Question

The following are the projected cash flows to equity and to the firm as a whole for the next five years. The firm has

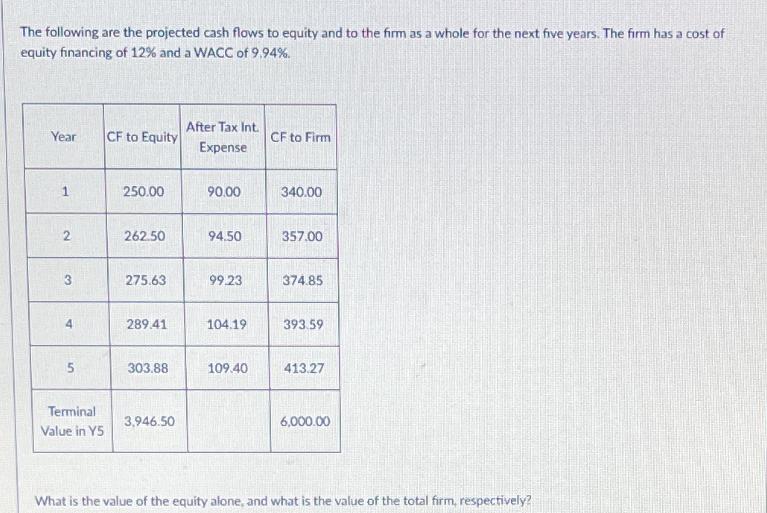

The following are the projected cash flows to equity and to the firm as a whole for the next five years. The firm has a cost of equity financing of 12% and a WACC of 9,94%. Year 1 2 3 4 5 Terminal Value in Y5 CF to Equity 250.00 262.50 275.63 289.41 303.88 3,946.50 After Tax Int. Expense 90.00 94.50 99.23 104.19 109.40 CF to Firm 340.00 357.00 374.85 393.59 413.27 6,000.00 What is the value of the equity alone, and what is the value of the total firm, respectively?

Step by Step Solution

3.49 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

The answer of the above asked question is below First of all given to calculate the value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App