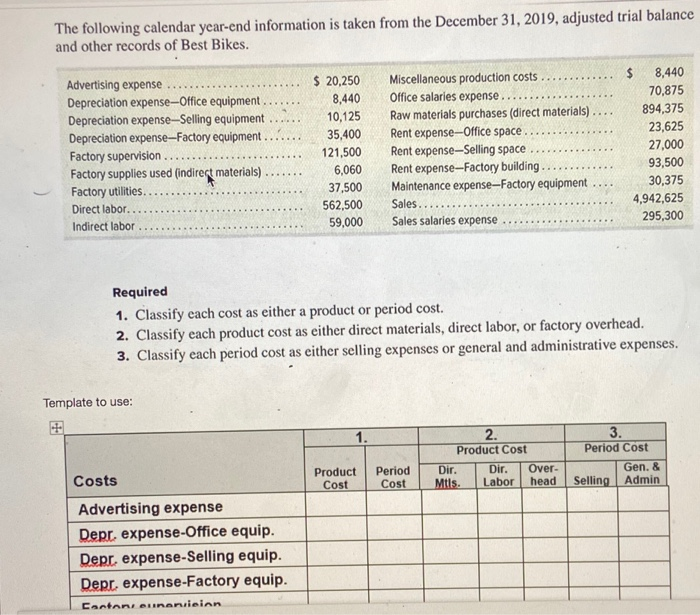

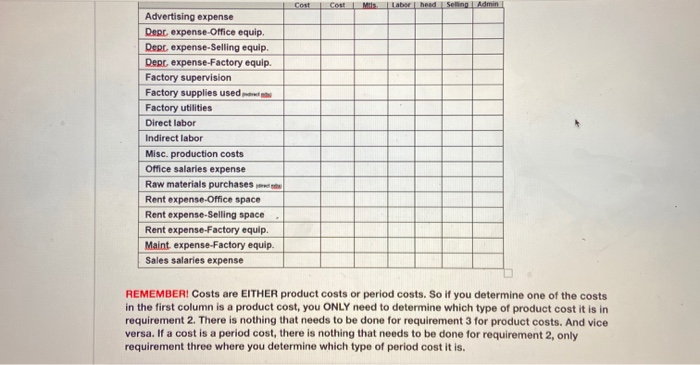

The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Best Bikes. Advertising expense ... Depreciation expense-Office equipment ... Depreciation expense-Selling equipment .. Depreciation expense-Factory equipment...... Factory supervision ......... Factory supplies used (indirect materials) ...... Factory utilities.... Direct labor..... Indirect labor .......... $ 20,250 8,440 10,125 35,400 121,500 6,060 37,500 562,500 59,000 Miscellaneous production costs ......... Office salaries expense......... Raw materials purchases (direct materials).. Rent expense-Office space Rent expense-Selling space ... Rent expense-Factory building ........... Maintenance expense-Factory equipment .. Sales Sales salaries expense..... $ 8,440 70.875 894,375 23,625 27,000 93,500 30,375 4,942,625 295,300 Required 1. Classify each cost as either a product or period cost. 2. Classify each product cost as either direct materials, direct labor, or factory overhead. 3. Classify each period cost as either selling expenses or general and administrative expenses. Template to use: Period Cost Costs Product Cost Period Cost Product Cost Dir. Dir. Over- Mtis. Labor head Selling Gen. & Admin Advertising expense Depr expense-Office equip. Depr, expense-Selling equip. Depr expense-Factory equip. Cartoni unansieinn Advertising expense Derr, expense-Office equip. Depr expense-Selling equip. Derr expense-Factory equip. Factory supervision Factory supplies used Factory utilities Direct labor Indirect labor Misc. production costs Office salaries expense Raw materials purchases Rent expense-Office space Rent expense-Selling space Rent expense-Factory equip. Maint. expense-Factory equip Sales salaries expense REMEMBERI Costs are EITHER product costs or period costs. So if you determine one of the costs in the first column is a product cost, you ONLY need to determine which type of product cost it is in requirement 2. There is nothing that needs to be done for requirement 3 for product costs. And vice versa. If a cost is a period cost, there is nothing that needs to be done for requirement 2. only requirement three where you determine which type of period cost it is