Answered step by step

Verified Expert Solution

Question

1 Approved Answer

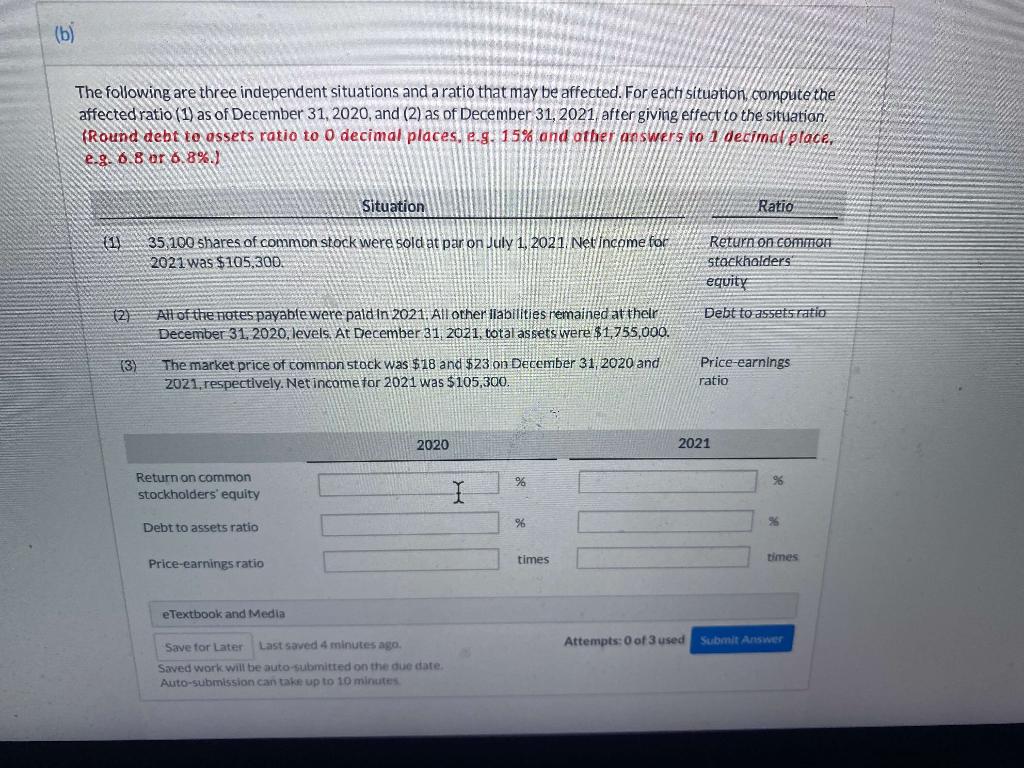

The following are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31,

The following are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2020, and (2) as of December 31, 2021, after giving effect to the situation.

