Answered step by step

Verified Expert Solution

Question

1 Approved Answer

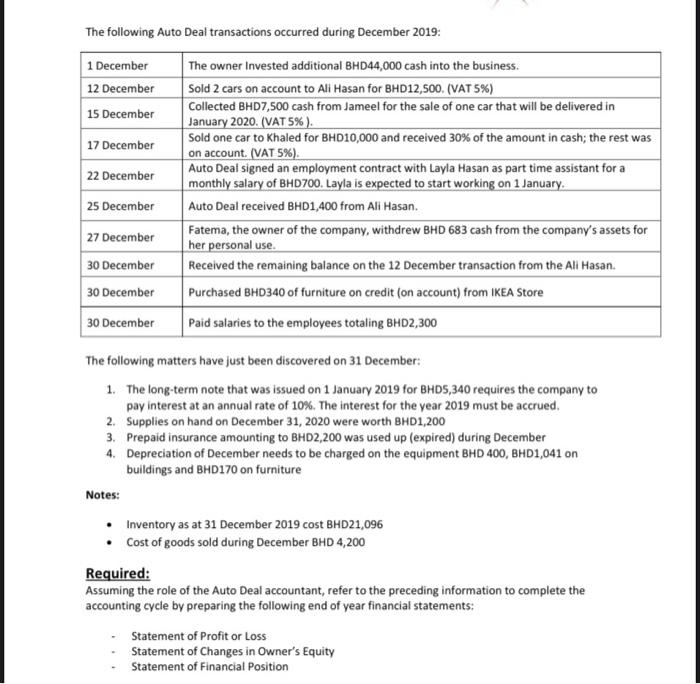

The following Auto Deal transactions occurred during December 2019: 1 December 12 December 15 December 17 December 22 December 25 December 27 December 30

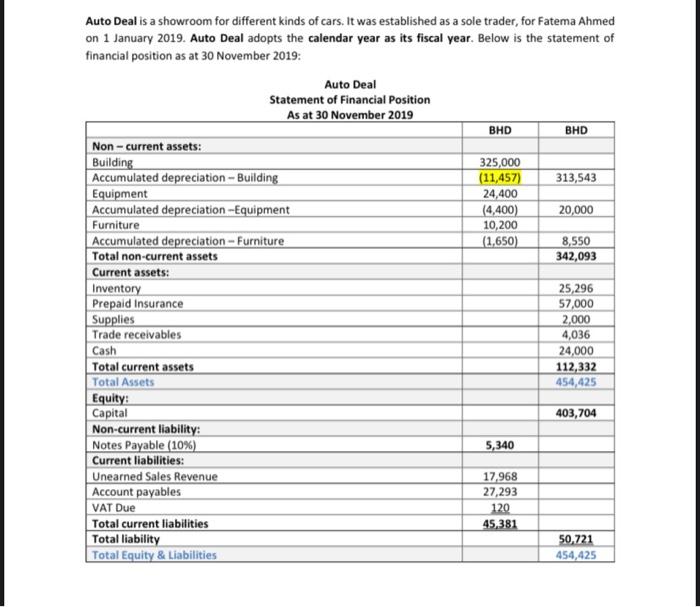

The following Auto Deal transactions occurred during December 2019: 1 December 12 December 15 December 17 December 22 December 25 December 27 December 30 December 30 December 30 December The following matters have just been discovered on 31 December: 1. The long-term note that was issued on 1 January 2019 for BHD5,340 requires the company to pay interest at an annual rate of 10%. The interest for the year 2019 must be accrued. 2. Supplies on hand on December 31, 2020 were worth BHD1,200 3. 4. Prepaid insurance amounting to BHD2,200 was used up (expired) during December Depreciation of December needs to be charged on the equipment BHD 400, BHD1,041 on buildings and BHD170 on furniture Notes: The owner Invested additional BHD44,000 cash into the business. Sold 2 cars on account to Ali Hasan for BHD12,500. (VAT 5%) Collected BHD7,500 cash from Jameel for the sale of one car that will be delivered in January 2020. (VAT 5%). Sold one car to Khaled for BHD10,000 and received 30% of the amount in cash; the rest was on account. (VAT 5%). Auto Deal signed an employment contract with Layla Hasan as part time assistant for a monthly salary of BHD700. Layla is expected to start working on 1 January. Auto Deal received BHD1,400 from Ali Hasan. Fatema, the owner of the company, withdrew BHD 683 cash from the company's assets for her personal use. Received the remaining balance on the 12 December transaction from the Ali Hasan. Purchased BHD340 of furniture on credit (on account) from IKEA Store Paid salaries to the employees totaling BHD2,300 . Required: Assuming the role of the Auto Deal accountant, refer to the preceding information to complete the accounting cycle by preparing the following end of year financial statements: . Inventory as at 31 December 2019 cost BHD21,096 Cost of goods sold during December BHD 4,200 Statement of Profit or Loss Statement of Changes in Owner's Equity Statement of Financial Position Auto Deal is a showroom for different kinds of cars. It was established as a sole trader, for Fatema Ahmed on 1 January 2019. Auto Deal adopts the calendar year as its fiscal year. Below is the statement of financial position as at 30 November 2019: Non-current assets: Building Accumulated depreciation - Building Equipment Accumulated depreciation -Equipment Furniture Accumulated depreciation - Furniture Total non-current assets Current assets: Inventory Prepaid Insurance Supplies Trade receivables Cash Total current assets Total Assets Equity: Capital Non-current liability: Notes Payable (10%) Current liabilities: Unearned Sales Revenue Account payables Auto Deal Statement of Financial Position As at 30 November 2019 VAT Due Total current liabilities Total liability Total Equity & Liabilities BHD 325,000 (11,457) 24,400 (4,400) 10,200 (1,650) 5,340 17,968 27,293 120 45,381 BHD 313,543 20,000 8,550 342,093 25,296 57,000 2,000 4,036 24,000 112,332 454,425 403,704 50,721 454,425

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started