Answered step by step

Verified Expert Solution

Question

1 Approved Answer

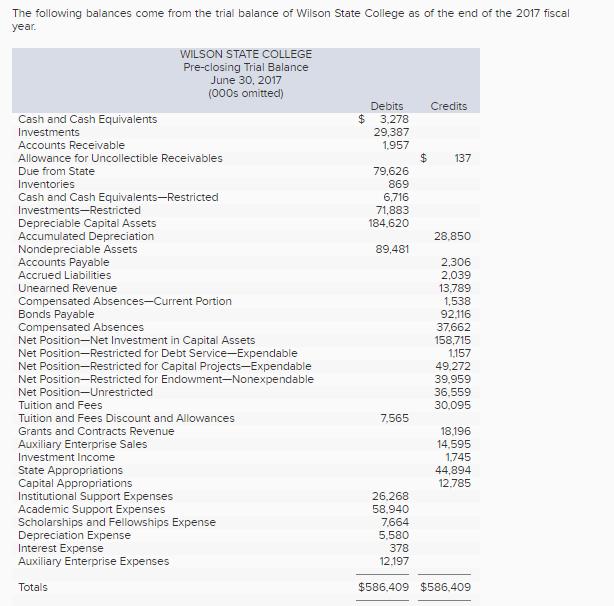

The following balances come from the trial balance of Wilson State College as of the end of the 2017 fiscal year. Cash and Cash

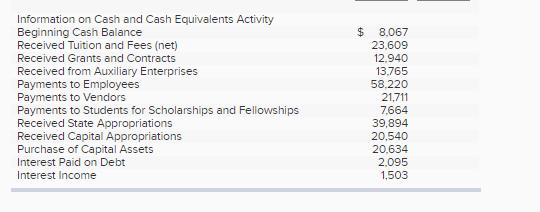

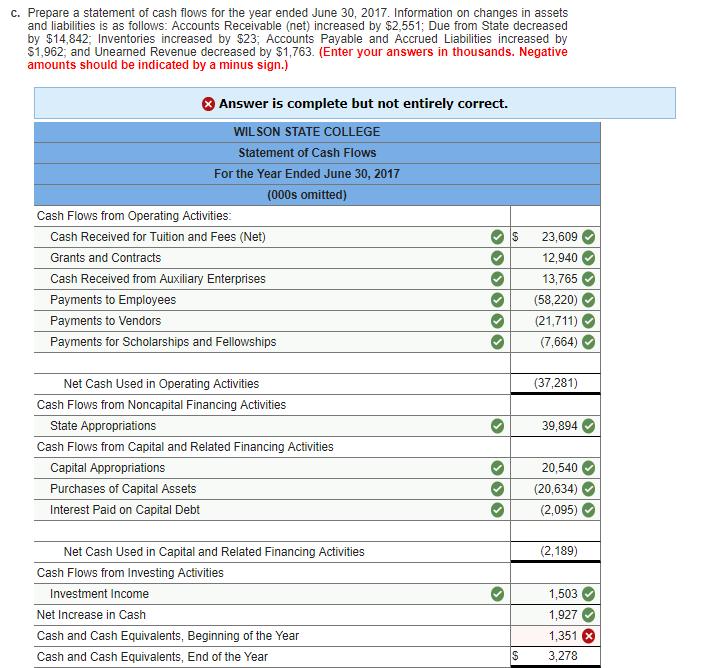

The following balances come from the trial balance of Wilson State College as of the end of the 2017 fiscal year. Cash and Cash Equivalents Investments Accounts Receivable Allowance for Uncollectible Receivables Due from State WILSON STATE COLLEGE Pre-closing Trial Balance June 30, 2017 (000s omitted) Inventories Cash and Cash Equivalents-Restricted Investments-Restricted Depreciable Capital Assets Accumulated Depreciation Nondepreciable Assets Accounts Payable Accrued Liabilities Unearned Revenue Compensated Absences-Current Portion Bonds Payable Compensated Absences Net Position-Net Investment in Capital Assets Net Position-Restricted for Debt Service-Expendable Net Position-Restricted for Capital Projects-Expendable Net Position-Restricted for Endowment-Nonexpendable Net Position-Unrestricted Tuition and Fees Tuition and Fees Discount and Allowances Grants and Contracts Revenue Auxiliary Enterprise Sales Investment Income State Appropriations Capital Appropriations Institutional Support Expenses Academic Support Expenses Scholarships and Fellowships Expense Depreciation Expense Interest Expense Auxiliary Enterprise Expenses Totals $ Debits 3,278 29,387 1,957 79,626 869 6,716 71,883 184,620 89,481 7,565 26,268 58,940 7,664 5,580 378 12.197 Credits $ 137 28,850 2,306 2,039 13.789 1,538 92,116 37,662 158,715 1,157 49,272 39,959 36,559 30,095 18,196 14,595 1,745 44,894 12,785 $586,409 $586,409 Information on Cash and Cash Equivalents Activity Beginning Cash Balance Received Tuition and Fees (net) Received Grants and Contracts Received from Auxiliary Enterprises Payments to Employees Payments to Vendors Payments to Students for Scholarships and Fellowships Received State Appropriations Received Capital Appropriations Purchase of Capital Assets Interest Paid on Debt Interest Income $ 8,067 23,609 12.940 13,765 58,220 21,711 7,664 39,894 20,540 20,634 2,095 1,503 c. Prepare a statement of cash flows for the year ended June 30, 2017. Information on changes in assets and liabilities is as follows: Accounts Receivable (net) increased by $2,551; Due from State decreased by $14,842; Inventories increased by $23; Accounts Payable and Accrued Liabilities increased by $1,962, and Unearned Revenue decreased by $1,763. (Enter your answers in thousands. Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. WILSON STATE COLLEGE Statement of Cash Flows For the Year Ended June 30, 2017 (000s omitted) Cash Flows from Operating Activities: Cash Received for Tuition and Fees (Net) Grants and Contracts Cash Received from Auxiliary Enterprises Payments to Employees Payments to Vendors Payments for Scholarships and Fellowships Net Cash Used in Operating Activities Cash Flows from Noncapital Financing Activities State Appropriations Cash Flows from Capital and Related Financing Activities Capital Appropriations Purchases of Capital Assets Interest Paid on Capital Debt Net Cash Used in Capital and Related Financing Activities Cash Flows from Investing Activities Investment Income Net Increase in Cash Cash and Cash Equivalents, Beginning of the Year Cash and Cash Equivalents, End of the Year $ $ 23,609 12,940 13,765 (58,220) (21,711) (7,664) (37,281) 39,894 20,540 (20,634) (2,095) (2,189) 1,503 1,927 1,351 3,278

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question Cash flows from investing Acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started