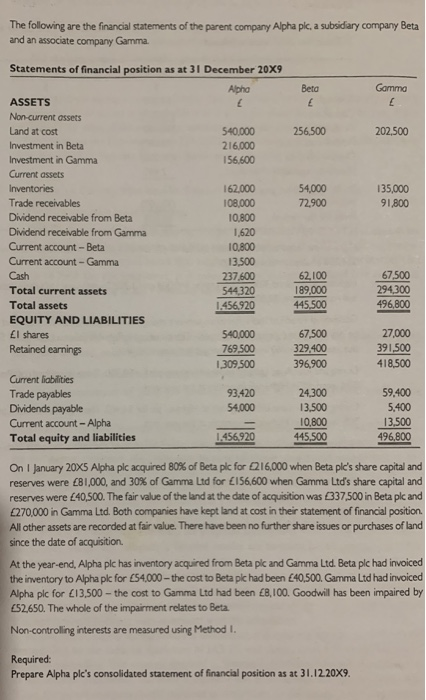

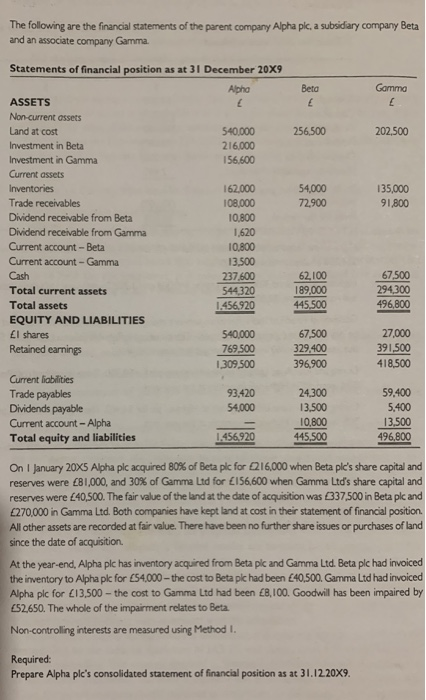

The following are the financial statements of the parent company Alpha pic, a subsidiary company Beta and an associate company Gamma Statements of financial position as at 31 December 20X9 Alpha Beta Gaming 256,500 202.500 540.000 216,000 156,600 54,000 72.900 135,000 91,800 ASSETS Non-current assets Land at cost Investment in Beta Investment in Gamma Current assets Inventories Trade receivables Dividend receivable from Beta Dividend receivable from Gamma Current account - Beta Current account - Gamma Cash Total current assets Total assets EQUITY AND LIABILITIES El shares Retained earnings 162.000 108,000 10,800 1,620 10,800 13,500 237,600 544320 1.456,920 62,100 189,000 445.500 67.500 294,300 496,800 540,000 769.500 1,309,500 67,500 329,400 396,900 27,000 391,500 418,500 Current liabilities Trade payables Dividends payable Current account - Alpha Total equity and liabilities 93,420 54,000 24.300 13.500 10,800 445.500 59,400 5,400 13,500 496,800 1.456920 On January 20X5 Alpha plc acquired 80% of Beta pic for 216,000 when Beta ple's share capital and reserves were 281,000, and 30% of Gamma Ltd for 156,600 when Gamma Ltd's share capital and reserves were 40,500. The fair value of the land at the date of acquisition was 1337.500 in Beta ple and 0270,000 in Gamma Ltd. Both companies have kept land at cost in their statement of financial position All other assets are recorded at fair value. There have been no further share issues or purchases of land since the date of acquisition At the year-end, Alpha plc has inventory acquired from Beta plc and Gamma Ltd. Beta plc had invoiced the inventory to Apha pl for 54.000- the cost to Beta pic had been 40.500.Garma Ltd had invoiced Alpha pic for 13.500 - the cost to Gamma Ltd had been 8,100. Goodwil has been impaired by 52.650. The whole of the impairment relates to Beta Non-controlling interests are measured using Method I. Required: Prepare Alpha ple's consolidated statement of financial position as at 31.12.20X9. The following are the financial statements of the parent company Alpha pic, a subsidiary company Beta and an associate company Gamma Statements of financial position as at 31 December 20X9 Alpha Beta Gaming 256,500 202.500 540.000 216,000 156,600 54,000 72.900 135,000 91,800 ASSETS Non-current assets Land at cost Investment in Beta Investment in Gamma Current assets Inventories Trade receivables Dividend receivable from Beta Dividend receivable from Gamma Current account - Beta Current account - Gamma Cash Total current assets Total assets EQUITY AND LIABILITIES El shares Retained earnings 162.000 108,000 10,800 1,620 10,800 13,500 237,600 544320 1.456,920 62,100 189,000 445.500 67.500 294,300 496,800 540,000 769.500 1,309,500 67,500 329,400 396,900 27,000 391,500 418,500 Current liabilities Trade payables Dividends payable Current account - Alpha Total equity and liabilities 93,420 54,000 24.300 13.500 10,800 445.500 59,400 5,400 13,500 496,800 1.456920 On January 20X5 Alpha plc acquired 80% of Beta pic for 216,000 when Beta ple's share capital and reserves were 281,000, and 30% of Gamma Ltd for 156,600 when Gamma Ltd's share capital and reserves were 40,500. The fair value of the land at the date of acquisition was 1337.500 in Beta ple and 0270,000 in Gamma Ltd. Both companies have kept land at cost in their statement of financial position All other assets are recorded at fair value. There have been no further share issues or purchases of land since the date of acquisition At the year-end, Alpha plc has inventory acquired from Beta plc and Gamma Ltd. Beta plc had invoiced the inventory to Apha pl for 54.000- the cost to Beta pic had been 40.500.Garma Ltd had invoiced Alpha pic for 13.500 - the cost to Gamma Ltd had been 8,100. Goodwil has been impaired by 52.650. The whole of the impairment relates to Beta Non-controlling interests are measured using Method I. Required: Prepare Alpha ple's consolidated statement of financial position as at 31.12.20X9