Question

The following are the compositions of the total gross income of a MSME domestic corporation which is subject to MCIT in 2021: (MSME uses

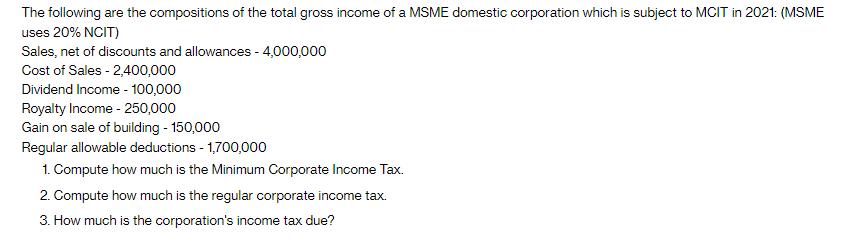

The following are the compositions of the total gross income of a MSME domestic corporation which is subject to MCIT in 2021: (MSME uses 20% NCIT) Sales, net of discounts and allowances - 4,000,000 Cost of Sales - 2,400,000 Dividend Income - 100,000 Royalty Income - 250,000 Gain on sale of building - 150,000 Regular allowable deductions - 1,700,000 1. Compute how much is the Minimum Corporate Income Tax. 2. Compute how much is the regular corporate income tax. 3. How much is the corporation's income tax due?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To compute the Minimum Corporate Income Tax MCIT regular Corporate Income Tax CIT and the corporatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: LibbyShort

7th Edition

78111021, 978-0078111020

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App