Answered step by step

Verified Expert Solution

Question

1 Approved Answer

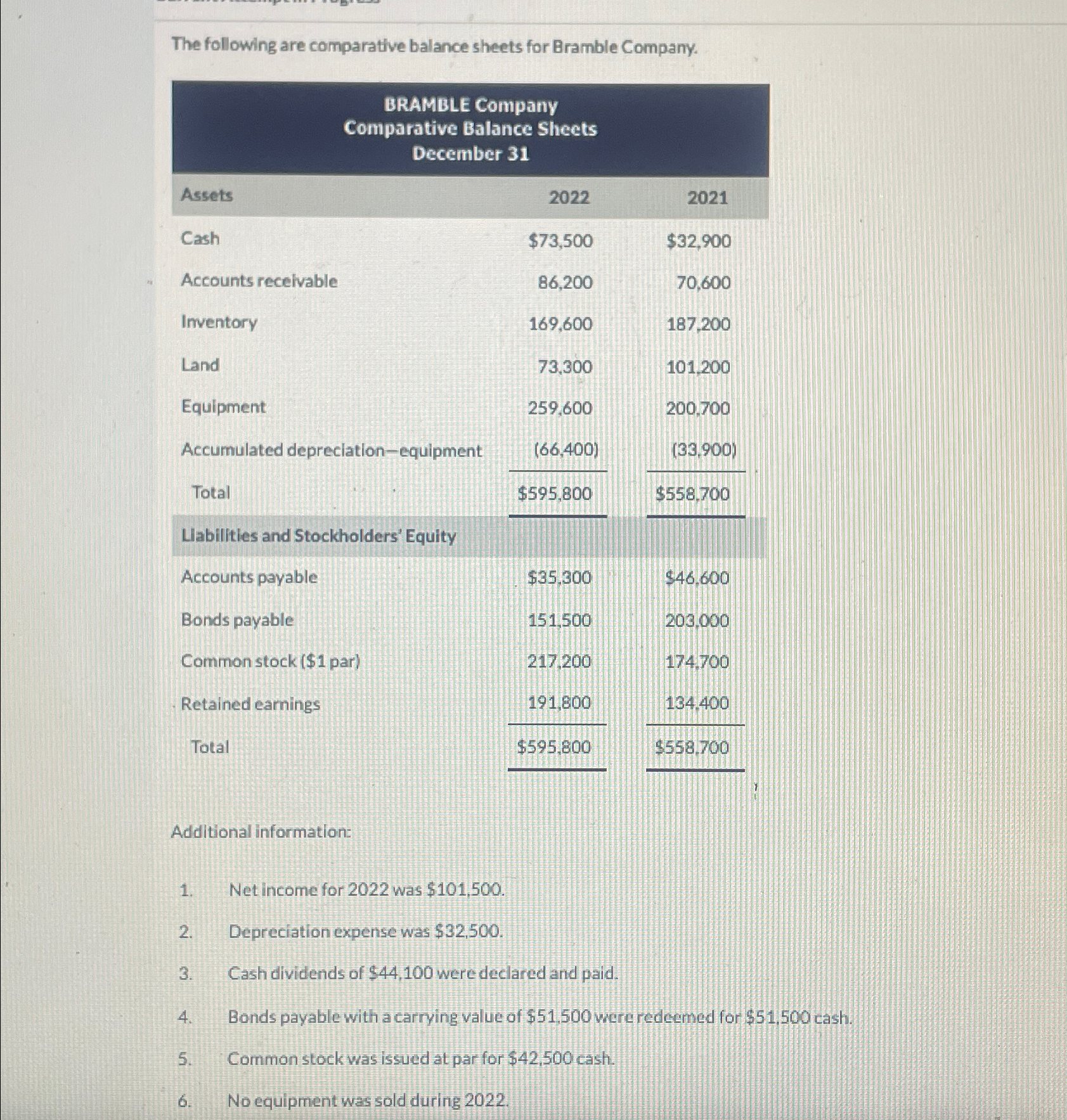

The following are comparative balance sheets for Bramble Company. BRAMBLE Company Comparative Balance Sheets December 31 Assets 2022 2021 Cash $73,500 $32,900 Accounts receivable

The following are comparative balance sheets for Bramble Company. BRAMBLE Company Comparative Balance Sheets December 31 Assets 2022 2021 Cash $73,500 $32,900 Accounts receivable 86,200 70,600 Inventory 169,600 187,200 Land 73,300 101.200 Equipment 259,600 200.700 Accumulated depreciation-equipment (66,400) (33,900) Total $595,800 $558.700 Liabilities and Stockholders' Equity Accounts payable $35.300 $46,600 Bonds payable 151,500 203.000 Common stock ($1 par) 217.200 174.700 Retained earnings 191,800 134.400 Total $595,800 $558,700 Additional information: 1. Net income for 2022 was $101,500. 2. Depreciation expense was $32,500. 3. Cash dividends of $44,100 were declared and paid. 4. Bonds payable with a carrying value of $51,500 were redeemed for $51,500 cash. 5. Common stock was issued at par for $42,500 cash. 6. No equipment was sold during 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

User Alex Corporation reports the following components of stockholders equity at December 31 of the prior year Common stock25 par value 70000 shares authorized 42000 shares issued and outstanding 1050...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started