Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following accounts were taken from ABC Company's unadjusted trial balance at December 31, 2025: Accounts Payable Accounts Receivable Advertising Expense Cashi Common Stock

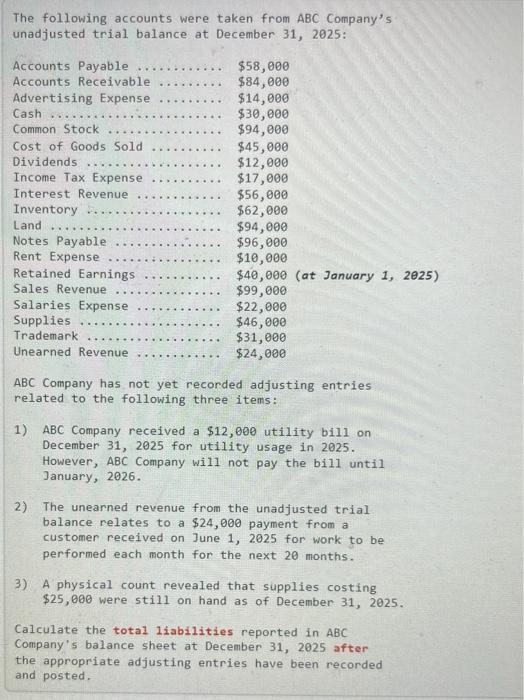

The following accounts were taken from ABC Company's unadjusted trial balance at December 31, 2025: Accounts Payable Accounts Receivable Advertising Expense Cashi Common Stock Cost of Goods Sold Dividends .. Income Tax Expense Interest Revenue Inventory. Land Notes Payable Rent Expense Retained Earnings Sales Revenue Salaries Expense Supplies Trademark Unearned Revenue .. ..... $58,000 $84,000 $14,000 $30,000 $94,000 $45,000 $12,000 $17,000 $56,000 $62,000 $94,000 $96,000 $10,000 $40,000 (at January 1, 2025) $99,000 $22,000 $46,000 $31,000 $24,000 ABC Company has not yet recorded adjusting entries related to the following three items: 1) ABC Company received a $12,000 utility bill on December 31, 2025 for utility usage in 2025. However, ABC Company will not pay the bill until January, 2026. 2) The unearned revenue from the unadjusted trial balance relates to a $24,000 payment from a customer received on June 1, 2025 for work to be performed each month for the next 20 months. 3) A physical count revealed that supplies costing $25,000 were still on hand as of December 31, 2025. Calculate the total liabilities reported in ABC Company's balance sheet at December 31, 2025 after the appropriate adjusting entries have been recorded and posted.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Particular Debit Credit Dec 31 Salaries Expenses 12000 Salaries ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started