Question

The following additional information is relevant: 1. TrustHavens revenues include RM7 million of goods it sold acting as an agent for UpCT for which it

The following additional information is relevant:

1. TrustHaven’s revenues include RM7 million of goods it sold acting as an agent for UpCT for which it earned a commission of 20% on these sales and remitted the difference (included in cost of sales) to UpCT.

2. The year-end stock-take revealed inventories originally purchased for RM3 million have been in stock for a very long time. They need modification costing RM0.5 million after which they could be sold for RM2.8 million.

3. Administrative expenses include ordinary share dividend of 2% paid during the year. At the end of the year, the board of directors proposed a further 3% dividend for the ordinary shareholders.

4. The freehold property has a land element of RM25 million. The company policy is to revalue the property at market value at each year end. The valuation in the trial balance led to an impairment loss of RM3.4 million which was reported as administrative expense in the profit or loss statement for the year ended 31 December 2019. At that date the estimated useful life of the building was 40 years with nil residual value. At 31 December 2020 the property was valued at RM80 million.

5. Plant and equipment are depreciated through cost of sales at 15% per annum on straight line method. On 1 July 2020, a piece of equipment acquired at a cost of RM1.6 million on 1 January 2017 was sold for RM0.8 million. The only entries made to record this disposal is a debit to bank account and credit sales of RM0.8 million.

6. The intangible assets comprise several ongoing projects, some of which were launched on the market during the year costing RM10 million with estimated useful life of 5 years. A full year amortisation will apply for the current year for these projects. The remaining intangible assets are amortised at 10% on a straight line method. Other development cost of RM3.1 million are included in administrative expenses. These development costs meet the criteria for capitalization of an intangible assets but they are still not completed.

7. On 1 October 2020, an ex-employee has sued TrustHaven for unfair dismissal. Legal advice was that there was an 80% chance that TrustHaven would lose the case and would need to pay an estimated RM1 million. Based on this advice, TrustHaven has made a provision of RM0.8 million which is included in administrative expenses.

8. The annual audit has discovered that the previous chief financial officer of TrustHaven engaged in fraudulent financial reporting. Trade receivable of RM3.7 million does not exist and RM2 million relates to the previous financial periods.

Prepare the following statements in accordance with MFRS 101 Preparation of Financial Statements for Publication (Show all workings):

(a) Statement of Comprehensive Income for the year ended 31 December 2020

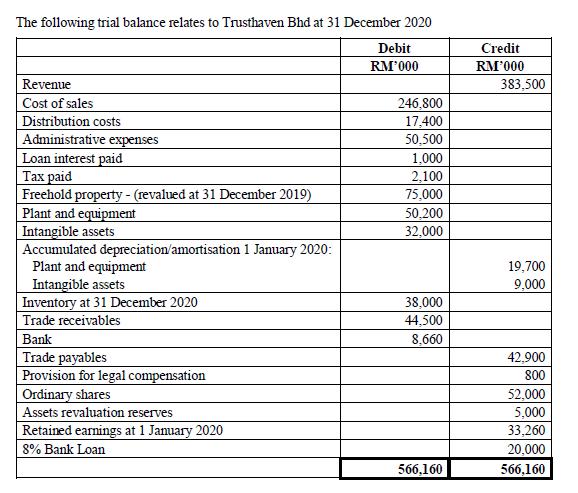

The following trial balance relates to Trusthaven Bhd at 31 December 2020 Debit Credit RM'000 RM'000 Revenue 383,500 246,800 17,400 Cost of sales Distribution costs Administrative expenses Loan interest paid aid Freehold property - (revalued at 31 December 2019) Plant and equipment Intangible assets Accumulated depreciation/amortisation 1 January 2020: Plant and equipment Intangible assets Inventory at 31 December 2020 Trade receivables Bank Trade payables Provision for legal compensation Ordinary shares Assets revaluation reserves 50,500 1,000 2,100 75,000 50,200 32,000 19,700 9,000 38,000 44,500 8,660 42,900 800 52,000 5,000 Retained earnings at 1 Jamuary 2020 33,260 20.000 566,160 8% Bank Loan 566,160

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Comprehen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started