Question

The following acts have been committed in the course of business of one of your dlients. (1) A customer invoice was omitted from accounting

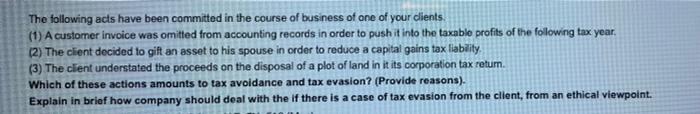

The following acts have been committed in the course of business of one of your dlients. (1) A customer invoice was omitted from accounting records in order to push it into the taxable profits of the following tax year. (2) The client decided to gift an asset to his spouse in order to reduce a capital gains tax liability. (3) The client understated the proceeds on the disposal of a plot of land in it its corporation tax retum. Which of these actions amounts to tax avoidance and tax evasion? (Provide reasons). Explain in brief how company should deal with the if there is a case of tax evasion from the client, from an ethical viewpoint.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Tax evasion is an illegal act where assessee report false or comprimised ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield

13th Edition

9780470374948, 470423684, 470374942, 978-0470423684

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App