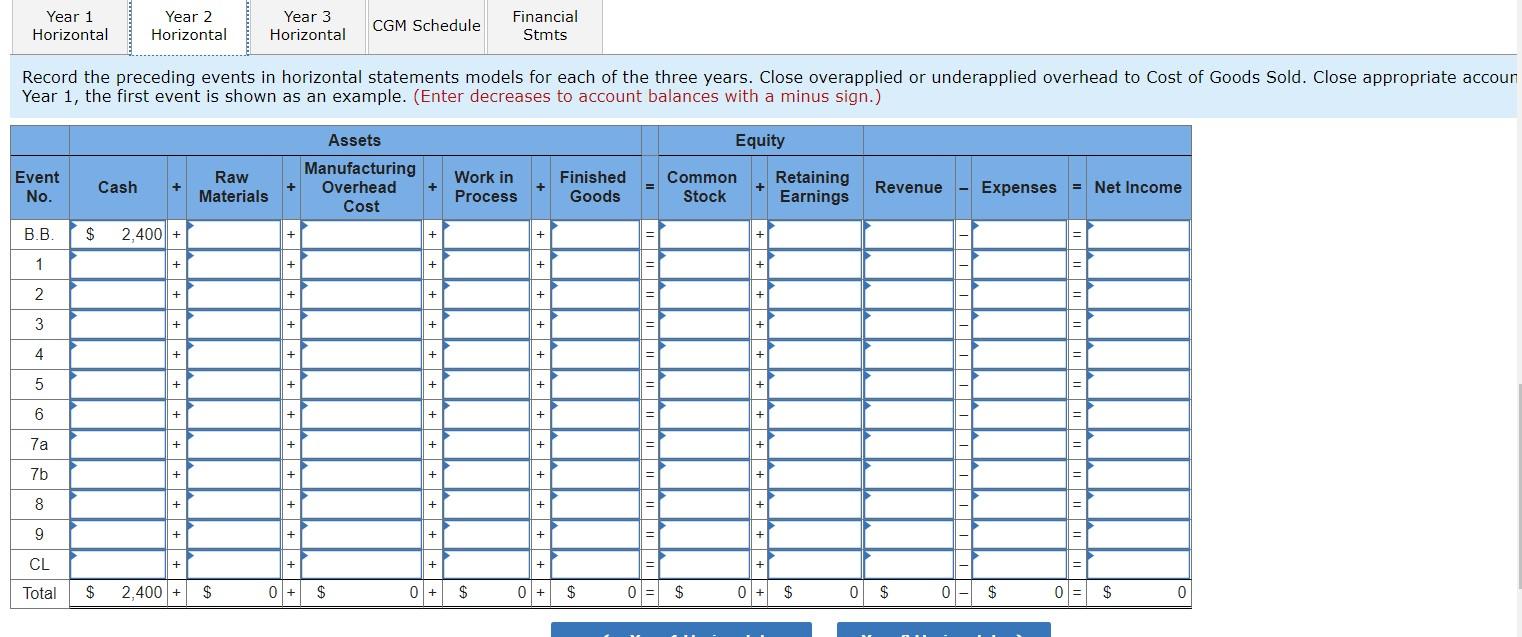

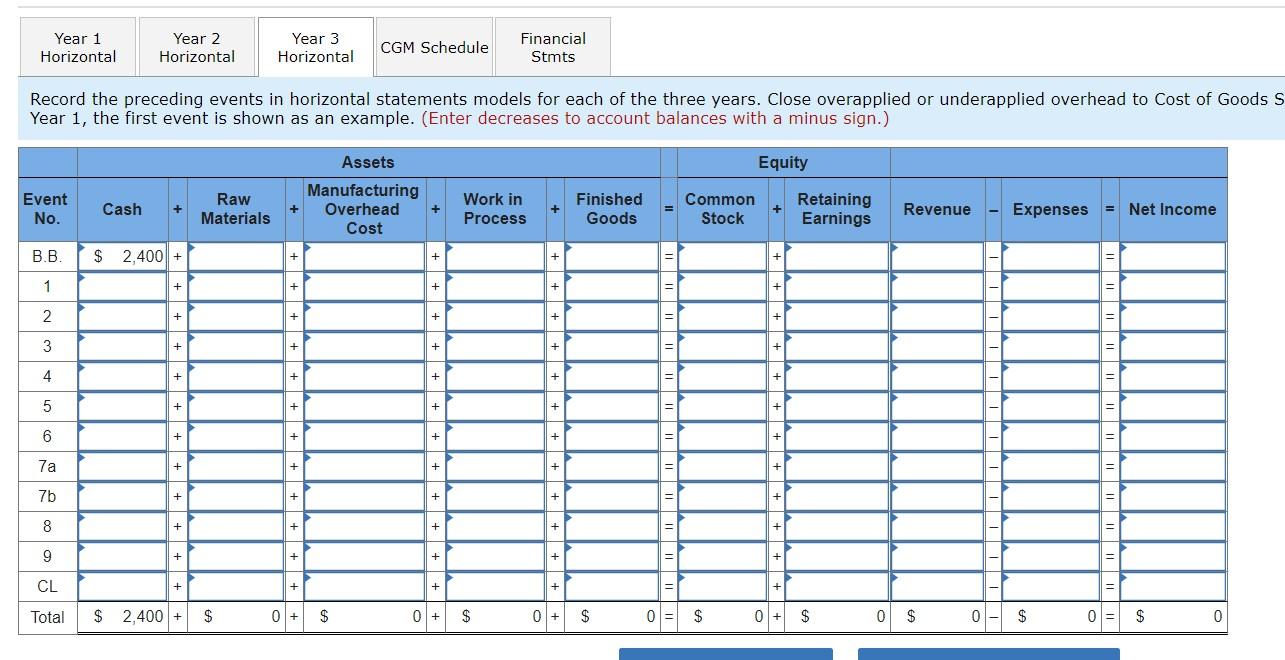

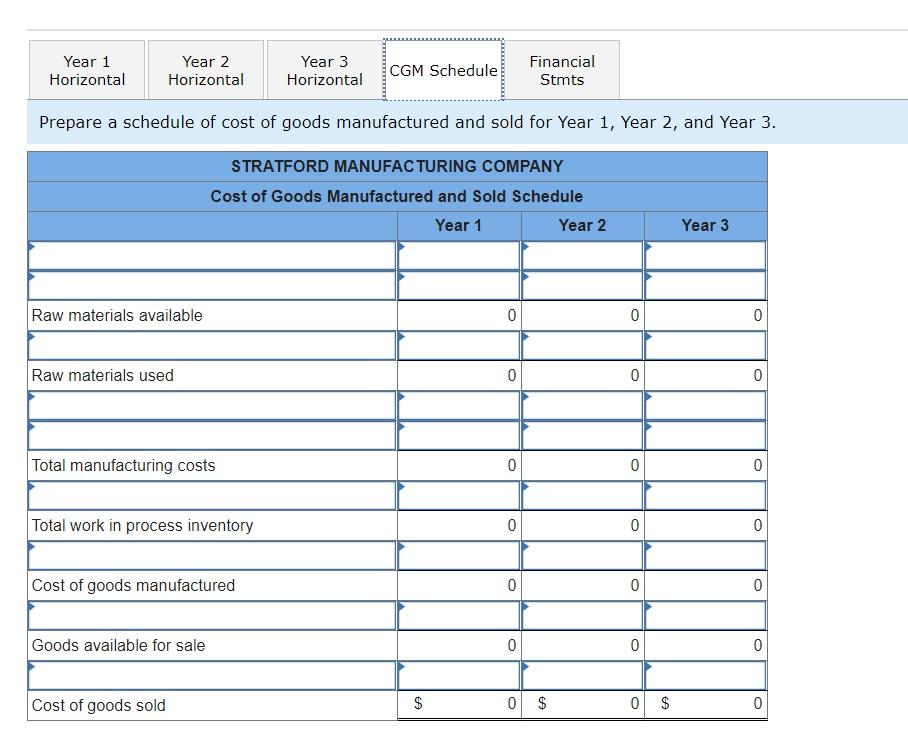

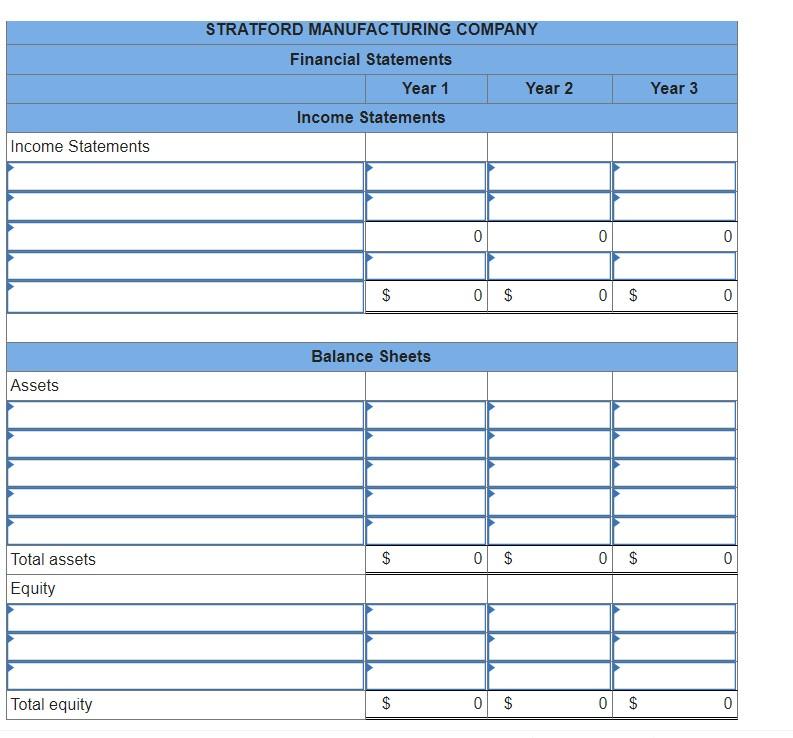

The following accounting events affected Stratford Manufacturing Company during its first three years of operation. Assume that all transactions are cash transactions. Transactions for Year 1 1. Started manufacturing company by issuing common stock for $2,000. 2. Purchased $600 of direct raw materials. 3. Used $400 of direct raw materials to produce inventory. 4. Paid $200 of direct labor wages to employees to make inventory. 5. Applied $125 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $450. 7. Sold goods that cost $300 for $550. 8. Paid $185 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $114 for the year. Transactions for Year 2 1. Acquired additional $400 of cash from common stock. 2. Purchased $600 of direct raw materials. 3. Used $650 of direct raw materials to produce inventory. 4. Paid $300 of direct labor wages to employees to make inventory. 5. Applied $160 of manufacturing overhead cost to Work in Process Inventory. 6. Finished work on inventory that cost $900. 7. Sold goods that cost $800 for $1,400. 8. Paid $250 for selling and administrative expenses. 9. Actual manufacturing overhead cost amounted to $165 for the year. Transactions for Year 3 1. Paid a cash dividend of $350. 2. Purchased $700 of direct raw materials. 3. Used $600 of direct raw materials to produce inventory. 4. Paid $220 of direct labor wages to employees to make inventory. 5. Applied $145 of manufacturing overhead cost to work in process. 