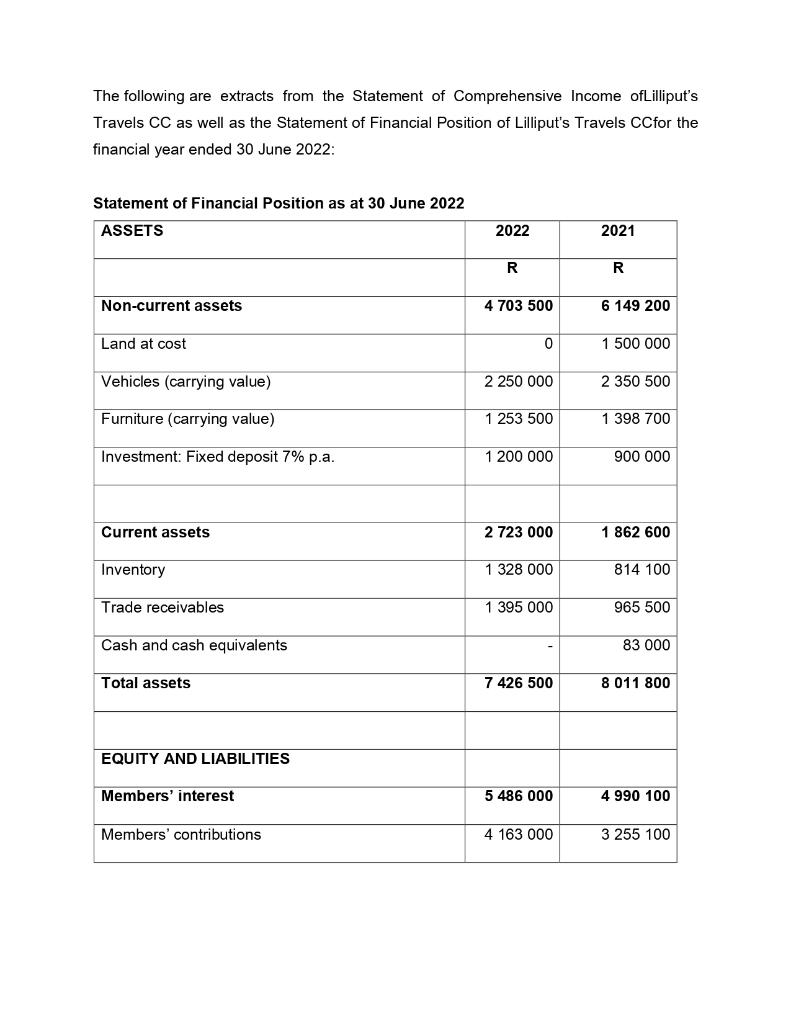

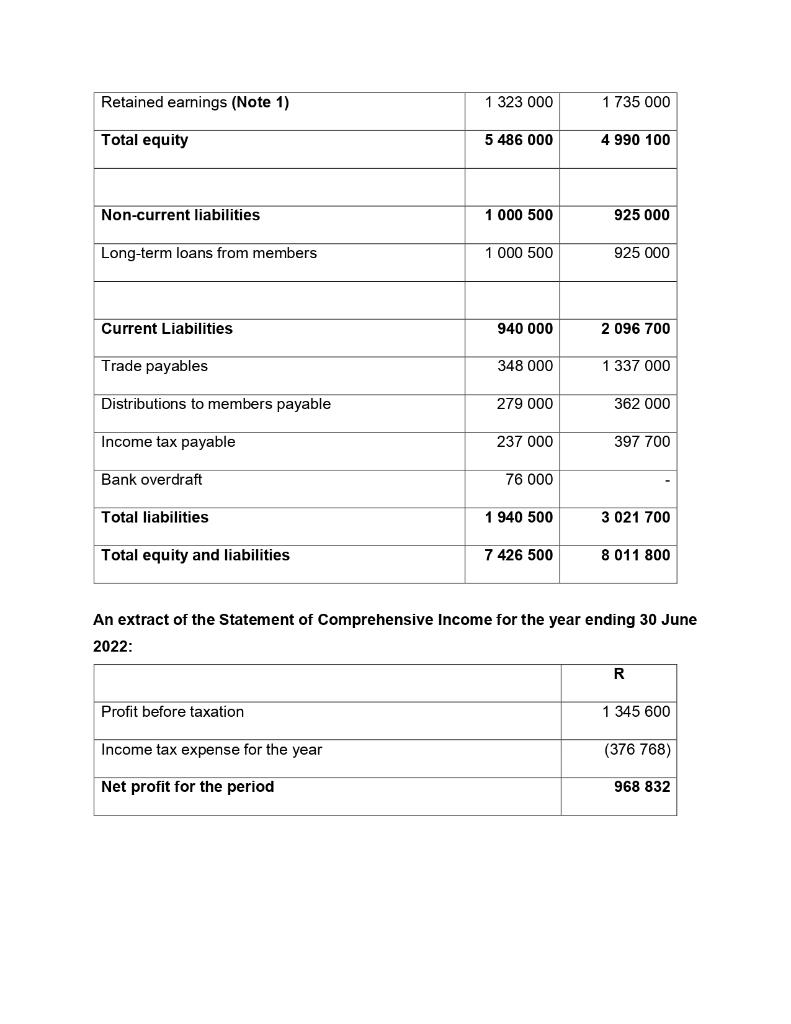

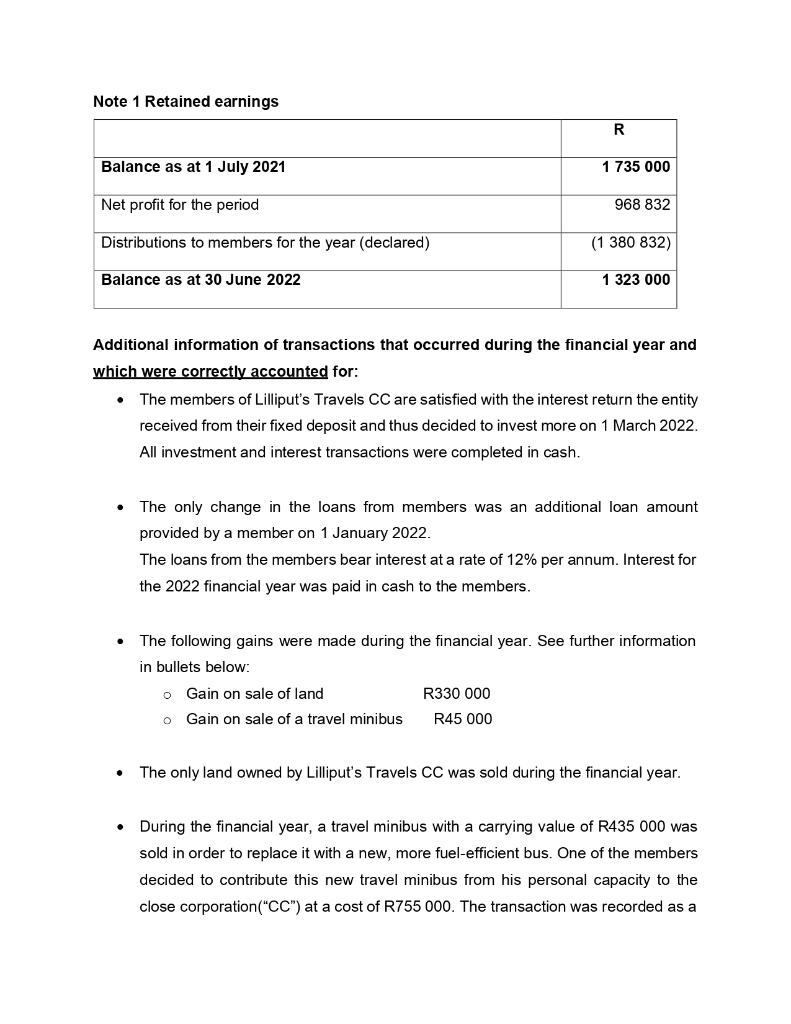

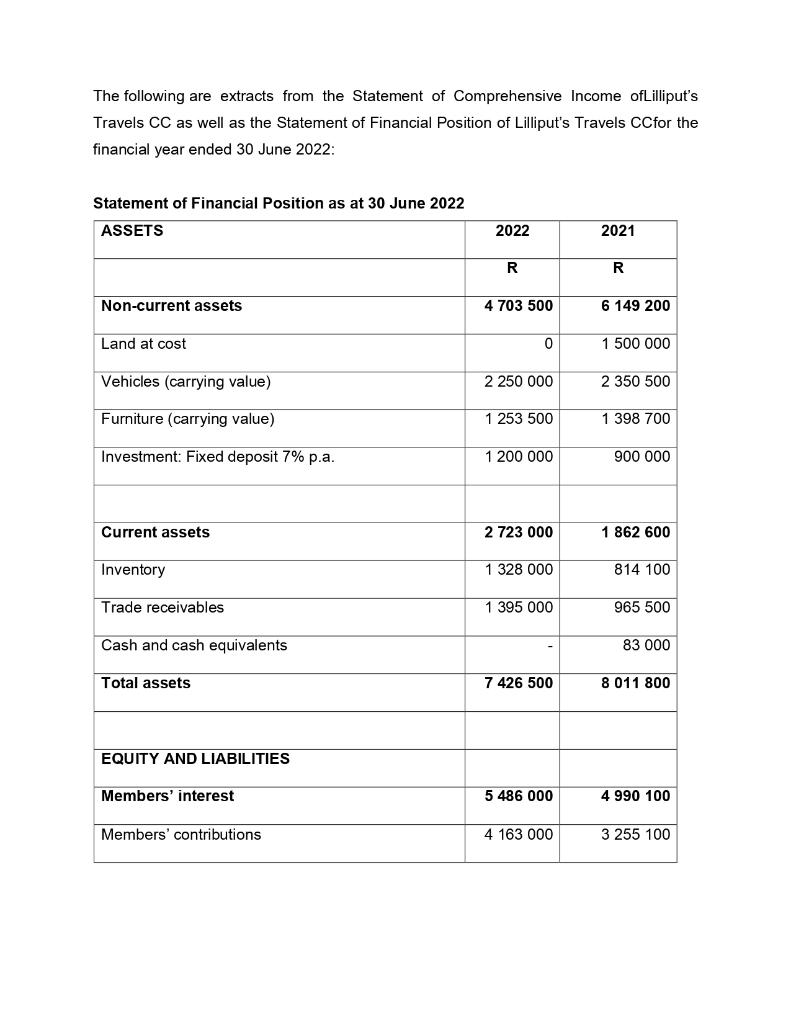

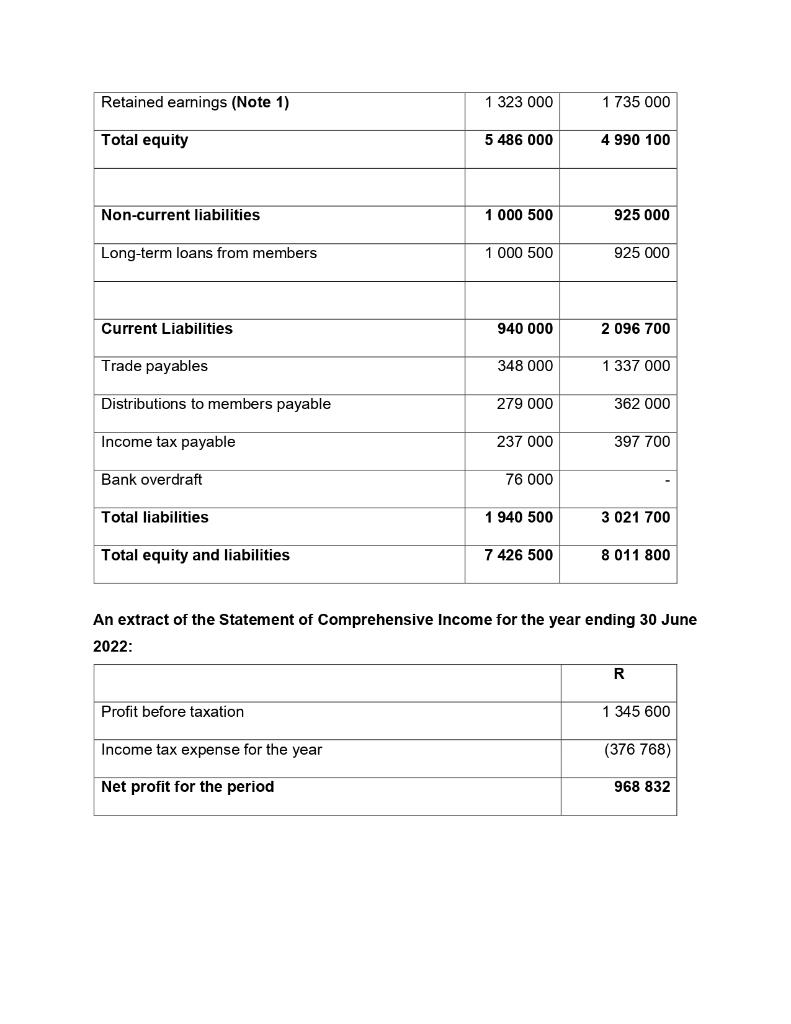

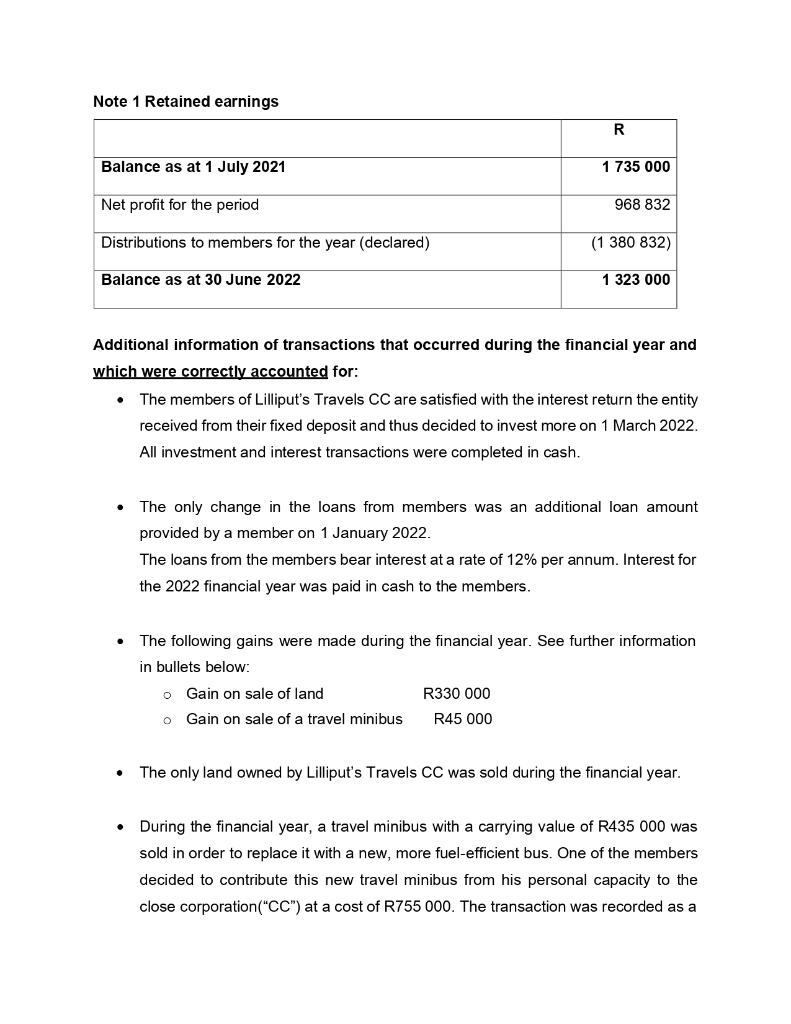

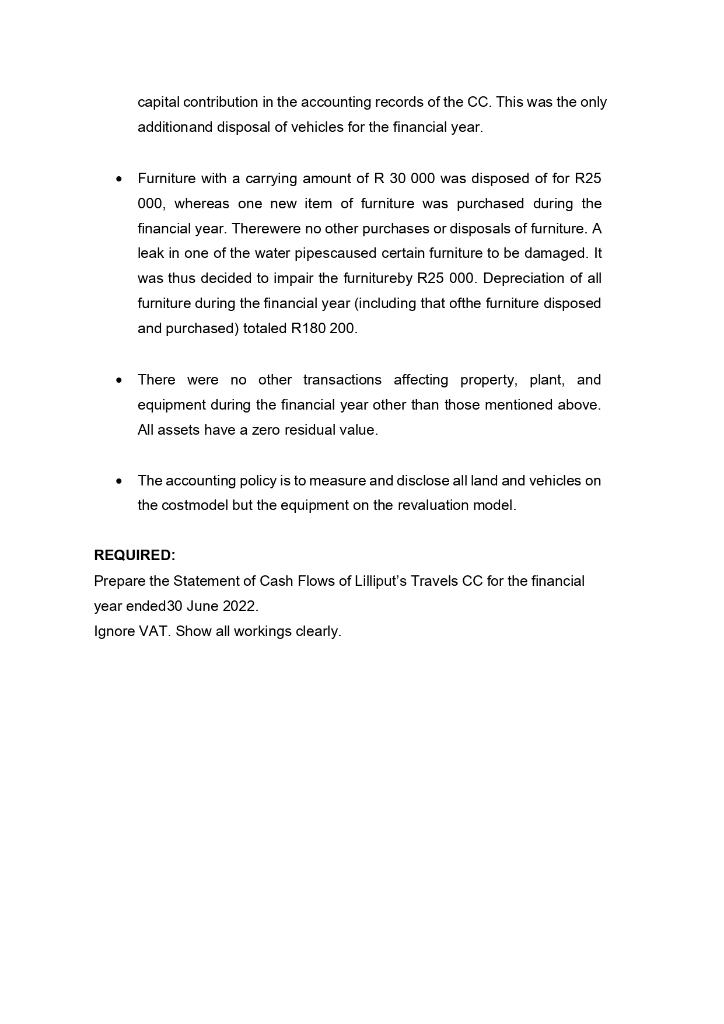

The following are extracts from the Statement of Comprehensive Income ofLilliput's Travels CC as well as the Statement of Financial Position of Lilliput's Travels CCfor the financial year ended 30 June 2022 : Statement of Financial Position as at 30 June 2022 An extract of the Statement of Comprehensive Income for the year ending 30 June 2022: Note 1 Retained earnings Additional information of transactions that occurred during the financial year and which were correctly accounted for: - The members of Lilliput's Travels CC are satisfied with the interest return the entity received from their fixed deposit and thus decided to invest more on 1 March 2022. All investment and interest transactions were completed in cash. - The only change in the loans from members was an additional loan amount provided