Answered step by step

Verified Expert Solution

Question

1 Approved Answer

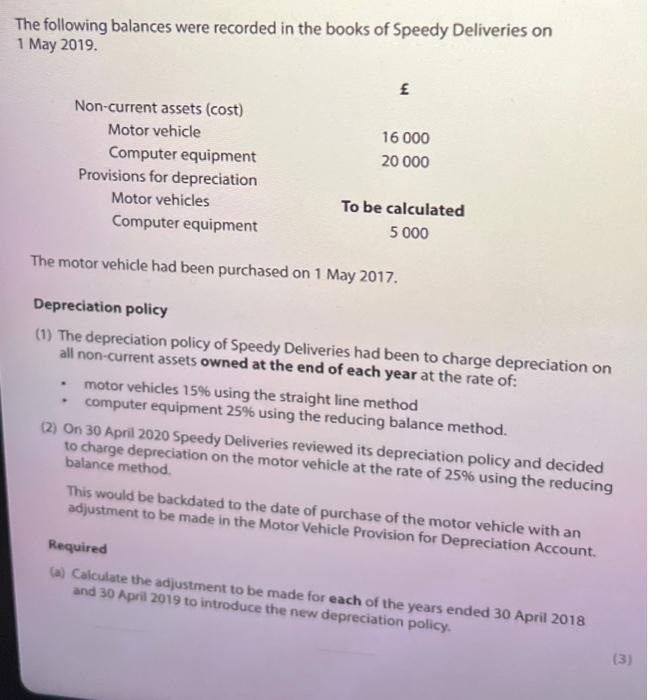

The following balances were recorded in the books of Speedy Deliveries on 1 May 2019. Non-current assets (cost) Motor vehicle Computer equipment Provisions for depreciation

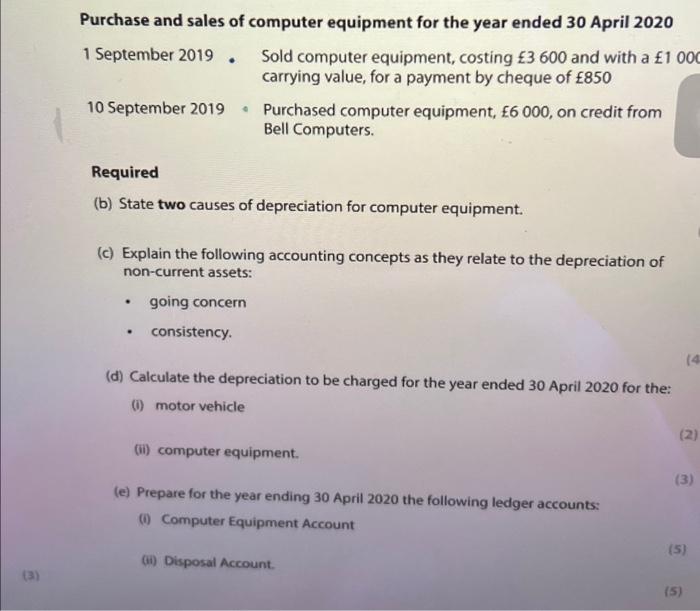

The following balances were recorded in the books of Speedy Deliveries on 1 May 2019. Non-current assets (cost) Motor vehicle Computer equipment Provisions for depreciation . Motor vehicles Computer equipment 16 000 20 000 The motor vehicle had been purchased on 1 May 2017. To be calculated 5 000 Depreciation policy (1) The depreciation policy of Speedy Deliveries had been to charge depreciation on all non-current assets owned at the end of each year at the rate of: motor vehicles 15% using the straight line method computer equipment 25% using the reducing balance method. (2) On 30 April 2020 Speedy Deliveries reviewed its depreciation policy and decided to charge depreciation on the motor vehicle at the rate of 25% using the reducing balance method. This would be backdated to the date of purchase of the motor vehicle with an adjustment to be made in the Motor Vehicle Provision for Depreciation Account. Required (a) Calculate the adjustment to be made for each of the years ended 30 April 2018 and 30 April 2019 to introduce the new depreciation policy. (3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started