Question

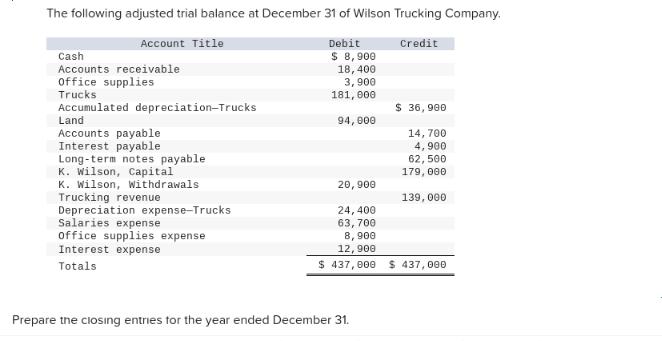

The following adjusted trial balance at December 31 of Wilson Trucking Company. Credit Account Title Cash Accounts receivable office supplies Trucks Accumulated depreciation-Trucks Land

The following adjusted trial balance at December 31 of Wilson Trucking Company. Credit Account Title Cash Accounts receivable office supplies Trucks Accumulated depreciation-Trucks Land Accounts payable Interest payable Long-term notes payable K. Wilson, Capital K. Wilson, Withdrawals Trucking revenue Depreciation expense-Trucks Salaries expense office supplies expense Interest expense Totals Debit $ 8,900 18,400 3,900 181, 000 94,000 20,900 24,400 63,700 8,900 12,900 $ 437,000 Prepare the closing entries for the year ended December 31. $36, 900 14,700 4,900 62,500 179, 090 139,000 $ 437,000

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Close revenue accounts Debit Trucking revenue 139000 Credit Income Summary 139000 Close ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

25th Edition

1260247988, 978-1260247985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App