Question

The following are the financial statements of two businesses: (a) Compute the following ratios based on the information given for Faber Trading: (i) Gross profit

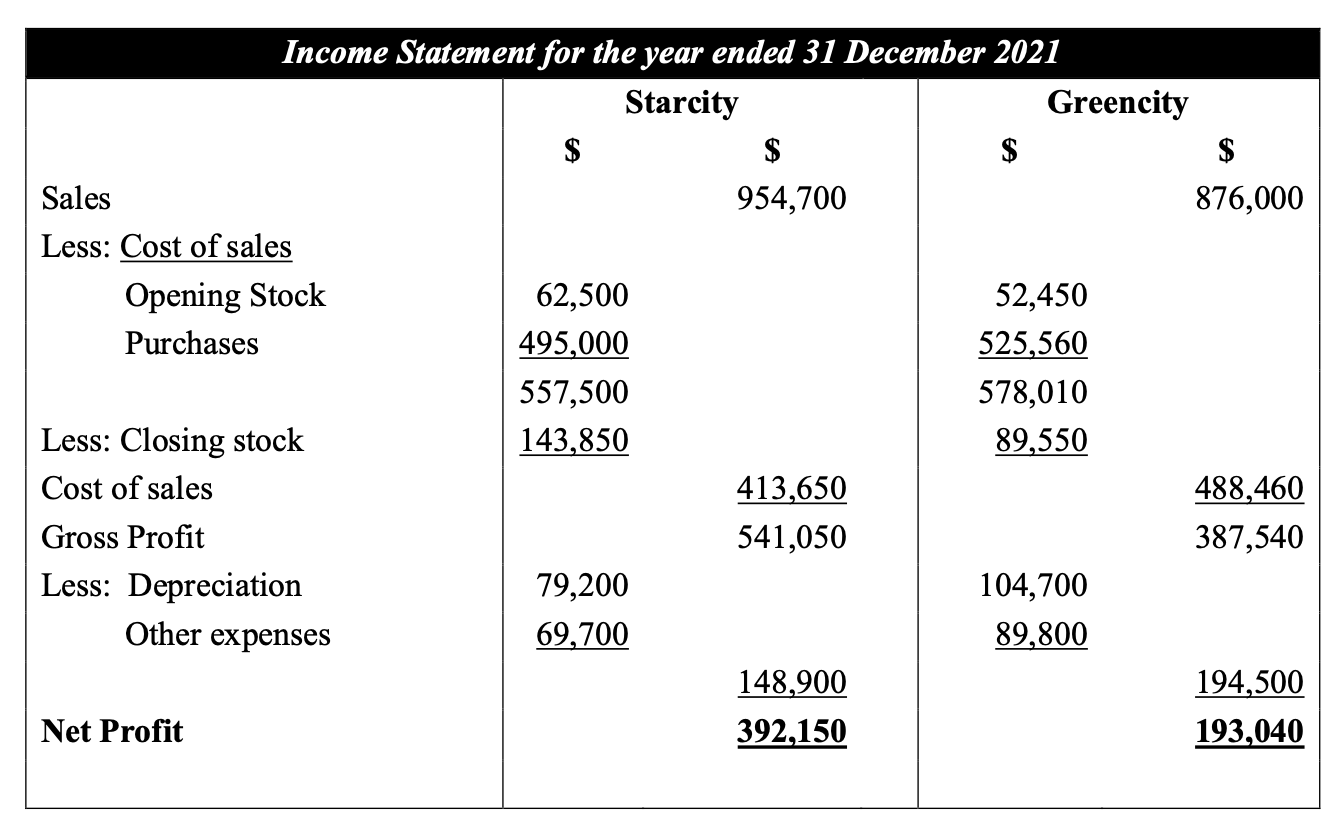

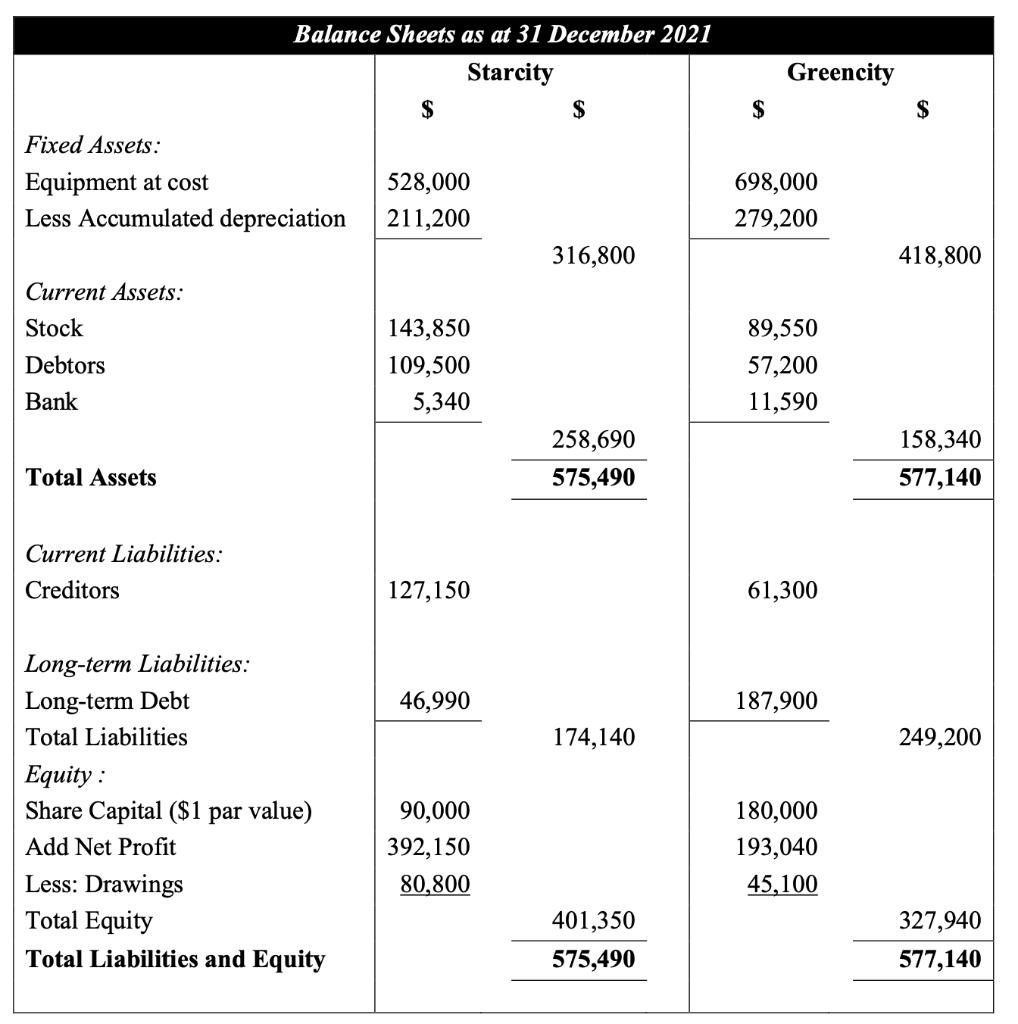

The following are the financial statements of two businesses:

(a) Compute the following ratios based on the information given for Faber Trading:

(i) Gross profit margin ratio (%)

(ii) Net profit margin ratio (%)

(iii) Current ratio (times)

(iv) Quick ratio (times)

(v) Average Stock Turnover Period (days)

(vi) Debtor Collection Period (days)

(b) Using the appropriate financial ratios calculated in (a), compare and comment on the performance and financial position of the two companies in terms of:

(i) Profitability (ii) Liquidity (Solvency) (iii) Efficiency of its inventory management.

Income Statement for the year ended 31 December 2021 Starcity Greencity $ $ Sales 954,700 876,000 Less: Cost of sales Opening Stock 62,500 52,450 Purchases 495,000 525,560 557,500 578,010 Less: Closing stock 143,850 89,550 Cost of sales 413,650 488,460 Gross Profit 541,050 387,540 Less: Depreciation 79,200 104,700 69,700 89,800 148,900 194,500 Net Profit 392,150 193,040 Other expenses Greencity $ $ 698,000 279,200 Balance Sheets as at 31 December 2021 Starcity $ $ Fixed Assets: Equipment at cost 528,000 Less Accumulated depreciation 211,200 316,800 Current Assets: Stock 143,850 Debtors 109,500 Bank 5,340 258,690 Total Assets 575,490 418,800 89,550 57,200 11,590 158,340 577,140 Current Liabilities: Creditors 127,150 61,300 46,990 187,900 174,140 249,200 Long-term Liabilities: Long-term Debt Total Liabilities Equity : Share Capital ($1 par value) Add Net Profit Less: Drawings Total Equity Total Liabilities and Equity 90,000 392,150 80,800 180,000 193,040 45,100 401,350 575,490 327,940 577,140Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started