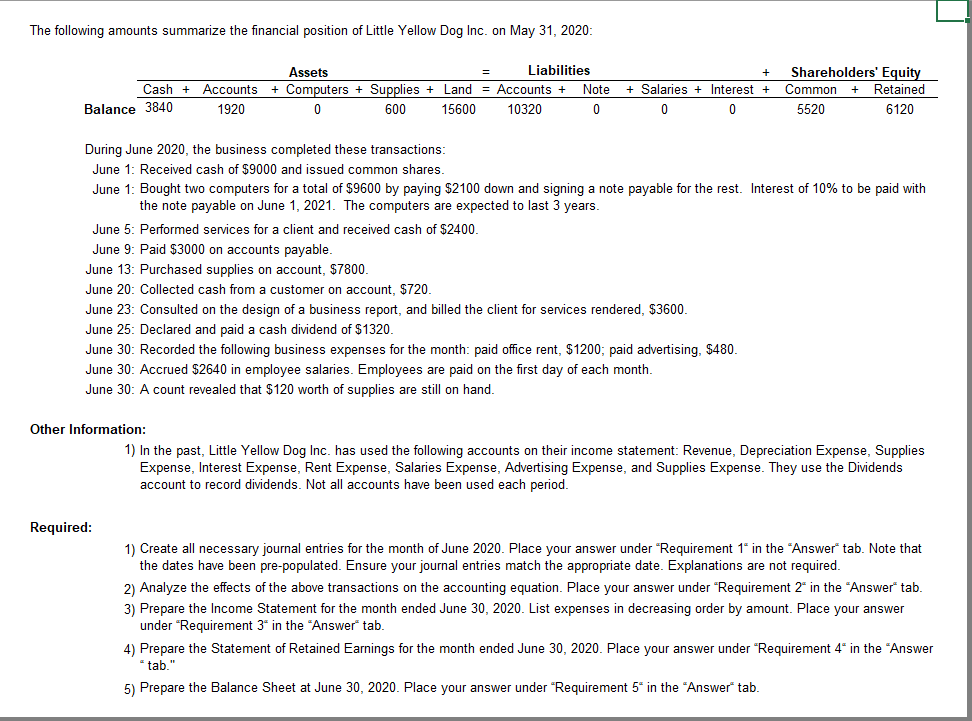

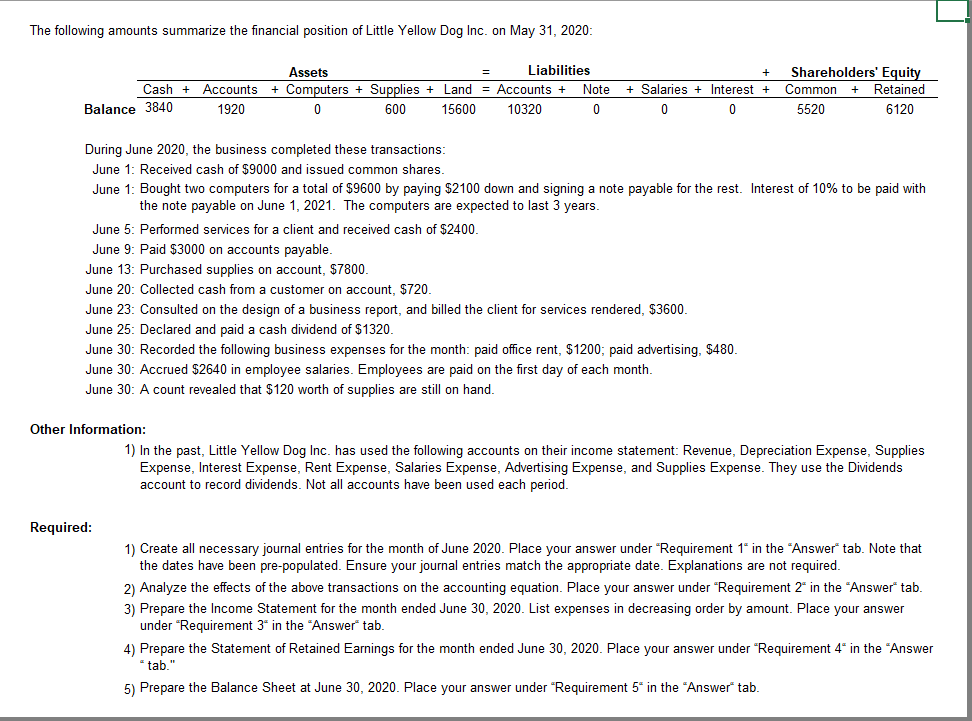

The following amounts summarize the financial position of Little Yellow Dog Inc. on May 31, 2020: Cash + Accounts Balance 3840 1920 Assets = Liabilities + Computers + Supplies + Land = Accounts + Note 600 15600 10320 0 + + Salaries + Interest + 0 0 Shareholders' Equity Common + Retained 5520 6120 During June 2020, the business completed these transactions: June 1: Received cash of $9000 and issued common shares. June 1: Bought two computers for a total of $9600 by paying $2100 down and signing a note payable for the rest. Interest of 10% to be paid with the note payable on June 1, 2021. The computers are expected to last 3 years. June 5: Performed services for a client and received cash of $2400. June 9: Paid $3000 on accounts payable. June 13: Purchased supplies on account, $7800. June 20: Collected cash from a customer on account, $720. June 23: Consulted on the design of a business report, and billed the client for services rendered, $3600. June 25: Declared and paid a cash dividend of $1320. June 30: Recorded the following business expenses for the month: paid office rent, $1200; paid advertising, $480. June 30: Accrued $2640 in employee salaries. Employees are paid on the first day of each month. June 30: A count revealed that $120 worth of supplies are still on hand. Other Information: 1) In the past, Little Yellow Dog Inc. has used the following accounts on their income statement: Revenue, Depreciation Expense, Supplies Expense, Interest Expense, Rent Expense, Salaries Expense, Advertising Expense, and Supplies Expense. They use the Dividends account to record dividends. Not all accounts have been used each period. Required: 1) Create all necessary journal entries for the month of June 2020. Place your answer under "Requirement 1* in the Answer" tab. Note that the dates have been pre-populated. Ensure your journal entries match the appropriate date. Explanations are not required. 2) Analyze the effects of the above transactions on the accounting equation. Place your answer under "Requirement 2 in the "Answer" tab. 3) Prepare the Income Statement for the month ended June 30, 2020. List expenses in decreasing order by amount. Place your answer under "Requirement 3* in the Answer" tab. 4) Prepare the Statement of Retained Earnings for the month ended June 30, 2020. Place your answer under "Requirement 4* in the "Answer * tab." 5) Prepare the Balance Sheet at June 30, 2020. Place your answer under "Requirement 5' in the "Answer" tab