Question

The following budgeted information was provided by sentinel enterprises. The expected bank balance of the 31 October 2021 is R20 000 (Favourable) Credit sales are

The following budgeted information was provided by sentinel enterprises.

The expected bank balance of the 31 October 2021 is R20 000 (Favourable)

Credit sales are forecast as follows

October 2021: R280 000

November 2021: R240 000

December 2021: R320 000

Credit sales are normally collected as follows.

30% in the month in which the transaction takes place and these debtors are entitled to a 5% discount .

70% in the following month.

Cash sales usually make up 60% of the total sales. The balance of the sales is in credit

Purchases of inventory for resale (excluding discounts) are as follows:

CREDIT PURCHASES

October Credit purchases: R200 000

November Credit Purchases: R400 000

December credit purchases:

CASH PURCHASES

October cash purchases: R150 000

November cash purchases: R200 000

December cash purchases: R140 000

Creditors are paid in the month after the purchase. 30% of the cash purchases is from suppliers who grant a 10% discount.

The salaries for December 2021 are expected to amount to R167200, after a 10% increase takes effect from 1 December 2021

Interest @ 15% per annum is payable on the loan at the end of each month. The loan balance on 1 November 2021 is expected to be R240 000 and capital repayments of R10 000 per month are also payable at the end of each month.

Part of the building is sublet to a tenant. The lease agreement for the year ended 30 November 2021 reflected the rental @ R96 000 per annum. The rental will increase by 10% on 1 Decemeber 2021. Rent is payable monthly.

Other cash operating expenses are budgeted @ R40 000

For October 2021. These expenses are expected to increase by 5% each month.

