Answered step by step

Verified Expert Solution

Question

1 Approved Answer

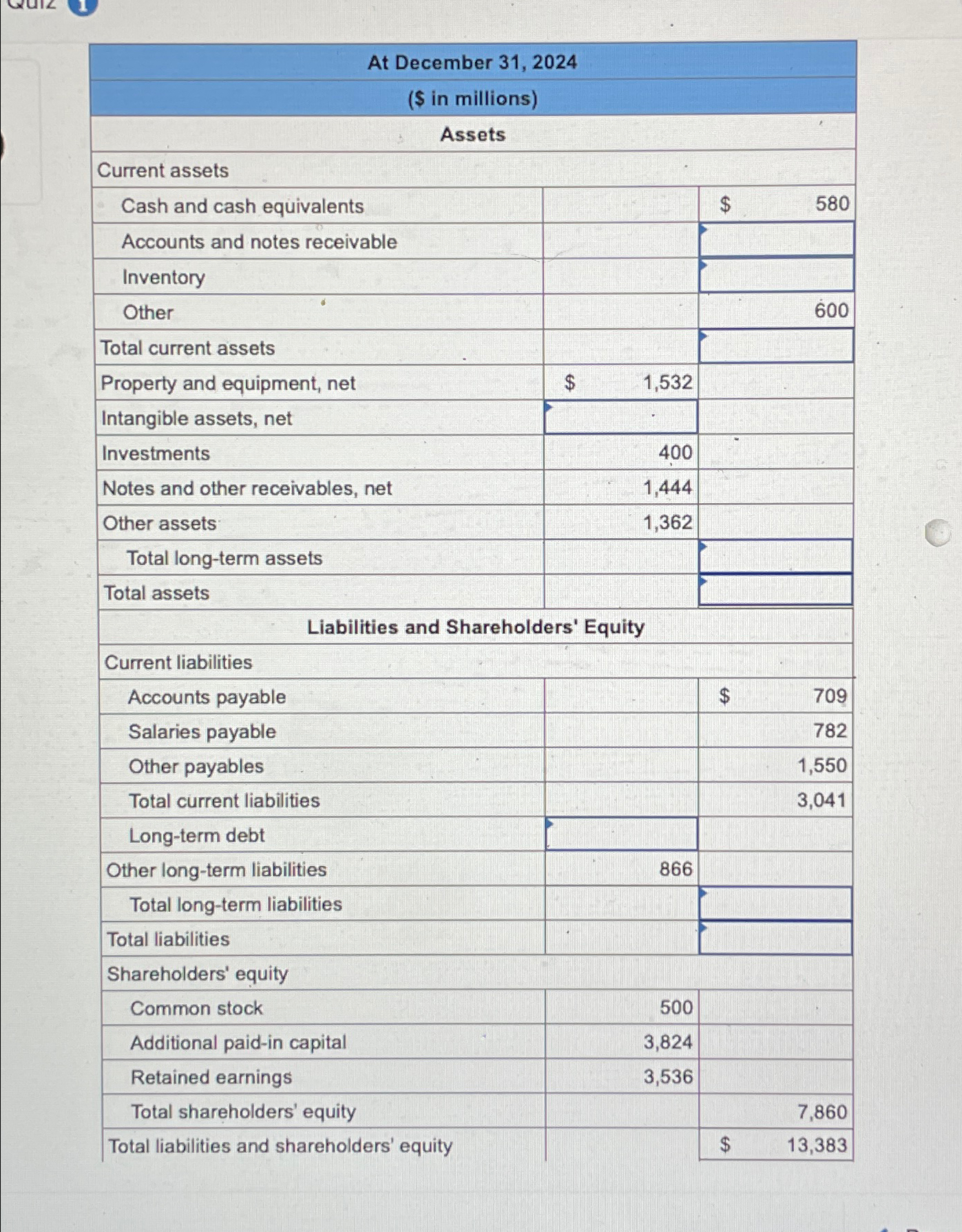

The following balance sheet information ( in $ millions ) comes from the Annual Report to Shareholders of Merry International Incorporated for the 2 0

The following balance sheet information in $ millions comes from the Annual Report to Shareholders of Merry International Incorporated for the fiscal year. The following additional information from an analysis of Merry's financial position is available:

Current ratio ; Acidtest ratio ; Debt to equity ratio

Required:

Compute the missing amounts in the balance sheet.

Note: Enter your answers in millions of dollars. Round your intermediate and final answers to the nearest whole dollar.

tableAt December $ in millionsAssetsCurrent assetsCash and cash equivalents,,$Accounts and notes receivableInventoryOtherTotal current assetsProperty and equipment, net,Intangible assets, netInvestmentsNotes and other receivables, net,Other assets,Total longterm assetsTotal assetsLiabilities and Shareholders' EquityCurrent liabilitiesAccounts payable,,$Salaries payable,,,Other payables,,,Total current liabilities,,,Longterm debtOther longterm liabilities,Total longterm liabilitiesTotal liabilitiesShareholders equityCommon stock,:Additional paidin capital,Retained earnings,Total shareholders' equity,,,Total liabilities and shareholders' equity,,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started