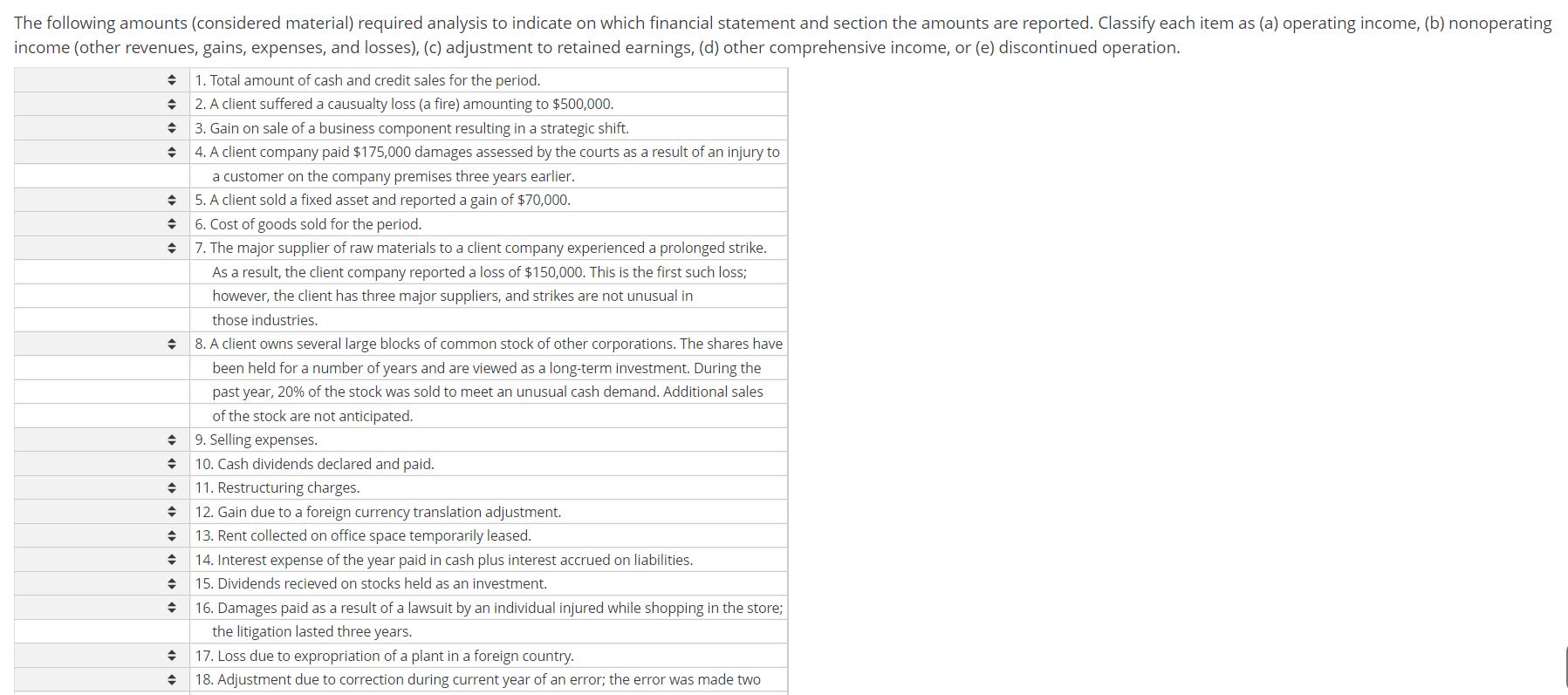

Question: The following amounts (considered material) required analysis to indicate on which financial statement and section the amounts are reported. Classify each item as (a)

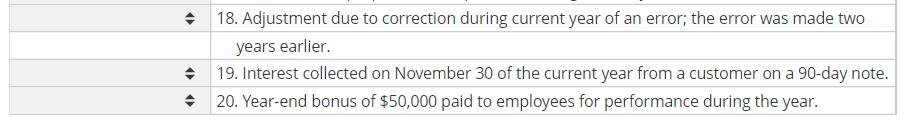

The following amounts (considered material) required analysis to indicate on which financial statement and section the amounts are reported. Classify each item as (a) operating income, (b) nonoperating income (other revenues, gains, expenses, and losses), (c) adjustment to retained earnings, (d) other comprehensive income, or (e) discontinued operation. + 1. Total amount of cash and credit sales for the period. 2. A client suffered a causualty loss (a fire) amounting to $500,000. + 3. Gain on sale of a business component resulting in a strategic shift. 4. A client company paid $175,000 damages assessed by the courts as a result of an injury to a customer on the company premises three years earlier. 5. A client sold a fixed asset and reported a gain of $70,000. 6. Cost of goods sold for the period. + 7. The major supplier of raw materials to a client company experienced a prolonged strike. As a result, the client company reported a loss of $150,000. This is the first such loss; however, the client has three major suppliers, and strikes are not unusual in those industries. + 8. A client owns several large blocks of common stock of other corporations. The shares have been held for a number of years and are viewed as a long-term investment. During the past year, 20% of the stock was sold to meet an unusual cash demand. Additional sales of the stock are not anticipated. + + 9. Selling expenses. 10. Cash dividends declared and paid. 11. Restructuring charges. 12. Gain due to a foreign currency translation adjustment. 13. Rent collected on office space temporarily leased. + + 14. Interest expense of the year paid in cash plus interest accrued on liabilities. 15. Dividends recieved on stocks held as an investment. 16. Damages paid as a result of a lawsuit by an individual injured while shopping in the store; the litigation lasted three years. 17. Loss due to expropriation of a plant in a foreign country. 18. Adjustment due to correction during current year of an error; the error was made two 18. Adjustment due to correction during current year of an error; the error was made two years earlier. 19. Interest collected on November 30 of the current year from a customer on a 90-day note. + 20. Year-end bonus of $50,000 paid to employees for performance during the year.

Step by Step Solution

3.50 Rating (167 Votes )

There are 3 Steps involved in it

1 Total amount of cash and credit sales for the period Operating Income Income Statement 2 A client suffered a causualty loss a fire amounting to 5000... View full answer

Get step-by-step solutions from verified subject matter experts