Answered step by step

Verified Expert Solution

Question

1 Approved Answer

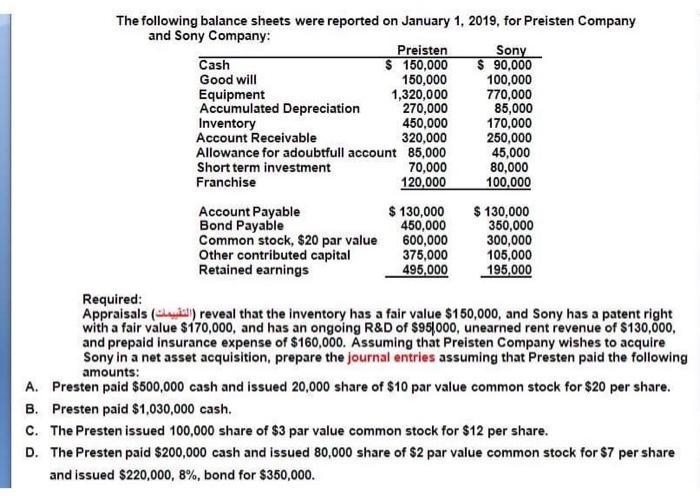

The following balance sheets were reported on January 1, 2019, for Preisten Company and Sony Company: Cash Good will Equipment Accumulated Depreciation Inventory Account

The following balance sheets were reported on January 1, 2019, for Preisten Company and Sony Company: Cash Good will Equipment Accumulated Depreciation Inventory Account Receivable 320,000 Allowance for adoubtfull account 85,000 Short term investment 70,000 Franchise 120,000 Account Payable Bond Payable Preisten $ 150,000 150,000 1,320,000 270,000 450,000 Common stock, $20 par value Other contributed capital Retained earnings $ 130,000 450,000 600,000 375,000 495,000 Sony $ 90,000 100,000 770,000 85,000 170,000 250,000 45,000 80,000 100,000 $ 130,000 350,000 300,000 105,000 195,000 Required: Appraisals () reveal that the inventory has a fair value $150,000, and Sony has a patent right with a fair value $170,000, and has an ongoing R&D of $951000, unearned rent revenue of $130,000, and prepaid insurance expense of $160,000. Assuming that Preisten Company wishes to acquire Sony in a net asset acquisition, prepare the journal entries assuming that Presten paid the following amounts: A. Presten paid $500,000 cash and issued 20,000 share of $10 par value common stock for $20 per share. B. Presten paid $1,030,000 cash. C. The Presten issued 100,000 share of $3 par value common stock for $12 per share. D. The Presten paid $200,000 cash and issued 80,000 share of $2 par value common stock for $7 per share and issued $220,000, 8%, bond for $350,000.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Prepare the Statement of Net Asset of the Transferor Company ie Sony Net Asset Total Asset Cash 90000 Goodwill 100000 Equipment 770000 Accumulated Dep 85000 Inventory 150000 at Fair Value as pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started