Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following adjustment information assuming an April 30, 2019 year end is: 1. Salaries of $5,200 have been earned by employees for the last

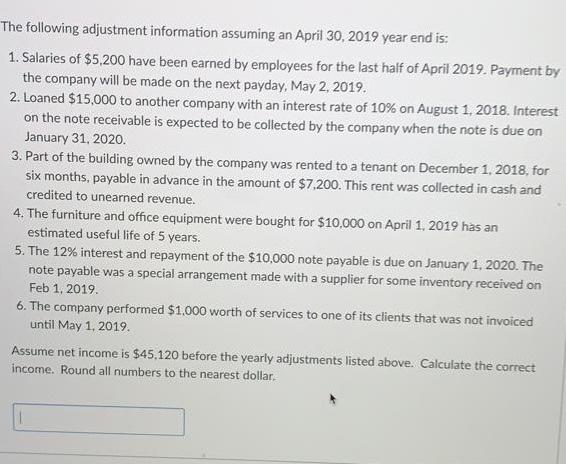

The following adjustment information assuming an April 30, 2019 year end is: 1. Salaries of $5,200 have been earned by employees for the last half of April 2019. Payment by the company will be made on the next payday, May 2, 2019. 2. Loaned $15,000 to another company with an interest rate of 10% on August 1, 2018. Interest on the note receivable is expected to be collected by the company when the note is due on January 31, 2020. 3. Part of the building owned by the company was rented to a tenant on December 1, 2018, for six months, payable in advance in the amount of $7,200. This rent was collected in cash and credited to unearned revenue. 4. The furniture and office equipment were bought for $10.000 on April 1, 2019 has an estimated useful life of 5 years. 5. The 12% interest and repayment of the $10,000 note payable is due on January 1, 2020. The note payable was a special arrangement made with a supplier for some inventory received on Feb 1, 2019. 6. The company performed $1.000 worth of services to one of its clients that was not invoiced until May 1, 2019. Assume net income is $45,120 before the yearly adjustments listed above. Calculate the correct income. Round all numbers to the nearest dollar.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

the total revenue before all the above adjustment is 45120 AJUSTMENT of above transactions CALCULATI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started