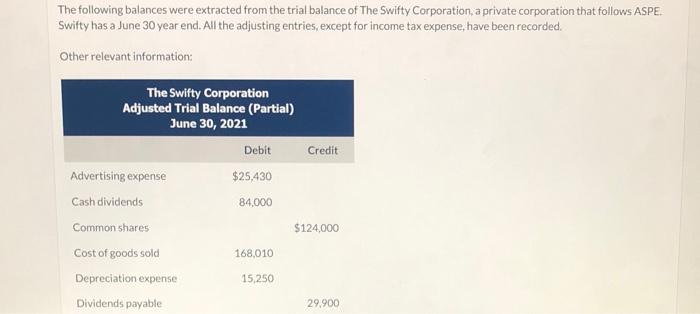

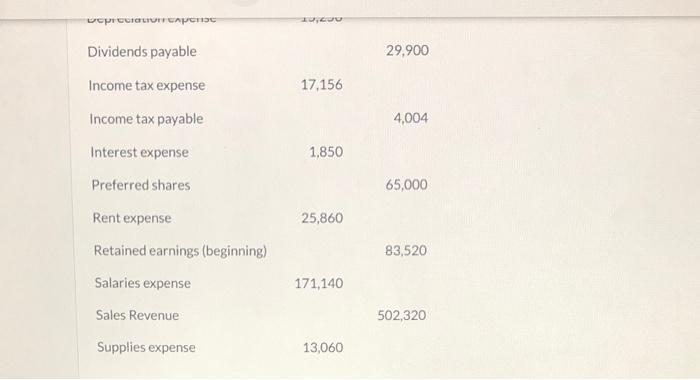

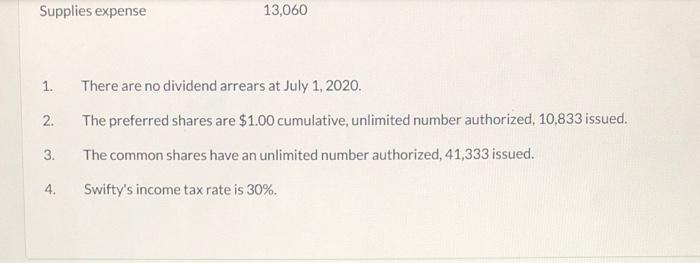

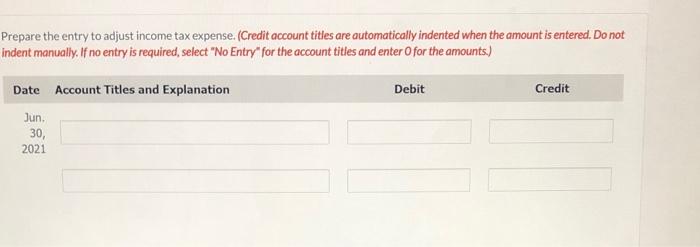

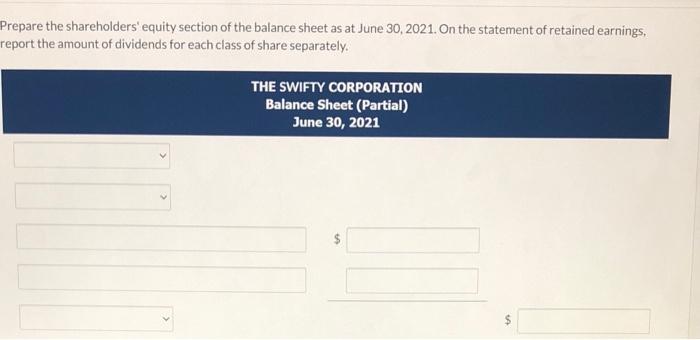

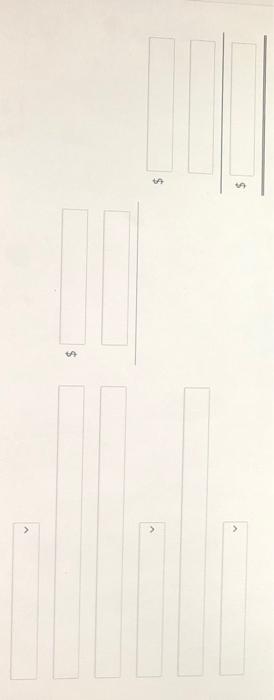

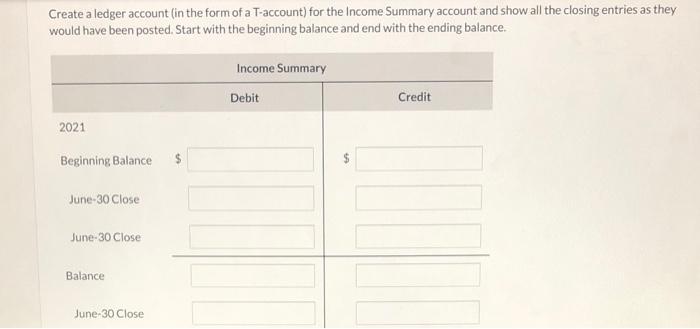

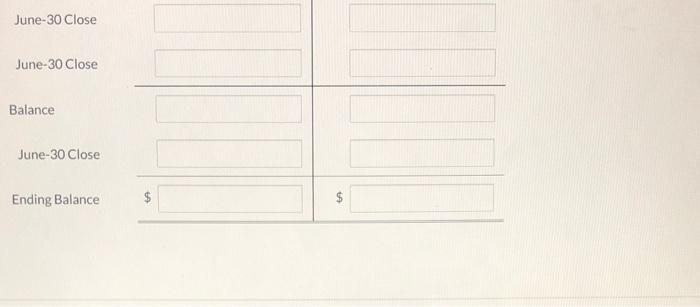

The following balances were extracted from the trial balance of The Swifty Corporation, a private corporation that follows ASPE Swifty has a June 30 year end. All the adjusting entries, except for income tax expense, have been recorded. Other relevant information: The Swifty Corporation Adjusted Trial Balance (Partial) June 30, 2021 Debit Credit Advertising expense $25,430 Cash dividends 84,000 Common shares $124,000 Cost of goods sold 168,010 Depreciation expense 15.250 Dividends payable 29.900 29,900 17,156 Dividends payable Income tax expense Income tax payable Interest expense Preferred shares 4,004 1,850 65,000 25,860 Rent expense Retained earnings (beginning) Salaries expense 83,520 171,140 Sales Revenue 502,320 Supplies expense 13,060 Supplies expense 13,060 1. 2. There are no dividend arrears at July 1, 2020. The preferred shares are $1.00 cumulative, unlimited number authorized, 10,833 issued. The common shares have an unlimited number authorized, 41,333 issued. Swifty's income tax rate is 30%. 3. 4. Prepare the entry to adjust income tax expense. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Jun. 30, 2021 Prepare a multiple-step income statement for the year ended June 30,2021. THE SWIFTY CORPORATION Income Statement Year Ended June 30, 2021 $ Prepare a statement of retained earnings at June 30, 2021. On the statement of retained earnings, report the amount of dividends for each class of share separately. (List items that increase retained earnings first.) THE SWIFTY CORPORATION Statement of Retained Earnings Year ended June 30, 2021 A > Prepare the shareholders' equity section of the balance sheet as at June 30, 2021. On the statement of retained earnings, report the amount of dividends for each class of share separately. THE SWIFTY CORPORATION Balance Sheet (Partial) June 30, 2021 $ > Create a ledger account (in the form of a T-account) for the Income Summary account and show all the closing entries as they would have been posted. Start with the beginning balance and end with the ending balance. Income Summary Debit Credit 2021 Beginning Balance June 30 Close June-30 Close Balance June 30 Close June-30 Close June-30 Close Balance June-30 Close Ending Balance $