6. Finished work on inventory that cost $1,000. 7. Sold goods that cost $1,100 for $1,750. 8. Paid $355 for selling and administrative expenses. 9. Annual manufacturing overhead costs were $140 for the year. Required a.c.&d. Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods Sold. Close appropriate accounts for Year 1, Year 2, and Year 3. In Year 1, the first event is shown as an example. b.&d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet as of the close of business on December 31, Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Year 1 Horizontal Year 2 Horizontal Year 3 Horizontal CGM Schedule Financial Stmts Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods Sold. Close appropriate accoun first event is shown as an example. (Enter decreases to account balances with a minus sign.) Equity Event No. Assets Manufacturing Overhead Cost Raw Materials Cash Work in Process Finished Goods Common Stock Retaining Earnings Revenue Expenses = Net Income 1 $ 2,000 + + + + $ 2,000 + 2 + + + + + 3 + + + + 4 + + + + + 5 + + + + + 6 + + + + 7a + + + + + 7b + + + + + 8 + + . + + + 9 + + + + + + + + + + CL Total $ 2,000 + $ 0 + $ 0 + $ 0 + $ 0 = $ 2,000 + $ 0 $ 0 $ 0 = $ 0 Year 1 Horizontal Year 2 Horizontal Year 3 Horizontal CGM Schedule Financial Stmts Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods Sold. Close appropriate accoun Year 1, the first event is shown as an example. (Enter decreases to account balances with a minus sign.) Equity Event No. Assets Manufacturing Overhead Cost Raw Materials Cash Work in Process Finished Goods Common Stock Retaining Earnings Revenue Expenses = Net Income B.B $ 2.400 + + + + + = 