Answered step by step

Verified Expert Solution

Question

1 Approved Answer

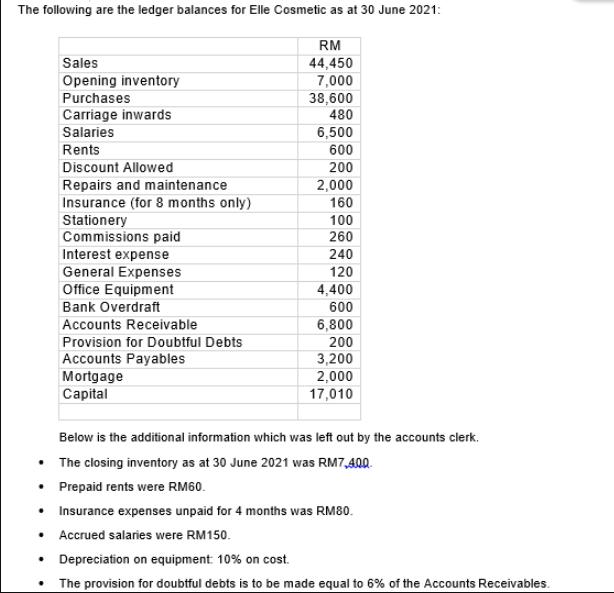

The following are the ledger balances for Elle Cosmetic as at 30 June 2021: Sales Opening inventory Purchases RM 44,450 7,000 38,600 Carriage inwards

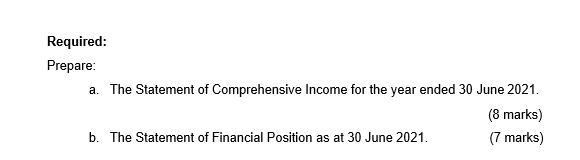

The following are the ledger balances for Elle Cosmetic as at 30 June 2021: Sales Opening inventory Purchases RM 44,450 7,000 38,600 Carriage inwards 480 Salaries 6,500 Rents 600 Discount Allowed 200 Repairs and maintenance 2,000 Insurance (for 8 months only) 160 Stationery 100 Commissions paid 260 Interest expense 240 General Expenses 120 Office Equipment 4,400 Bank Overdraft 600 Accounts Receivable 6,800 Provision for Doubtful Debts 200 Accounts Payables 3,200 Mortgage 2,000 Capital 17,010 Below is the additional information which was left out by the accounts clerk. The closing inventory as at 30 June 2021 was RM7,400. Prepaid rents were RM60. Insurance expenses unpaid for 4 months was RM80. Accrued salaries were RM150. Depreciation on equipment: 10% on cost. The provision for doubtful debts is to be made equal to 6% of the Accounts Receivables. Required: Prepare: a. The Statement of Comprehensive Income for the year ended 30 June 2021. (8 marks) b. The Statement of Financial Position as at 30 June 2021. (7 marks) Question 1 a. Describe the difference between depreciation and depletion. (5 marks) b. Outline the accounting entries required when plant assets are disposed by a company. (10 marks) Question 2 Style photo sells only one product. The statement of comprehensive income for 2021 is provided below: Sales 60,000 Less variable expenses (30,000) Contribution margin 30,000 Less fixed expenses Net income (22,500) 7,500 Required: Calculate with workings: a. The contribution margin ratio in percentage. (3 marks) b. Thee breakeven point in total sales ringgits. (3 marks) c. The sales in RM if the company wants to achieve RM40,000 in net income. (4 marks) d. The increase in net income if sales increase by RM50.000 (3 marks) e. The contribution margin in RM if there is no change in fixed and variable expenses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started