by a member on 1 January 2022. The loans from the members bear interest at a rate of 12% per annum. Interest for the 2022 financial year was paid in cash to the members. - The following gains were made during the financial year. See further information in bullets below: GainonsaleoflandGainonsaleofatravelminibusR330000R45000 - The only land owned by Lilliput's Travels CC was sold during the financial year. - During the financial year, a travel minibus with a carrying value of R435000 was sold in order to replace it with a new, more fuel-efficient bus. One of the members decided to contribute this new travel minibus from his personal capacity to the close corporation("CC") at a cost of R755000. The transaction was recorded as a capital contribution in the accounting records of the CC. This was the only additionand disposal of vehicles for the financial year. - Furniture with a carrying amount of R 30000 was disposed of for R25 000 , whereas one new item of furniture was purchased during the financial year. Therewere no other purchases or disposals of furniture. A leak in one of the water pipescaused certain furniture to be damaged. It was thus decided to impair the furnitureby R25 000 . Depreciation of all furniture during the financial year (including that ofthe furniture disposed and purchased) totaled R180200. - There were no other transactions affecting property, plant, and equipment during the financial year other than those mentioned above. All assets have a zero residual value. - The accounting policy is to measure and disclose all land and vehicles on the costmodel but the equipment on the revaluation model. REQUIRED: Prepare the Statement of Cash Flows of Lilliput's Travels CC for the financial year ended 30 June 2022. Ignore VAT. Show all workings clearly. The following are extracts from the Statement of Comprehensive Income ofLilliput's Travels CC as well as the Statement of Financial Position of Lilliput's Travels CCfor the financial year ended 30 June 2022 : Statement of Financial Position as at 30 June 2022 An extract of the Statement of Comprehensive Income for the year ending 30 June 2022: Note 1 Retained earnings Additional information of