Answered step by step

Verified Expert Solution

Question

1 Approved Answer

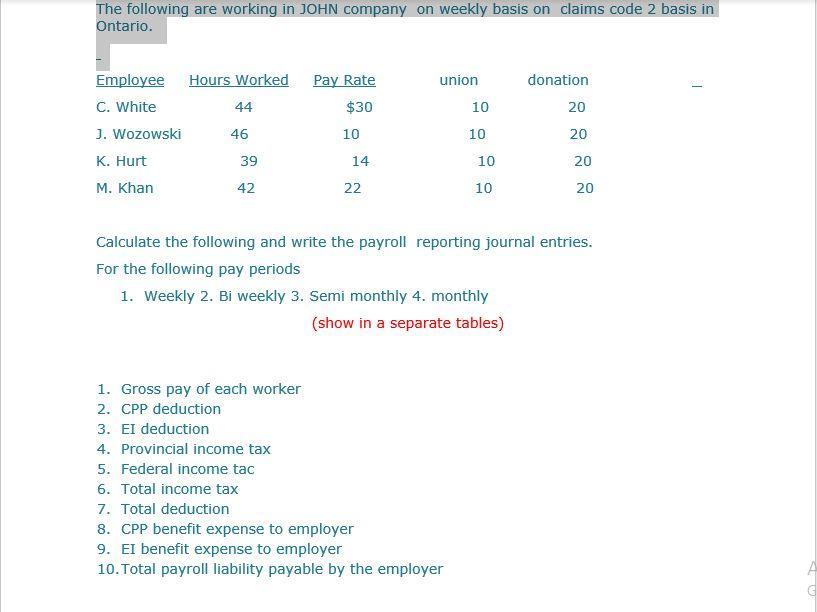

The following are working in JOHN company on weekly basis on claims code 2 basis in Ontario. Employee Hours Worked C. White J. Wozowski

The following are working in JOHN company on weekly basis on claims code 2 basis in Ontario. Employee Hours Worked C. White J. Wozowski K. Hurt M. Khan 44 46 39 42 1. Gross pay of each worker 2. CPP deduction 3. EI deduction 4. Provincial income tax 5. Federal income tac 6. Total income tax 7. Total deduction Pay Rate $30 10 14 22 union 10 8. CPP benefit expense to employer 9. El benefit expense to employer 10. Total payroll liability payable by the employer 10 10 10 donation Calculate the following and write the payroll reporting journal entries. For the following pay periods 1. Weekly 2. Bi weekly 3. Semi monthly 4. monthly (show in a separate tables) 20 20 20 20 T A

Step by Step Solution

★★★★★

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Untitled 1 LibreOffice Writer File Edit View Insert Format Styles Table Form Tools Window Help Defau...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started