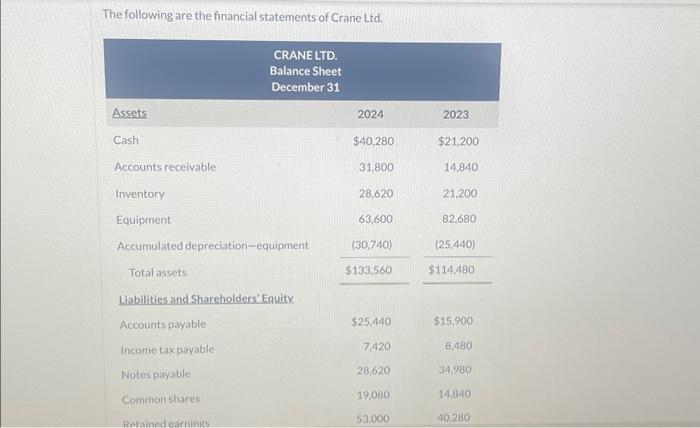

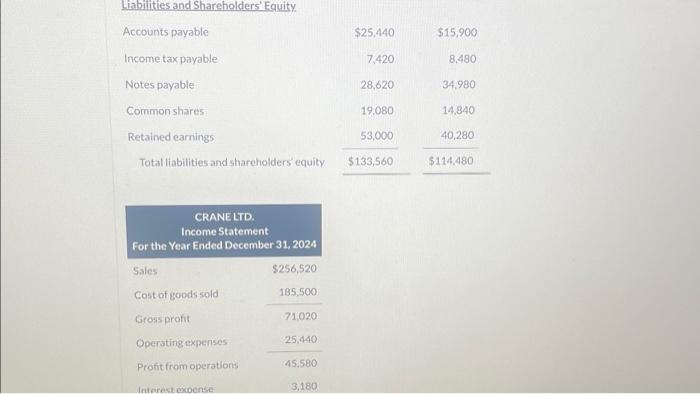

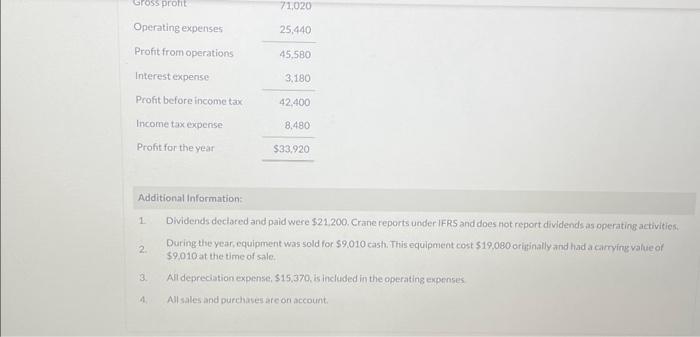

The following are the financial statements of Crane Ltd. Liabilities and Shareholders' Equity. Accounts payable $25,440$15,900 Income taxpayable 7.4208,480 Notes payable Common shares CRANE LTD. Income Statement For the Year Ended December 31, 2024 Ssles Cost of goods sold Grossprofit 71,020 \begin{tabular}{lr} Operating expenses & 25,440 \\ \hline Profit from operations & 45,580 \end{tabular} Interest cyoon'a 3,180 Additional information: 1. Dividends declared and paid were $21.200. Crane reports under IFRS and does not report dividends as operating activities, 2. During the year, equipment was sold for $9.010 cash. This equipment cost $19,080 oritinally and had a cimping value of $9010 at the time of sale. 3. Afl depreciation expense, $15,370, is included in the operating expenses 4. Alsales and purchases are ori account. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign es. -15, 000 or in parenthesis es. (15,000). Calculate free cash flow. (Show amounts that decreose cash flow with either a-sign eg- 15,000 or in porenthesis es. (15,000).) Free cashflow. $ The following are the financial statements of Crane Ltd. Liabilities and Shareholders' Equity. Accounts payable $25,440$15,900 Income taxpayable 7.4208,480 Notes payable Common shares CRANE LTD. Income Statement For the Year Ended December 31, 2024 Ssles Cost of goods sold Grossprofit 71,020 \begin{tabular}{lr} Operating expenses & 25,440 \\ \hline Profit from operations & 45,580 \end{tabular} Interest cyoon'a 3,180 Additional information: 1. Dividends declared and paid were $21.200. Crane reports under IFRS and does not report dividends as operating activities, 2. During the year, equipment was sold for $9.010 cash. This equipment cost $19,080 oritinally and had a cimping value of $9010 at the time of sale. 3. Afl depreciation expense, $15,370, is included in the operating expenses 4. Alsales and purchases are ori account. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign es. -15, 000 or in parenthesis es. (15,000). Calculate free cash flow. (Show amounts that decreose cash flow with either a-sign eg- 15,000 or in porenthesis es. (15,000).) Free cashflow. $