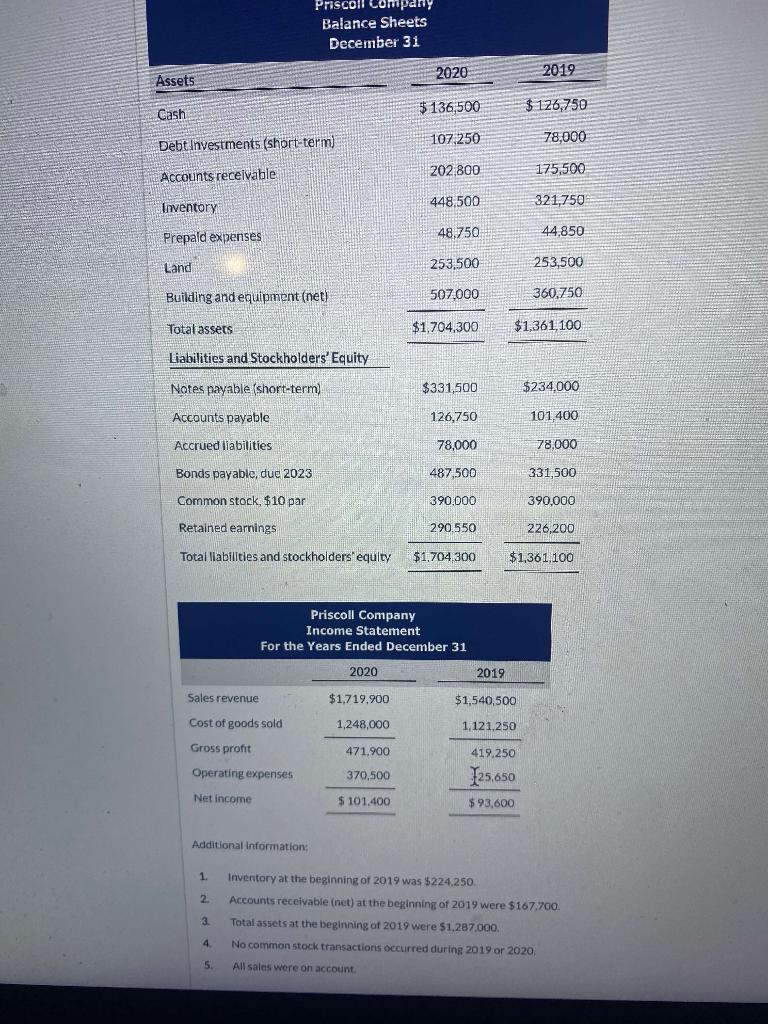

Priscoll Company Balance Sheets December 31 2019 $126,750 78,000 175,500 321,750 44,850 253,500 360,750 $1,361,100 $234,000 101,400 78,000 331,500 390,000 226,200 $1,361,100 2020 Assets $136,500 Cash 107,250 Debt Investments (short-term) 202,800 Accounts receivable 448.500 Inventory Prepald expenses 48.750 Land 253,500 Building and equipment (net) 507.000 Total assets $1,704,300 Liabilities and Stockholders' Equity Notes payable (short-term) $331,500. Accounts payable 126,750 Accrued liabilities 78,000 Bonds payable, duc 2023 487,500 Common stock, $10 par 390,000 Retained earnings 290.550 Total liabilities and stockholders' equity $1,704,300 Priscoll Company Income Statement For the Years Ended December 31 2020 Sales revenue $1,719,900 Cost of goods sold 1,248,000 Gross profit 471,900 Operating expenses 370,500 Net income $ 101.400 Additional Information: 1. Inventory at the beginning of 2019 was $224.250. 2. Accounts receivable (net) at the beginning of 2019 were $167,700. 3. Total assets at the beginning of 2019 were $1,287,000. 4. No common stock transactions occurred during 2019 or 2020, 5. All sales were on account. 2019 $1,540,500 1,121,250 419,250 125.650 $93,600 The following are three independent situations and a ratio that may be affected. For each situation, compute the affected ratio (1) as of December 31, 2020, and (2) as of December 31, 2021, after giving effect to the situation. (Round debt to assets ratio to 0 decimal places, e.g. 15% and other answers to 1 decimal place, e.g. 6.8 or 6.8%) Situation Ratio (1) 35,100 shares of common stock were sold at par on July 1, 2021. Net income for 2021 was $105,300. Return on common stockholders equity (2) Debt to assets ratio All of the notes payable were paid in 2021. All other lilabilities remained at their December 31, 2020, levels. At December 31, 2021, total assets were $1,755,000. (3) The market price of common stock was $18 and $23 on December 31, 2020 and 2021, respectively. Net income for 2021 was $105,300. Price-earnings ratio 2020 % % Return on common stockholders' equity % Debt to assets ratio times Price-earnings ratio eTextbook and Media Save for Later Last saved 4 minutes ago. Saved work will be auto-submitted on the due date. Auto-submission can take up to 10 minutes I 2021 % times Attempts: 0 of 3 used SubmitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started