1 + + + + - - 2 + + + + + - 3 + + + + - + - 4 + + + + + + 5 + + + + + + = 6 + + + + + 7a + + + + 7b + + + + + 8 + + + + + 9 + + + + - + - 1 - CL + + + + + Total $ 2,400 + $ 0 + $ 0 + $ 0 + $ 0 = $ 0 + $ 0 $ 0 $ 0 = $ 0 Year 1 Horizontal Year 2 Horizontal Year 3 Horizontal CGM Schedule Financial Stmts Record the preceding events in horizontal statements models for each of the three years. Close overapplied or underapplied overhead to Cost of Goods S Year 1, the first event is shown as an example. (Enter decreases to account balances with a minus sign.) Equity Event No. Assets Manufacturing Overhead Cost Raw Materials Cash Work in Process Finished Goods Common Stock Retaining Earnings Revenue Expenses = Net Income B.B. $ 2,400 + + + 1 + + + + + 2 + + + + + 3 + + + + + - 4 + + + + + 5 + + + + + - 6 + + + + + 7a + + 7b + + + + + 8 + + + + + 9 + + + + + CL + + + + + Total $ 2,400 + $ 0 + $ 0 + $ 0 + $ 0 = $ 0 + $ 0 $ 0 - $ 0 = $ 0 Year 1 Horizontal Year 2 Horizontal Year 3 Horizontal CGM Schedule Financial Stmts Prepare a schedule of cost of goods manufactured and sold for Year 1, Year 2, and Year 3. STRATFORD MANUFACTURING COMPANY Cost of Goods Manufactured and Sold Schedule Year 1 Year 2 Year 3 Raw materials available 0 0 0 Raw materials used 0 0 0 Total manufacturing costs 0 0 0 Total work in process inventory 0 0 0 Cost of goods manufactured 0 0 0 0 Goods available for sale 0 0 0 Cost of goods sold $ 0 $ 0 $ 0 STRATFORD MANUFACTURING COMPANY Financial Statements Year 1 Year 2 Income Statements Year 3 Income Statements 0 0 0 $ 0 $ 0 $ 0 Balance Sheets Assets $ 0 $ 0 $ 0 Total assets Equity Total equity $ 0 $ 0 $ 0