Answered step by step

Verified Expert Solution

Question

1 Approved Answer

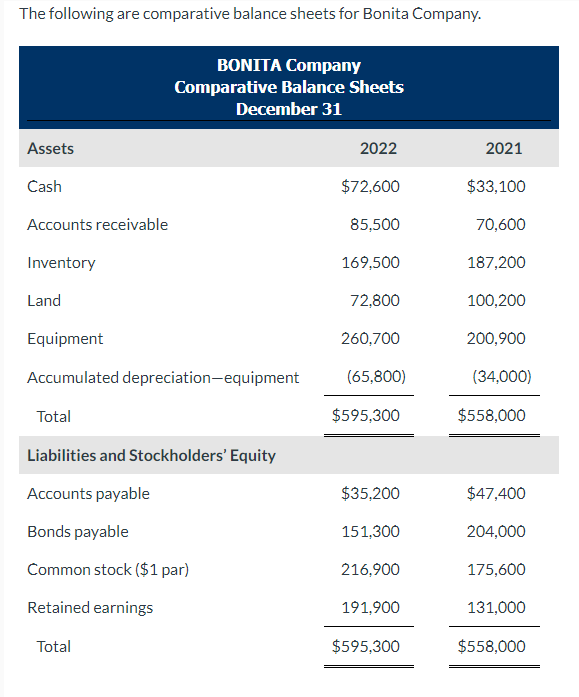

The following are comparative balance sheets for Bonita Company. BONITA Company Comparative Balance Sheets December 31 Assets 2022 2021 Cash $72,600 $33,100 Accounts receivable

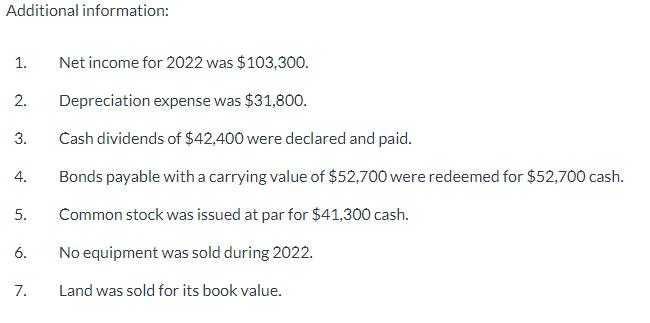

The following are comparative balance sheets for Bonita Company. BONITA Company Comparative Balance Sheets December 31 Assets 2022 2021 Cash $72,600 $33,100 Accounts receivable 85,500 70,600 Inventory 169,500 187,200 Land 72,800 100,200 Equipment 260,700 200,900 Accumulated depreciation-equipment (65,800) (34,000) Total $595,300 $558,000 Liabilities and Stockholders' Equity Accounts payable $35,200 $47,400 Bonds payable 151,300 204,000 Common stock ($1 par) 216,900 175,600 Retained earnings 191,900 131,000 Total $595,300 $558,000 Additional information: 1. Net income for 2022 was $103,300. 2. Depreciation expense was $31,800. 3. Cash dividends of $42,400 were declared and paid. 4. Bonds payable with a carrying value of $52,700 were redeemed for $52,700 cash. 5. Common stock was issued at par for $41,300 cash. 6. No equipment was sold during 2022. 7. Land was sold for its book value. Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sig BONITA Company Statement of Cash Flows Adjustments to reconcile net income to > +A $ > +A > > >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started