transactions that occurred during the financial year and which were correctly accounted for: - The members of Lilliput's Travels CC are satisfied with the interest return the entity received from their fixed deposit and thus decided to invest more on 1 March 2022. All investment and interest transactions were completed in cash. - The only change in the loans from members was an additional loan amount provided by a member on 1 January 2022. The loans from the members bear interest at a rate of 12% per annum. Interest for the 2022 financial year was paid in cash to the members. - The following gains were made during the financial year. See further information in bullets below: GainonsaleoflandGainonsaleofatravelminibusR330000R45000 - The only land owned by Lilliput's Travels CC was sold during the financial year. - During the financial year, a travel minibus with a carrying value of R435000 was sold in order to replace it with a new, more fuel-efficient bus. One of the members decided to contribute this new travel minibus from his personal capacity to the close corporation("CC") at a cost of R755000. The transaction was recorded as a capital contribution in the accounting records of the CC. This was the only additionand disposal of vehicles for the financial year. - Furniture with a carrying amount of R 30000 was disposed of for R25 000 , whereas one new item of furniture was purchased during the financial year. Therewere no other purchases or disposals of furniture. A leak in one of the water pipescaused certain furniture to be damaged. It was thus decided to impair the furnitureby R25 000 . Depreciation of all furniture during the financial year (including that ofthe furniture disposed and purchased) totaled R180200. - There were no other transactions affecting property, plant, and equipment during the financial year other than those mentioned above. All assets have a zero residual value. - The accounting policy is to measure and disclose all land and vehicles on the costmodel but the equipment on the revaluation model. REQUIRED: Prepare the Statement of Cash Flows of Lilliput's Travels CC for the financial year ended 30 June 2022. Ignore VAT. Show all workings clearly