Answered step by step

Verified Expert Solution

Question

1 Approved Answer

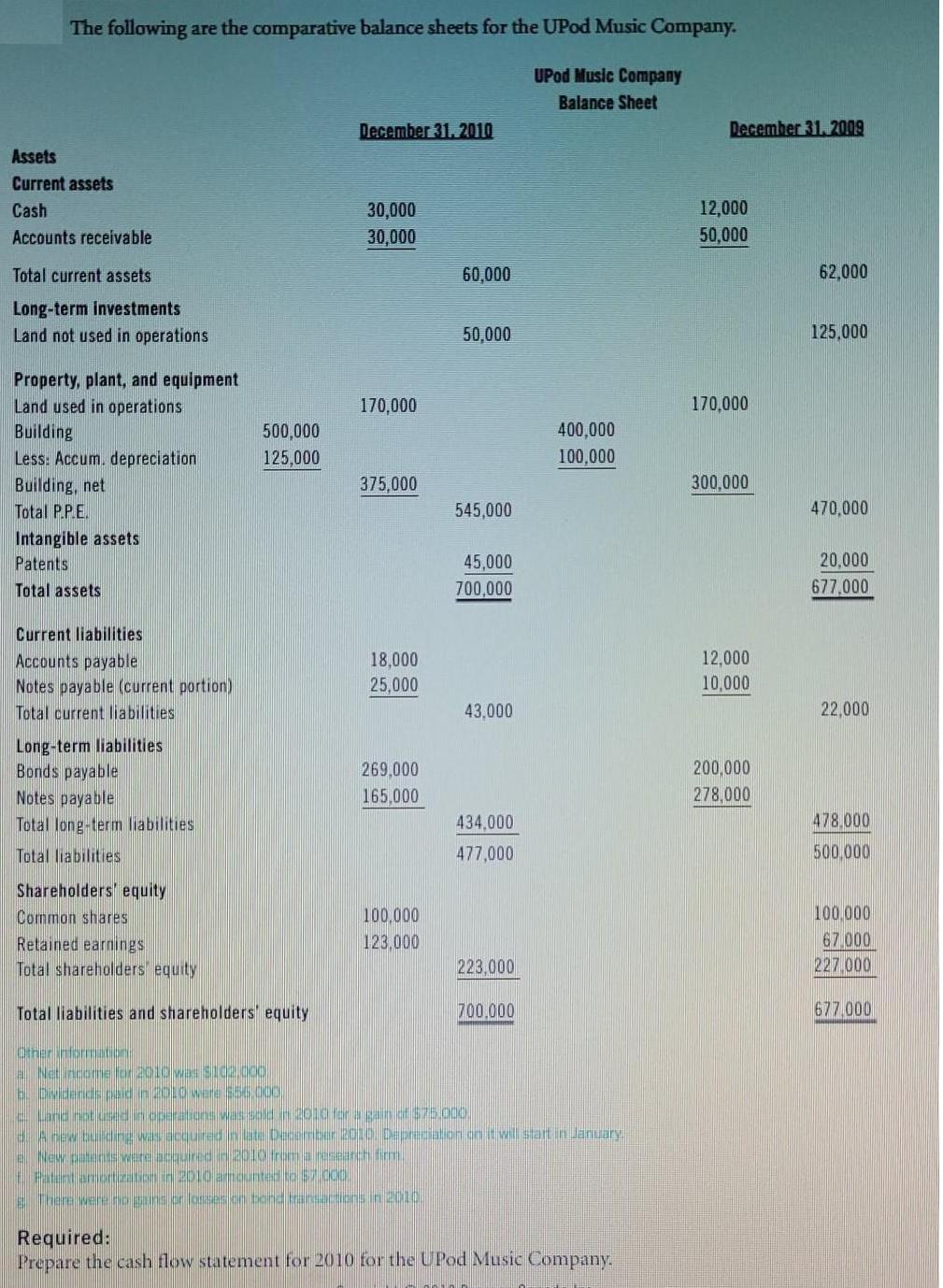

The following are the comparative balance sheets for the UPod Music Company. UPod Music Company Balance Sheet Assets Current assets Cash Accounts receivable Total

The following are the comparative balance sheets for the UPod Music Company. UPod Music Company Balance Sheet Assets Current assets Cash Accounts receivable Total current assets Long-term investments Land not used in operations Property, plant, and equipment Land used in operations Building Less: Accum. depreciation Building, net Total P.P.E. Intangible assets Patents Total assets Current liabilities Accounts payable Notes payable (current portion) Total current liabilities Long-term liabilities Bonds payable Notes payable Total long-term liabilities Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders equity 500,000 125,000 Total liabilities and shareholders' equity Other information Net income for 2010 was $102,000 b. Dividends paid in 2010 were $56.000. December 31, 2010 30,000 30,000 170,000 375,000 18,000 25,000 269,000 165,000 100,000 123,000 60,000 50,000 545,000 45,000 700,000 43,000 434,000 477,000 223,000 700.000 400,000 100,000 Land not used in operations was sold in 2010 for a gain of $75.000. d. A new building was acquired in late December 2010. Depreciation on it will start in January. New patents were sequired in 2010 from a research firm. Patent amortization in 2010 amounted to 57.000 There were no gains or losses on bond transactions in 2010. Required: Prepare the cash flow statement for 2010 for the UPod Music Company. December 31, 2009 12,000 50,000 170,000 300,000 12,000 10,000 200,000 278,000 62,000 125,000 470,000 20,000 677,000 22,000 478.000 500,000 100,000 67.000 227.000 677,000

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow statement Indirect Method Cash flow from operating activities net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started