Answered step by step

Verified Expert Solution

Question

1 Approved Answer

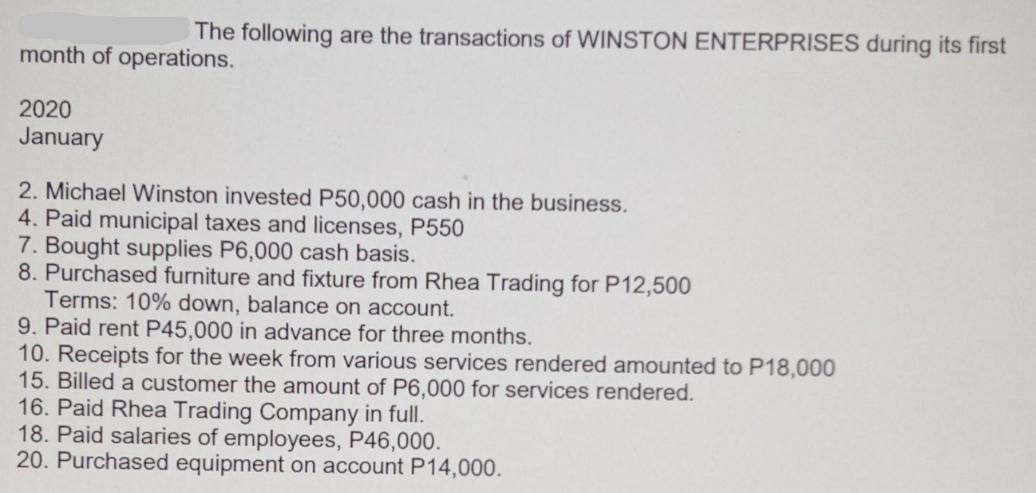

The following are the transactions of WINSTON ENTERPRISES during its first month of operations. 2020 January 2. Michael Winston invested P50,000 cash in the

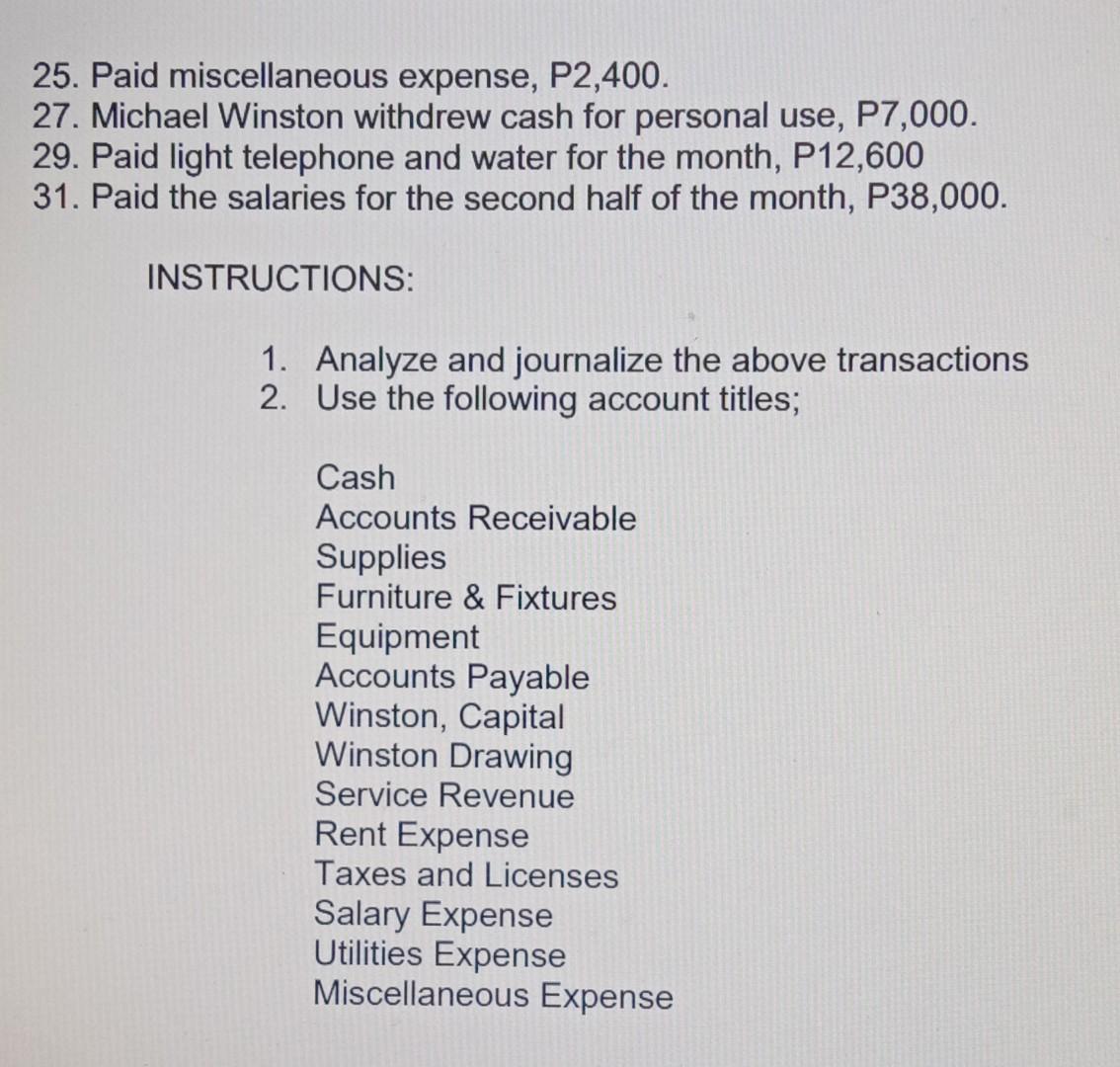

The following are the transactions of WINSTON ENTERPRISES during its first month of operations. 2020 January 2. Michael Winston invested P50,000 cash in the business. 4. Paid municipal taxes and licenses, P550 7. Bought supplies P6,000 cash basis. 8. Purchased furniture and fixture from Rhea Trading for P12,500 Terms: 10% down, balance on account. 9. Paid rent P45,000 in advance for three months. 10. Receipts for the week from various services rendered amounted to P18,000 15. Billed a customer the amount of P6,000 for services rendered. 16. Paid Rhea Trading Company in full. 18. Paid salaries of employees, P46,000. 20. Purchased equipment on account P14,000. 25. Paid miscellaneous expense, P2,400. 27. Michael Winston withdrew cash for personal use, P7,000. 29. Paid light telephone and water for the month, P12,600 31. Paid the salaries for the second half of the month, P38,000. INSTRUCTIONS: 1. Analyze and journalize the above transactions 2. Use the following account titles; Cash Accounts Receivable Supplies Furniture & Fixtures Equipment Accounts Payable Winston, Capital Winston Drawing Service Revenue Rent Expense Taxes and Licenses Salary Expense Utilities Expense Miscellaneous Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Analyze and Journalize the above transactions January 2 Cash Dr 50000 Winston Capital Cr 50000 Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started