QUESTION

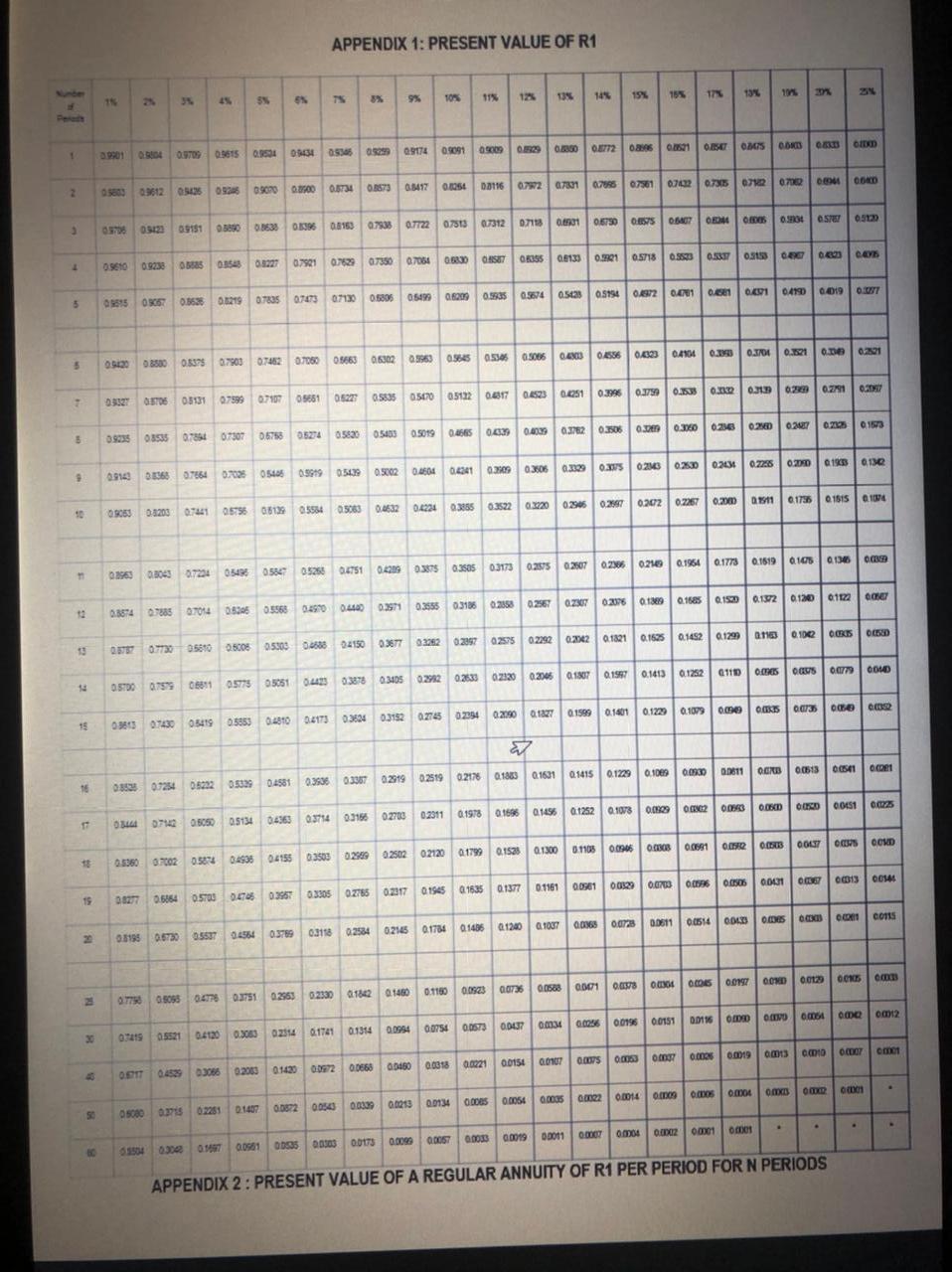

1) Payback period of both projects (expressed in years, months, days)

2) Accounting rate of return (on average investment) of project X (expressed to 2 decimal places).

3) Net present value of each project

4) Internal rate of return of project Y using interpolation ( expressed to 2 decimal places

Additional information:

The initial investment of each project is R400 000, with a useful life of 4 years. The estimated cost of capital is 16%. No scrap values are anticipated for the projects. The straight line method of depreciation is used.

Estimated profits of project X over 4 years are as follows:

Year 1: R70 000

Year 2: R50 000

Year 3: R100 000

Year 4: 30 000

Project Y is expected to generate net cash flows of R140 000 per year over the 4 year period

