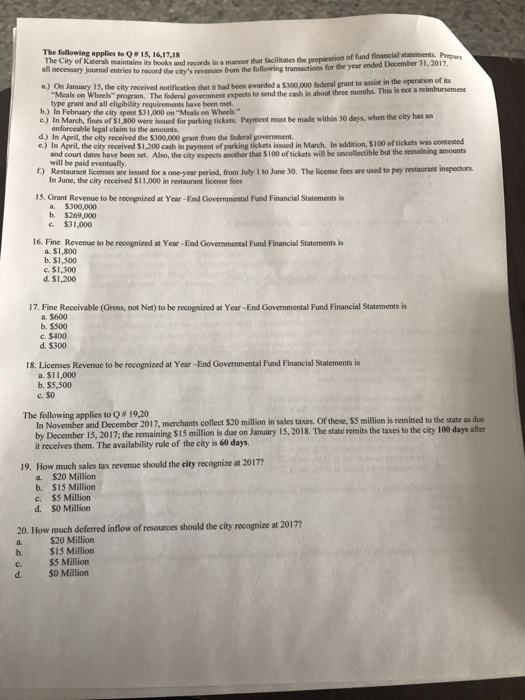

The following applies to Q 15, 16,17.18 The City of Katerah maintains its books and records in a manser that facilitates the preparation o all necessary journal entries to record the city's revenues from the following transactions for a.) On January 15, the city fund financial stamements Prepare the year ended Dacember 31. 2017 the city's revemues from the following transactions for the year ended December 31.2017 received notification that it had been awarded a $300,000 Sederal grant to assist in the operation of its Meals on Wheels program. The federal type grant and all eligibility government expects to send the cash in about three months. This is not a reimbursement b.) In February the city spent $31,000 on "Meals on Wheels." c) In March, fines or s1,800 were issued for parking t d.) In April, the city received the $300,000 grant from the federal government e.) In April, the city received $1,200 cash in payment of parking tickets issued in March. In addition, $100 of tickets was ickets Payment must be made within 30 daxys, when the city has an enforceable legal claim to the amounts and court dates have been set. Also, the city expects another that $100 of tickets will be uncollectible but the remaining amounts will be paid eventually r) Restaurant licenses are issued for a one-year peried, from July I to June 30. The license fees are used to pay restaurant inspectors In June, the city received $11,000 in restaurant license fiees 15. Grant Revenue to be recognized at Year-End Governmental Fund Financial Statements is a. $300,000 b. $269,000 c $31,000 16. Fine Revenue to be recognized at Year-End Govemmental Fund Financial Statements is a. $1,800 b. $1,500 c. $1,300 d. $1,200 17. Fine Receivable (Gross, not Net) to be recognized at Year-End Governmental Fund Financial Statements is a. $600 b.$500 c.$400 d. $300 18. Licenses Revenue to be recognized at Year -End Governmental Fund Financial Statements is a. $11,000 b. $5,500 c.$O The following applies to Q#1920 In November and December 2017, merchants collect $20 million in sales taxes. Of these, $5 million is remitted to the state as due by December 15, 2017; the remaining S15 million is due on January 15, 2018. The state remits the taxes to the city 100 days after it receives them. The availability rule of the city is 60 days 19. How much sales tax revenue should the city recognize at 2017 a. $20 Million b. $15 Million c. $3 Million d. S0 Million 20. How much deferred inflow of resources should the city recognize at 20177 $20 Million S15 Million c. $5 Million b. d $0 Million