Answered step by step

Verified Expert Solution

Question

1 Approved Answer

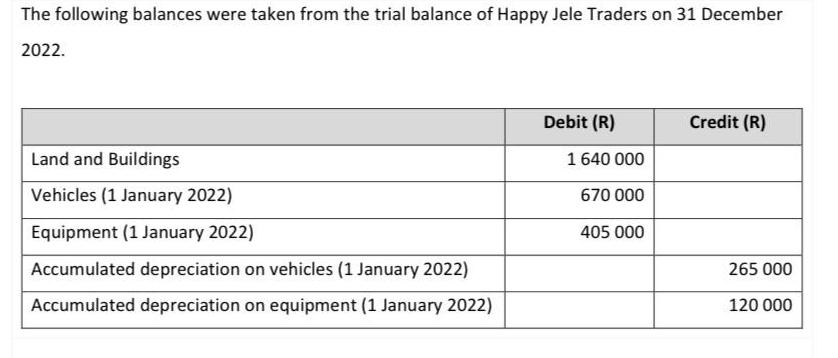

The following balances were taken from the trial balance of Happy Jele Traders on 31 December 2022. Land and Buildings Vehicles (1 January 2022)

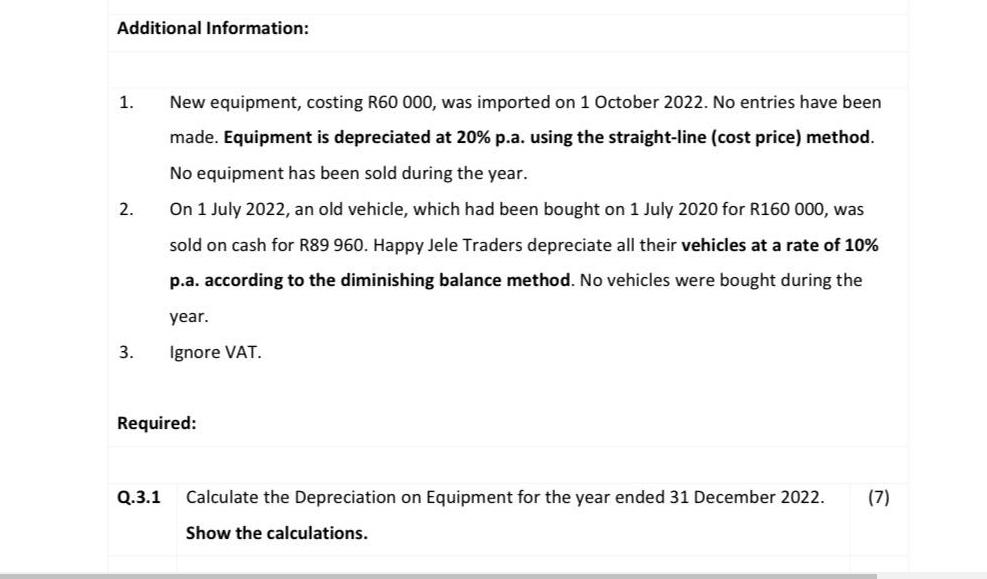

The following balances were taken from the trial balance of Happy Jele Traders on 31 December 2022. Land and Buildings Vehicles (1 January 2022) Equipment (1 January 2022) Accumulated depreciation on vehicles (1 January 2022) Accumulated depreciation on equipment (1 January 2022) Debit (R) 1 640 000 670 000 405 000 Credit (R) 265 000 120 000 Additional Information: 1. 2. 3. New equipment, costing R60 000, was imported on 1 October 2022. No entries have been made. Equipment is depreciated at 20% p.a. using the straight-line (cost price) method. No equipment has been sold during the year. On 1 July 2022, an old vehicle, which had been bought on 1 July 2020 for R160 000, was sold on cash for R89 960. Happy Jele Traders depreciate all their vehicles at a rate of 10% p.a. according to the diminishing balance method. No vehicles were bought during the year. Ignore VAT. Required: Q.3.1 Calculate the Depreciation on Equipment for the year ended 31 December 2022. (7) Show the calculations. Q.3.2 Complete the Depreciation Schedule provided in the answer booklet for the Vehicle sold on 1 July 2022. Show the calculations. Q.3.3 Prepare the Assets Disposal Account in the General Ledger on 1 July 2022. Show the calculations. Q.3.4 Calculate the carrying value of Equipment for the year ended 31 December 2022. Show the calculations. The following balances were taken from the trial balance of Happy Jele Traders on 31 December 2022. Land and Buildings Vehicles (1 January 2022) Equipment (1 January 2022) Accumulated depreciation on vehicles (1 January 2022) Accumulated depreciation on equipment (1 January 2022) Debit (R) 1 640 000 670 000 405 000 Credit (R) 265 000 120 000 Additional Information: 1. 2. 3. New equipment, costing R60 000, was imported on 1 October 2022. No entries have been made. Equipment is depreciated at 20% p.a. using the straight-line (cost price) method. No equipment has been sold during the year. On 1 July 2022, an old vehicle, which had been bought on 1 July 2020 for R160 000, was sold on cash for R89 960. Happy Jele Traders depreciate all their vehicles at a rate of 10% p.a. according to the diminishing balance method. No vehicles were bought during the year. Ignore VAT. Required: Q.3.1 Calculate the Depreciation on Equipment for the year ended 31 December 2022. (7) Show the calculations. Q.3.2 Complete the Depreciation Schedule provided in the answer booklet for the Vehicle sold on 1 July 2022. Show the calculations. Q.3.3 Prepare the Assets Disposal Account in the General Ledger on 1 July 2022. Show the calculations. Q.3.4 Calculate the carrying value of Equipment for the year ended 31 December 2022. Show the calculations.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Q31 Calculate the Depreciation on Equipment for the year ended 31 December 2022 Show the calculations To calculate the depreciation on equipment we need to determine the depreciation expense for the y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started