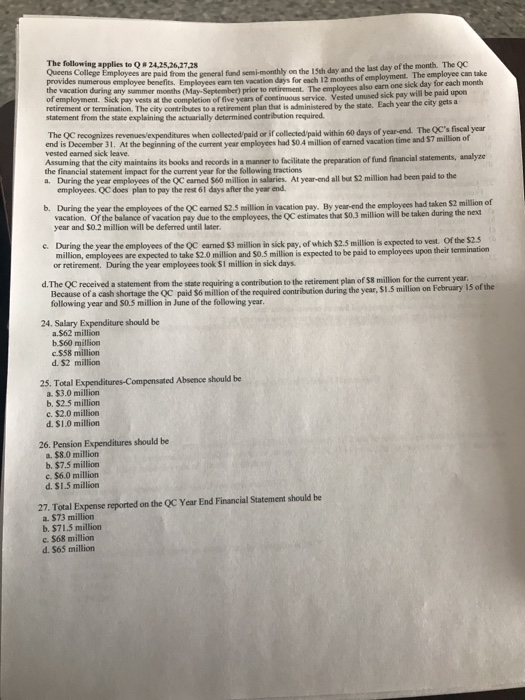

The following applies to Q . 2425,26,2728 sare paid from the general fund semi-monthly on the 15th day and the last day of the month. The QC provides numerous employee benefits. earn the vacation daring any of employment. Sick retirement or termination. The city contributes to a retirement plan that is administered by the state. Each year the city gets a statement from the state explaining the actuarially determined contribution required ts. Employees earn ten vacation days for each 12 months of employment. The employee can take g any summer months (May-September) prior to retirement. The employees also earn one sick day for cach month pay vests at the completion of five years of continuous service. Vested unused sick pay will be paid upon The OC recognizes revenues/expenditures when collected/paid or if collected/paid within 60 days of year-end. The OC's fiscal year end is December 31. At the beginning of the current year employees had 50.4 million of earned vacation time and $7 million of vested eamed sick leave. Assuming that the city maintains its books and records in a manner to facilitate the preparation of fund financial statements, analyze the financial statement impact for the current year for the following tractions a. During the year employees of the QC earned $60 million in salaries. At year-end all but $2 million had been paid to the employees. QC does plan to pay the rest 61 days after the year end b. During the year the employees of the QC earmed S2.5 million in vacation pay. By year-end the employees had taken $2 million of vacation. Of the balance of vacation pay due to the employees, the OC estimates that $0.3 million will be taken during the next year and $0.2 million will be deferred until later e. During the year the employees of the QC earned $3 million in sick pay, of which $2.5 million is expected to vest Of the $2.5 million, employees are expected to take $2.0 million and $0.5 million is expected to be paid to employees upon their term or retirement. During the year employees took $1 million in sick days. ination d.The QC received a statement from the state requiring a contribution to the retirement plan of $8 million for the current year Because of a cash shortage the QC paid S million of the required contribution during the year, SI.5 million on February 15 of following year and $0.5 million in June of the following year 24. Salary Expenditure should be a.$62 million b.560 million c.$58 million d. $2 million 25, Total Expenditures-Compensated Absene should be a. $3.0 million b. $2.5 million c. $2.0 million d. $1.0 million 26. Pension Expenditures should be a. $8.0 million b. $7.5 million c. $6.0 million d. S1.5 million 27. Total Expense reported on the QC Year End Financial Statement should be a. $73 million b. $71.5 million c. $68 million d. $65 million The following applies to Q . 2425,26,2728 sare paid from the general fund semi-monthly on the 15th day and the last day of the month. The QC provides numerous employee benefits. earn the vacation daring any of employment. Sick retirement or termination. The city contributes to a retirement plan that is administered by the state. Each year the city gets a statement from the state explaining the actuarially determined contribution required ts. Employees earn ten vacation days for each 12 months of employment. The employee can take g any summer months (May-September) prior to retirement. The employees also earn one sick day for cach month pay vests at the completion of five years of continuous service. Vested unused sick pay will be paid upon The OC recognizes revenues/expenditures when collected/paid or if collected/paid within 60 days of year-end. The OC's fiscal year end is December 31. At the beginning of the current year employees had 50.4 million of earned vacation time and $7 million of vested eamed sick leave. Assuming that the city maintains its books and records in a manner to facilitate the preparation of fund financial statements, analyze the financial statement impact for the current year for the following tractions a. During the year employees of the QC earned $60 million in salaries. At year-end all but $2 million had been paid to the employees. QC does plan to pay the rest 61 days after the year end b. During the year the employees of the QC earmed S2.5 million in vacation pay. By year-end the employees had taken $2 million of vacation. Of the balance of vacation pay due to the employees, the OC estimates that $0.3 million will be taken during the next year and $0.2 million will be deferred until later e. During the year the employees of the QC earned $3 million in sick pay, of which $2.5 million is expected to vest Of the $2.5 million, employees are expected to take $2.0 million and $0.5 million is expected to be paid to employees upon their term or retirement. During the year employees took $1 million in sick days. ination d.The QC received a statement from the state requiring a contribution to the retirement plan of $8 million for the current year Because of a cash shortage the QC paid S million of the required contribution during the year, SI.5 million on February 15 of following year and $0.5 million in June of the following year 24. Salary Expenditure should be a.$62 million b.560 million c.$58 million d. $2 million 25, Total Expenditures-Compensated Absene should be a. $3.0 million b. $2.5 million c. $2.0 million d. $1.0 million 26. Pension Expenditures should be a. $8.0 million b. $7.5 million c. $6.0 million d. S1.5 million 27. Total Expense reported on the QC Year End Financial Statement should be a. $73 million b. $71.5 million c. $68 million d. $65 million