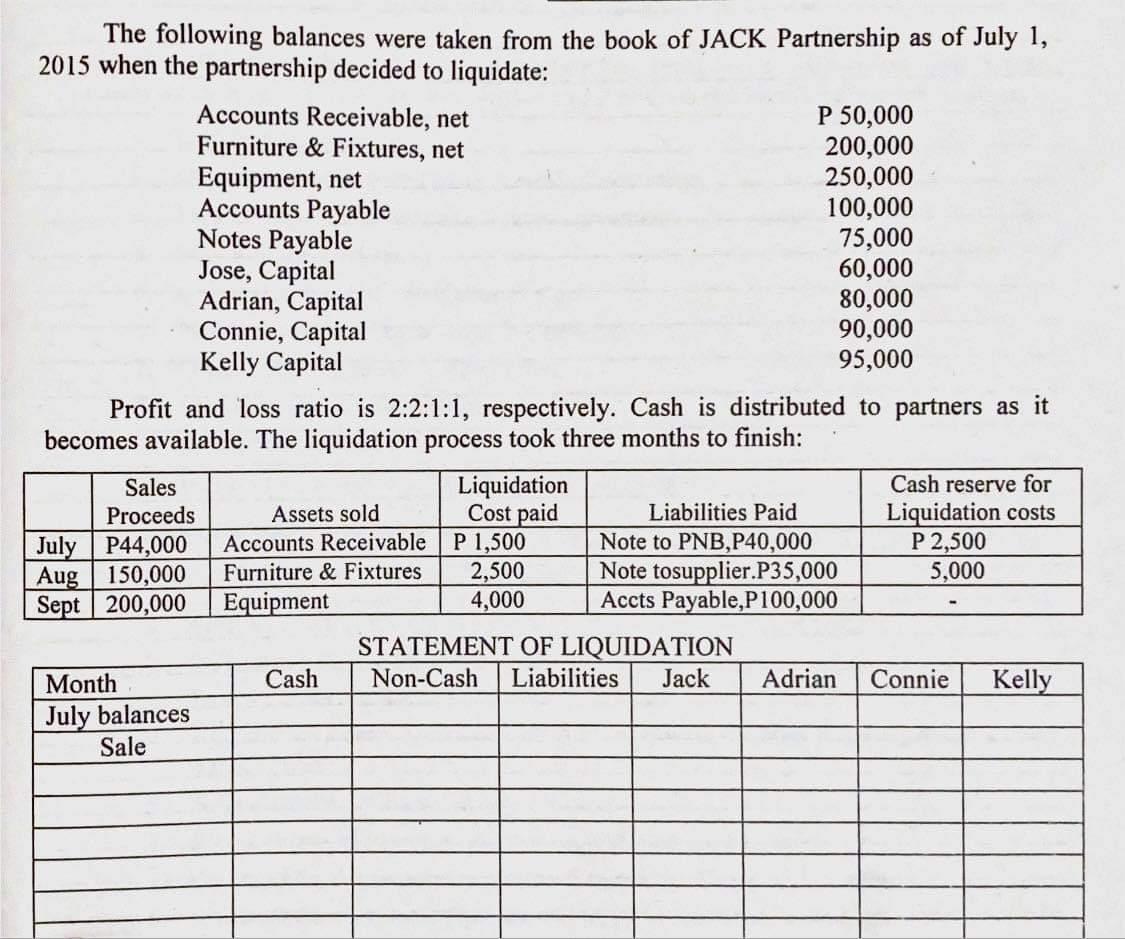

The following balances were taken from the book of JACK Partnership as of July 1, 2015 when the partnership decided to liquidate: Accounts Receivable,

The following balances were taken from the book of JACK Partnership as of July 1, 2015 when the partnership decided to liquidate: Accounts Receivable, net Furniture & Fixtures, net Sales Proceeds July P44,000 Aug 150,000 Sept 200,000 Month July balances Sale Equipment, net Accounts Payable Notes Payable Jose, Capital Profit and loss ratio is 2:2:1:1, respectively. Cash is distributed to partners as it becomes available. The liquidation process took three months to finish: Adrian, Capital Connie, Capital Kelly Capital Assets sold Accounts Receivable Furniture & Fixtures Equipment Cash Liquidation Cost paid P 1,500 P 50,000 200,000 250,000 100,000 75,000 60,000 80,000 90,000 95,000 2,500 4,000 Liabilities Paid Note to PNB,P40,000 Note tosupplier.P35,000 Accts Payable, P100,000 Cash reserve for Liquidation costs P 2,500 5,000 STATEMENT OF LIQUIDATION Non-Cash Liabilities Jack Adrian Connie Kelly REQUIRED: Prepare the following: A. STATEMENT OF LIQUIDATION B. Corresponding JOURNAL ENTRIES

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Statement of Liquidation July August September Cash Distribution to Partners Jack Adrian Conn...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started