APPENDIX 1: PRESENT VALUE OF R1 13 14% 15% 15% 171 13% 10% 9% SN 107 1 0.0004 0979 0.9615 0961 01431 0534 033 09174 09091 000 099 0220 ET2 026 01 DESETOMS COME OM 2 09612 00 090 0900 0.000 03734 08573 03477 00054 00116 072 071 070 075610702 073 072 0712 COM CORO 0.51 0312 09151 03 0.1638 OKS 0.0180 0.7538 07722 07513 07312 07118 00 065730 08 0807 M. SPET OS 000 c. 09610 01548 32270791 072 07350 0.7064 BRUN ORSET ORIOS 081310.91 0.7180.53 0.0.31 BGES 4 0.0190 OUT 01219 07835 07073 07130 07130 0.5308 0.5806 0549 0.8009 0.5835 0.5674 0.568 0.595404872 0.1 0.1 0410 0515 035 0.5535 5 0.000291 05:30 08500 0.3375 0.750 0.7462 070600566306302 09863 0.585 0534 0.0006 - 0.556 00323 DANA 0.333 0.21 0.DE 0.2910 033Z OSTOS 05131 0.7107 09851 052 0580505170 05122 041 04823 04251 0.396 0.750 0.5 0.3 0.4 0 0 0527405820 0.5403 05019 0.285 0039 04029 0372 0.3608 0.2 0.3060 0236 0230 030270 01573 0.7307 0.6758 03535 07351 3 091231066 07864 0.7036 05406 0.5919 0549 05439 050020160404041 0.30 03:00 0.2299 0.33 0.21 0.20 0.2034 0.22 0.20 0180130 9 0.5063 0.32 0.4234 0.741 0579808139 0.33 0.35220.2220 0.96 0.28670202 0.2267 0.30 am 017850 1851 90 0.29 0.3173 0.3 0.359 03173 02875 0.2507 0.2386 0216 0.1964 0.17 0.1819010801360 1969 05496058405268 05268 0.4751 03043 07234 CONET 0.4440 031 0355 0.3186 02353 02567 OZN 0.2378 0.18 0.1885 0.15 0.1572 01200112 12 070140335 0.5568 0.490 0857407885 DED 0500805303 05303 04838 02150 0387 0212 02297 02575 0.2292 02342 0.1821 01625 0.1452 0.1299 2180102 ORKES 0.7730 05690 10 03878 057750505104433 03405 020202633 02330 0.2005 0.1307 023200204601807 015570.1413 0.1252 0910 000 000 0040 OSTO 0755 0.759906811 0.2.90 0.12 0.1999 0.1401 0.1229 0.1379 00 OK 0073sowe 15 0.4810 0.4173 0.3634 03634 0.3152 0775 0.2745 02394 09813 07430 0.5419 0.5853 OCD1 02178 0.1833 01631 0.5415 0.1229 0.1009 0.08 0.0810RB 0051054 0.39.36 0.33702919 02519 03538 07254 05232 16 0.33904581 0.3166 0270 02311 0.1918 0.1896 0.1856 0.1252 0.1073 ONS ON2008 OECD CSD COSTS 0:5050 05134 04363 0.4363 0.3714 03503 0.4935 4155 02009 010020582 0.2502 02120 01799 0.1528 0.1300 01100009460.01308 0.081 000 COAT COND 10 O 000010 13 0014 0.3305 0.3957 0.5703 0708 OZ785 0.2317 01945 Q 1635 0.1377 0.1161 0.0961 00129 0.000057% 15 1277 0.5064 OMES C0115 0.001100514 COLD 0.3118 0.2165 01734 0.1486 0.1240 0.1037 0.036800778 0.2584 0554 18 08195 05537 0.6730 OM 0.012 0.012 OCRESCA 0.5095 0.4 Q.3751 02953 0.2330 0182 01460 0.1180 00823 20738 000 0001 0.4378 OU 0.0 0.0197 om om12 0.0094 0.0756 ODST 0.1314 0034 0.006 0.003600196 0019600151 0.0156 OD OVOGA 00437 07415 0.083 02014 02114 0.1741 05521 0.4120 O 00026 0.0019 omsomo CD cm 0.1430 0072 00450 0.0668 00018 0.0221 0.0156 0.0967 0.0075 000750.00 3066 0.2000 OTT ODES 0.000 m2 0.0014 0001400 0 000 Omo OXB OMX om 0.0056 00339 00213 0.0134 0.1007 0.0572 00543 02251 5000 75 . . ombet Om 0.0004 0.002 001 QBOST 00011 0.0033 0.0019 0.009 0.32 0.1997 00561 00335 00303 0.0173 APPENDIX 2: PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS APPENDIX 1: PRESENT VALUE OF R1 13 