Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following adjustment data assuming a March 31, 2020 year end is: 1. The supplies account has a beginning balance of $1,200. During the

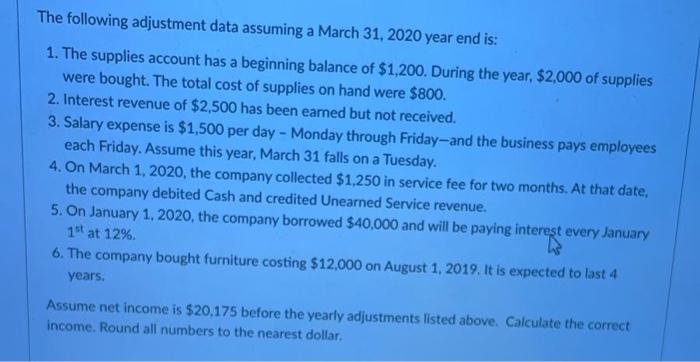

The following adjustment data assuming a March 31, 2020 year end is: 1. The supplies account has a beginning balance of $1,200. During the year, $2,000 of supplies were bought. The total cost of supplies on hand were $800. 2. Interest revenue of $2,500 has been earned but not received. 3. Salary expense is $1,500 per day - Monday through Friday-and the business pays employees each Friday. ASsume this year, March 31 falls on a Tuesday. 4. On March 1, 2020, the company collected $1,250 in service fee for two months. At that date, the company debited Cash and credited Unearned Service revenue. 5. On January 1, 2020, the company borrowed $40,000 and will be paying interest every January 1st at 12%. 6. The company bought furniture costing $12,000 on August 1, 2019. It is expected to last 4 years. Assume net income is $20,175 before the yearly adjustments listed above. Calculate the correct income. Round all numbers to the nearest dollar.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Net income before adjustments 1 Supplies expense 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started