Answered step by step

Verified Expert Solution

Question

1 Approved Answer

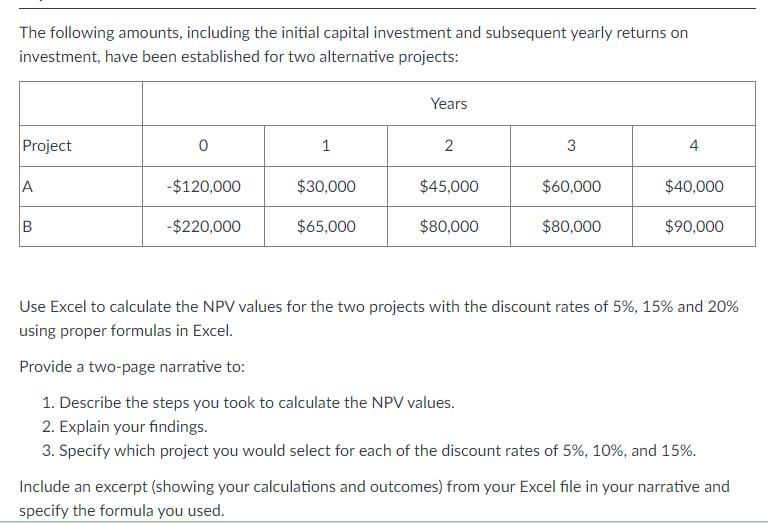

The following amounts, including the initial capital investment and subsequent yearly returns on investment, have been established for two alternative projects: Project A B

The following amounts, including the initial capital investment and subsequent yearly returns on investment, have been established for two alternative projects: Project A B 0 -$120,000 -$220,000 1 $30,000 $65,000 Years 2 $45,000 $80,000 3 $60,000 $80,000 4 $40,000 $90,000 Use Excel to calculate the NPV values for the two projects with the discount rates of 5%, 15% and 20% using proper formulas in Excel. Provide a two-page narrative to: 1. Describe the steps you took to calculate the NPV values. 2. Explain your findings. 3. Specify which project you would select for each of the discount rates of 5%, 10%, and 15%. Include an excerpt (showing your calculations and outcomes) from your Excel file in your narrative and specify the formula you used. The following amounts, including the initial capital investment and subsequent yearly returns on investment, have been established for two alternative projects: Project A B 0 -$120,000 -$220,000 1 $30,000 $65,000 Years 2 $45,000 $80,000 3 $60,000 $80,000 4 $40,000 $90,000 Use Excel to calculate the NPV values for the two projects with the discount rates of 5%, 15% and 20% using proper formulas in Excel. Provide a two-page narrative to: 1. Describe the steps you took to calculate the NPV values. 2. Explain your findings. 3. Specify which project you would select for each of the discount rates of 5%, 10%, and 15%. Include an excerpt (showing your calculations and outcomes) from your Excel file in your narrative and specify the formula you used.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve the problem in the image we need to use the following steps Calculate the NPV for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started