Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following activity is to be used to prepare your adjusting journal entries for your company. This is the first fiscal year end for

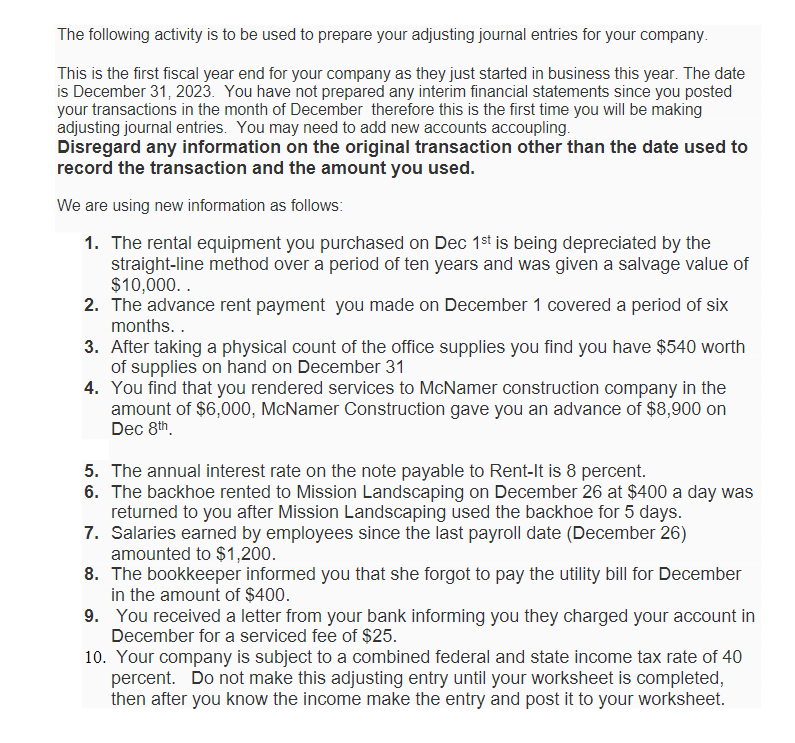

The following activity is to be used to prepare your adjusting journal entries for your company. This is the first fiscal year end for your company as they just started in business this year. The date is December 31, 2023. You have not prepared any interim financial statements since you posted your transactions in the month of December therefore this is the first time you will be making adjusting journal entries. You may need to add new accounts accoupling. Disregard any information on the original transaction other than the date used to record the transaction and the amount you used. We are using new information as follows: 1. The rental equipment you purchased on Dec 1st is being depreciated by the straight-line method over a period of ten years and was given a salvage value of $10,000.. 2. The advance rent payment you made on December 1 covered a period of six months. . 3. After taking a physical count of the office supplies you find you have $540 worth of supplies on hand on December 31 4. You find that you rendered services to McNamer construction company in the amount of $6,000, McNamer Construction gave you an advance of $8,900 on Dec 8th 5. The annual interest rate on the note payable to Rent-It is 8 percent. 6. The backhoe rented to Mission Landscaping on December 26 at $400 a day was returned to you after Mission Landscaping used the backhoe for 5 days. 7. Salaries earned by employees since the last payroll date (December 26) amounted to $1,200. 8. The bookkeeper informed you that she forgot to pay the utility bill for December in the amount of $400. 9. You received a letter from your bank informing you they charged your account in December for a serviced fee of $25. 10. Your company is subject to a combined federal and state income tax rate of 40 percent. Do not make this adjusting entry until your worksheet is completed, then after you know the income make the entry and post it to your worksheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started