14% 15% 15% 171 13% 10% 9% SN 107 1 0.0004 0979 0.9615 0961 01431 0534 033 09174 09091 000 099 0220 ET2 026 01 DESETOMS COME OM 2 09612 00 090 0900 0.000 03734 08573 03477 00054 00116 072 071 070 075610702 073 072 0712 COM CORO 0.51 0312 09151 03 0.1638 OKS 0.0180 0.7538 07722 07513 07312 07118 00 065730 08 0807 M. SPET OS 000 c. 09610 01548 32270791 072 07350 0.7064 BRUN ORSET ORIOS 081310.91 0.7180.53 0.0.31 BGES 4 0.0190 OUT 01219 07835 07073 07130 07130 0.5308 0.5806 0549 0.8009 0.5835 0.5674 0.568 0.595404872 0.1 0.1 0410 0515 035 0.5535 5 0.000291 05:30 08500 0.3375 0.750 0.7462 070600566306302 09863 0.585 0534 0.0006 - 0.556 00323 DANA 0.333 0.21 0.DE 0.2910 033Z OSTOS 05131 0.7107 09851 052 0580505170 05122 041 04823 04251 0.396 0.750 0.5 0.3 0.4 0 0 0527405820 0.5403 05019 0.285 0039 04029 0372 0.3608 0.2 0.3060 0236 0230 030270 01573 0.7307 0.6758 03535 07351 3 091231066 07864 0.7036 05406 0.5919 0549 05439 050020160404041 0.30 03:00 0.2299 0.33 0.21 0.20 0.2034 0.22 0.20 0180130 9 0.5063 0.32 0.4234 0.741 0579808139 0.33 0.35220.2220 0.96 0.28670202 0.2267 0.30 am 017850 1851 90 0.29 0.3173 0.3 0.359 03173 02875 0.2507 0.2386 0216 0.1964 0.17 0.1819010801360 1969 05496058405268 05268 0.4751 03043 07234 CONET 0.4440 031 0355 0.3186 02353 02567 OZN 0.2378 0.18 0.1885 0.15 0.1572 01200112 12 070140335 0.5568 0.490 0857407885 DED 0500805303 05303 04838 02150 0387 0212 02297 02575 0.2292 02342 0.1821 01625 0.1452 0.1299 2180102 ORKES 0.7730 05690 10 03878 057750505104433 03405 020202633 02330 0.2005 0.1307 023200204601807 015570.1413 0.1252 0910 000 000 0040 OSTO 0755 0.759906811 0.2.90 0.12 0.1999 0.1401 0.1229 0.1379 00 OK 0073sowe 15 0.4810 0.4173 0.3634 03634 0.3152 0775 0.2745 02394 09813 07430 0.5419 0.5853 OCD1 02178 0.1833 01631 0.5415 0.1229 0.1009 0.08 0.0810RB 0051054 0.39.36 0.33702919 02519 03538 07254 05232 16 0.33904581 0.3166 0270 02311 0.1918 0.1896 0.1856 0.1252 0.1073 ONS ON2008 OECD CSD COSTS 0:5050 05134 04363 0.4363 0.3714 03503 0.4935 4155 02009 010020582 0.2502 02120 01799 0.1528 0.1300 01100009460.01308 0.081 000 COAT COND 10 O 000010 13 0014 0.3305 0.3957 0.5703 0708 OZ785 0.2317 01945 Q 1635 0.1377 0.1161 0.0961 00129 0.000057% 15 1277 0.5064 OMES C0115 0.001100514 COLD 0.3118 0.2165 01734 0.1486 0.1240 0.1037 0.036800778 0.2584 0554 18 08195 05537 0.6730 OM 0.012 0.012 OCRESCA 0.5095 0.4 Q.3751 02953 0.2330 0182 01460 0.1180 00823 20738 000 0001 0.4378 OU 0.0 0.0197 om om12 0.0094 0.0756 ODST 0.1314 0034 0.006 0.003600196 0019600151 0.0156 OD OVOGA 00437 07415 0.083 02014 02114 0.1741 05521 0.4120 O 00026 0.0019 omsomo CD cm 0.1430 0072 00450 0.0668 00018 0.0221 0.0156 0.0967 0.0075 000750.00 3066 0.2000 OTT ODES 0.000 m2 0.0014 0001400 0 000 Omo OXB OMX om 0.0056 00339 00213 0.0134 0.1007 0.0572 00543 02251 5000 75 . . ombet Om 0.0004 0.002 001 QBOST 00011 0.0033 0.0019 0.009 0.32 0.1997 00561 00335 00303 0.0173 APPENDIX 2: PRESENT VALUE OF A REGULAR ANNUITY OF R1 PER PERIOD FOR N PERIODS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started