Answered step by step

Verified Expert Solution

Question

1 Approved Answer

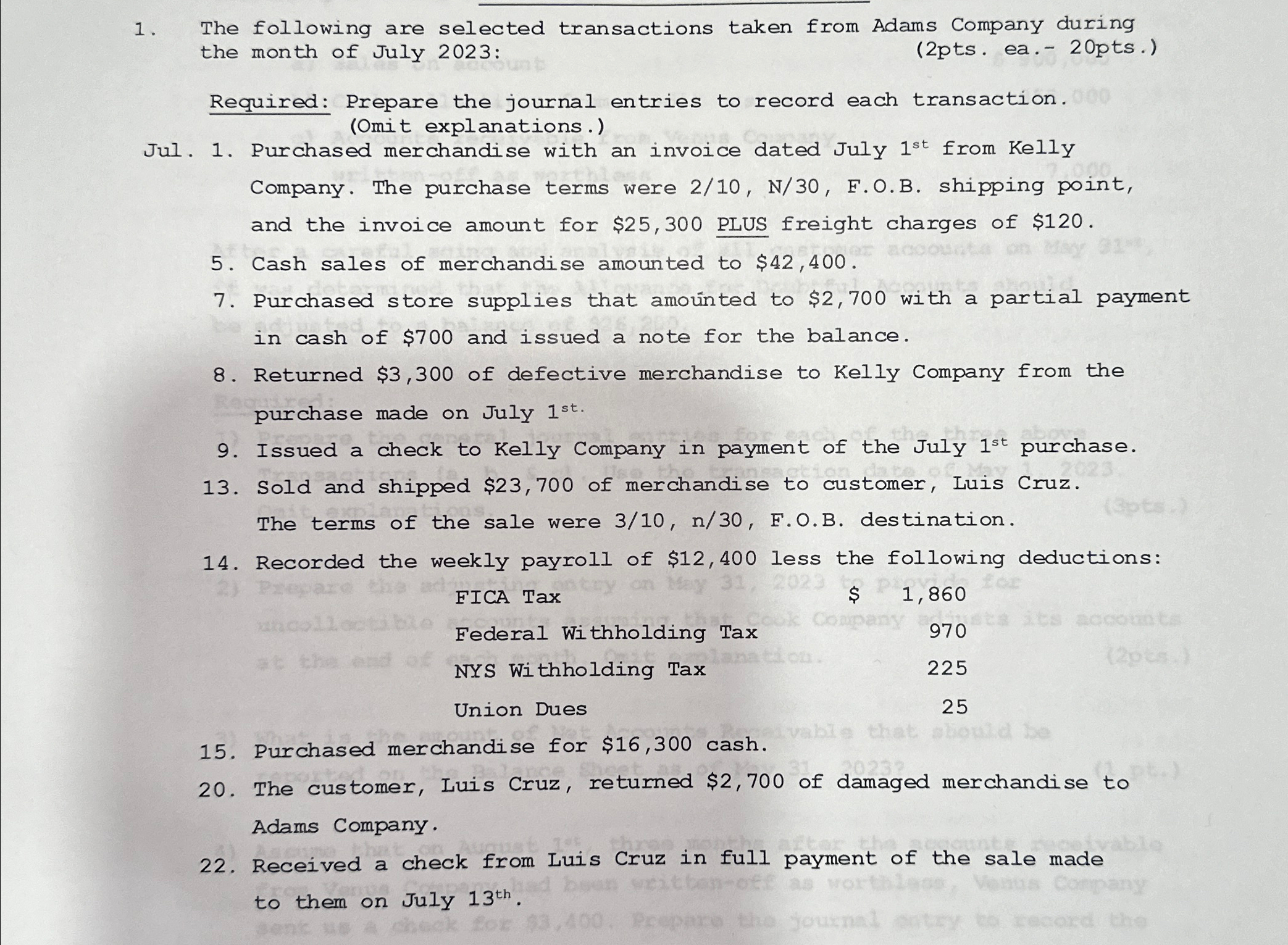

The following are selected transactions taken from Adams Company during the month of July 2 0 2 3 : ( 2 pts . ea .

The following are selected transactions taken from Adams Company during the month of July :

pts ea pts

Required: Prepare the journal entries to record each transaction. Omit explanations.

Jul. Purchased merchandise with an invoice dated July from Kelly Company. The purchase terms were N FOB shipping point, and the invoice amount for $ PLUS freight charges of $

Cash sales of merchandise amounted to $

Purchased store supplies that amouinted to $ with a partial payment in cash of $ and issued a note for the balance.

Returned $ of defective merchandise to Kelly Company from the purchase made on July

Issued a check to Kelly Company in payment of the July purchase.

Sold and shipped $ of merchandise to customer, Luis Cruz. The terms of the sale were FOB destination.

Recorded the weekly payroll of $ less the following deductions:

FICA Tax

$

Federal Withholding Tax

NYS Withholding Tax

Union Dues

Purchased merchandise for $cash.

The customer, Luis Cruz, returned $ of damaged merchandise to Adams Company.

Received a check from Luis Cruz in full payment of the sale made to them on July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started