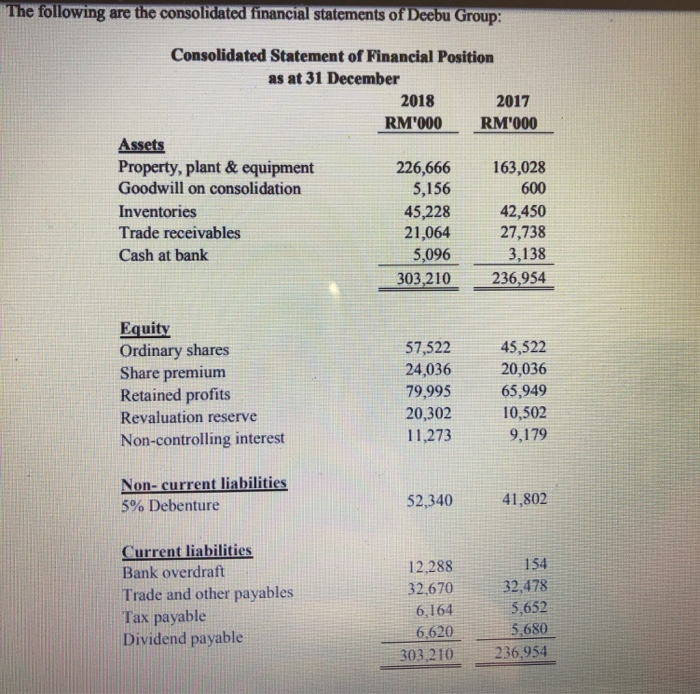

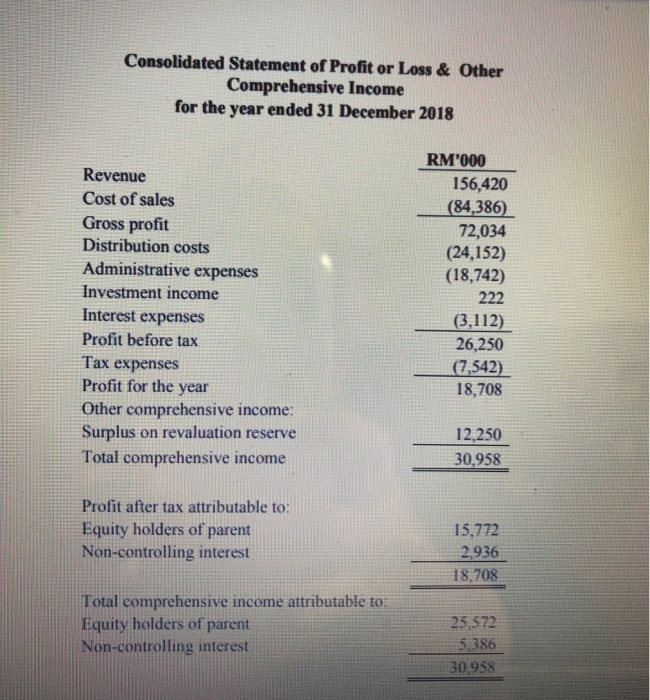

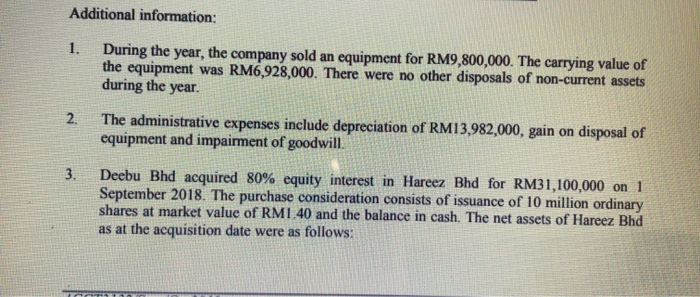

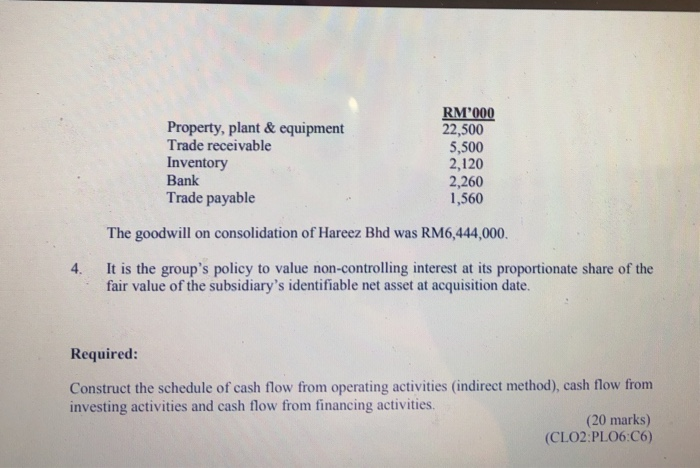

The following are the consolidated financial statements of Deebu Group: Consolidated Statement of Financial Position as at 31 December 2018 2017 RM1000 RM'000 Assets Property, plant & equipment 226,666 163,028 Goodwill on consolidation 5,156 600 Inventories 45,228 42,450 Trade receivables 21,064 27,738 Cash at bank 5,096 3,138 303,210 236,954 Equity Ordinary shares Share premium Retained profits Revaluation reserve Non-controlling interest 57,522 24,036 79,995 20,302 11,273 45,522 20,036 65,949 10,502 9,179 Non-current liabilities 5% Debenture 52,340 41,802 Current liabilities Bank overdraft Trade and other payables Tax payable Dividend payable 12,288 32,670 6,164 6,620 303,210 154 32,478 5,652 5,680 236,954 Consolidated Statement of Profit or Loss & Other Comprehensive Income for the year ended 31 December 2018 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Investment income Interest expenses Profit before tax Tax expenses Profit for the year Other comprehensive income: Surplus on revaluation reserve Total comprehensive income RM'000 156,420 (84,386) 72,034 (24,152) (18,742) 222 (3,112) 26,250 (7,542) 18,708 12,250 30,958 Profit after tax attributable to: Equity holders of parent Non-controlling interest 15,772 2,936 18.708 Total comprehensive income attributable to Equity holders of parent Non-controlling interest 25,572 5.386 30,958 Additional information: 1. During the year, the company sold an equipment for RM9,800,000. The carrying value of the equipment was RM6,928,000. There were no other disposals of non-current assets during the year. 2. The administrative expenses include depreciation of RM13,982,000, gain on disposal of equipment and impairment of goodwill. 3. Deebu Bhd acquired 80% equity interest in Hareez Bhd for RM31,100,000 on 1 September 2018. The purchase consideration consists of issuance of 10 million ordinary shares at market value of RM1.40 and the balance in cash. The net assets of Hareez Bhd as at the acquisition date were as follows: Property, plant & equipment Trade receivable Inventory Bank Trade payable RM'000 22,500 5,500 2,120 2,260 1,560 The goodwill on consolidation of Hareez Bhd was RM6,444,000. 4. It is the group's policy to value non-controlling interest at its proportionate share of the fair value of the subsidiary's identifiable net asset at acquisition date. Required: Construct the schedule of cash flow from operating activities (indirect method), cash flow from investing activities and cash flow from financing activities, (20 marks) (CLO2:PLO6:06)