Answered step by step

Verified Expert Solution

Question

1 Approved Answer

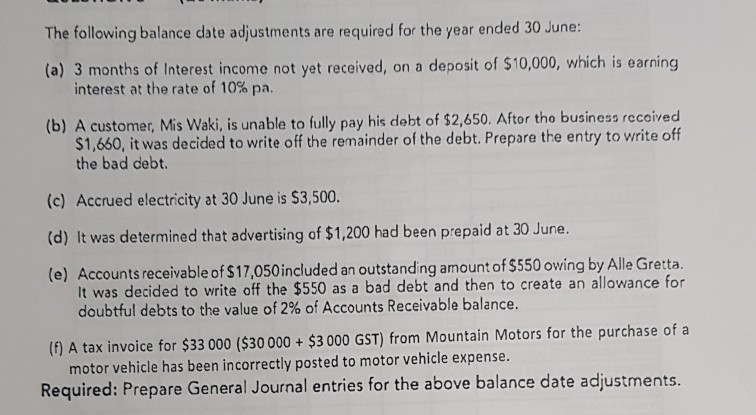

The following balance date adjustments are required for the year ended 30 June: (a) 3 months of Interest income not yet received, on a deposit

The following balance date adjustments are required for the year ended 30 June: (a) 3 months of Interest income not yet received, on a deposit of $10,000, which is earning interest at the rate of 10% pa. (b) A customer, Mis Waki, is unable to fully pay his debt of $2,650. Aftor tho business recoived $1,650, it was decided to write off the remainder of the debt. Prepare the entry to write off the bad debt. (c) Accrued electricity at 30 June is $3,500. (d) It was determined that advertising of $1,200 had been prepaid at 30 June. (e) Accounts receivable of $17,050included an outstanding amount of $550 owing by Alle Gretta. It was decided to write off the $550 as a bad debt and then to create an allowance for doubtful debts to the value of 2% of Accounts Receivable balance (1 A tax invoice for $33 000 ($30000 + $3 000 GST) from Mountain Motors for the purchase of a motor vehicle has been incorrectly posted to motor vehicle expense. Required: Prepare General Journal entries for the above balance date adjustments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started