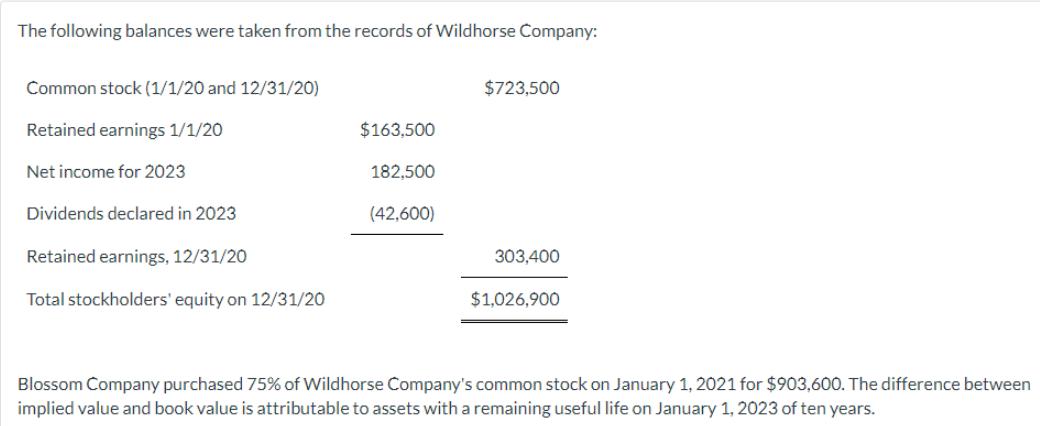

The following balances were taken from the records of Wildhorse Company: Common stock (1/1/20 and 12/31/20) Retained earnings 1/1/20 Net income for 2023 Dividends

The following balances were taken from the records of Wildhorse Company: Common stock (1/1/20 and 12/31/20) Retained earnings 1/1/20 Net income for 2023 Dividends declared in 2023 Retained earnings, 12/31/20 Total stockholders' equity on 12/31/20 $163,500 182,500 (42,600) $723,500 303,400 $1,026,900 Blossom Company purchased 75% of Wildhorse Company's common stock on January 1, 2021 for $903,600. The difference between implied value and book value is attributable to assets with a remaining useful life on January 1, 2023 of ten years. Compute the difference between cost/(implied) and book value applying: 1. Parent company theory. Economic unit theory. 2. Assuming the economic unit theory: 1. Compute noncontrolling interest in consolidated income for 2023. 2. Compute noncontrolling interest in net assets on December 31, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the difference between cost implied and book value for Wildhorse Company applying both the Parent Company Theory and the Economic Unit ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started