Answered step by step

Verified Expert Solution

Question

1 Approved Answer

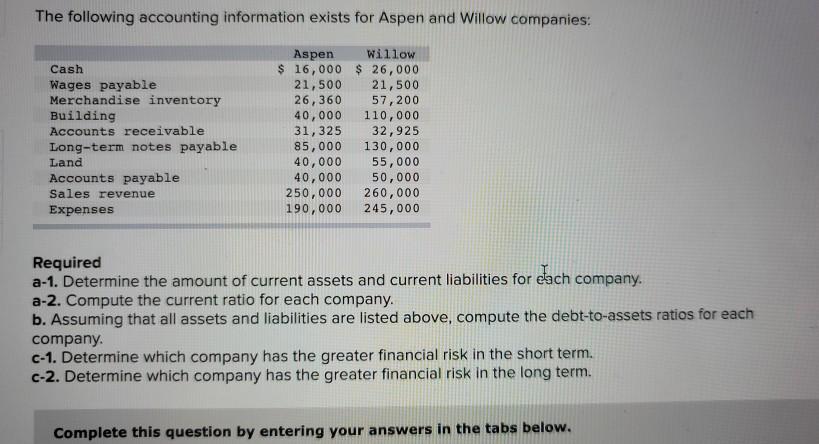

The following accounting information exists for Aspen and Willow companies: Cash Wages payable Merchandise inventory Building Accounts receivable Long-term notes payable Land Accounts payable Sales

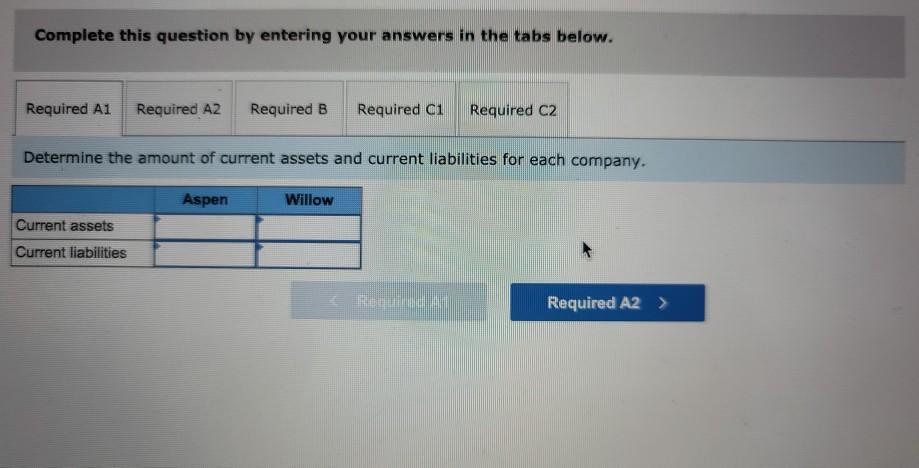

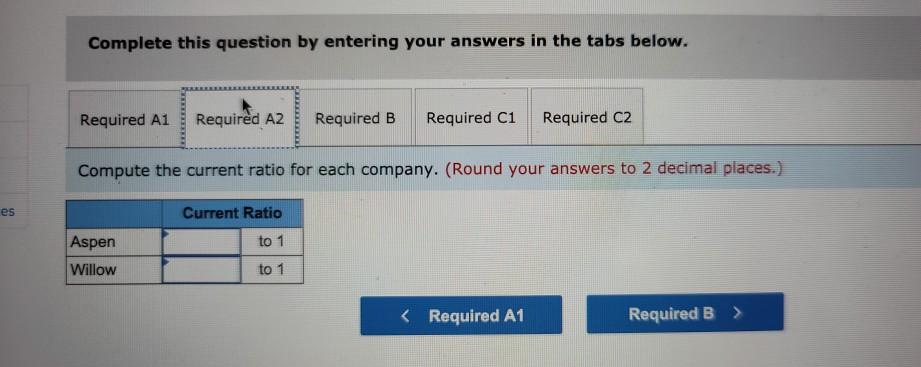

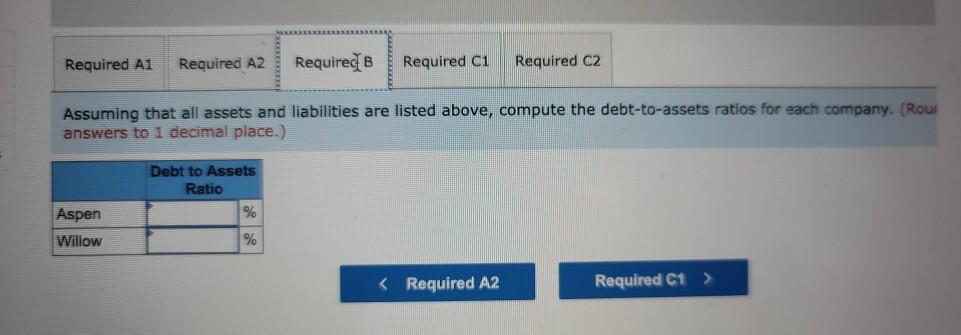

The following accounting information exists for Aspen and Willow companies: Cash Wages payable Merchandise inventory Building Accounts receivable Long-term notes payable Land Accounts payable Sales revenue Expenses Aspen Willow $ 16,000 $ 26,000 21,500 21,500 26,360 57,200 40,000 110,000 31, 325 32,925 85,000 130,000 40,000 55,000 40,000 50,000 250,000 260,000 190,000 245,000 Required a-1. Determine the amount of current assets and current liabilities for each company. a-2. Compute the current ratio for each company. b. Assuming that all assets and liabilities are listed above, compute the debt-to-assets ratios for each company c-1. Determine which company has the greater financial risk in the short term. c-2. Determine which company has the greater financial risk in the long term. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required A1 Required AZ Required B Required ci Required C2 Determine the amount of current assets and current liabilities for each company. Aspen Willow Current assets Current liabilities Required A2 > Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Required C1 Required C2 Compute the current ratio for each company. (Round your answers to 2 decimal places.) es Current Ratio to 1 Aspen Willow to 1 Required A1 Required A2 Required B Required ci Required C2 Assuming that all assets and liabilities are listed above, compute the debt-to-assets ratios for each company. (Rout answers to 1 decimal place.) Debt to Assets Ratio % Aspen Willow % Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required B Requided c1 Required C2 Determine which company has the greater financial risk in the short term. Determine which company has the greater financial risk in the short term. Required A1 Required A2 Required B Required C1 Required A2 Determine which company has the greater financial risk in the long term. Determine which company has the greater financial risk in the long term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started