Answered step by step

Verified Expert Solution

Question

1 Approved Answer

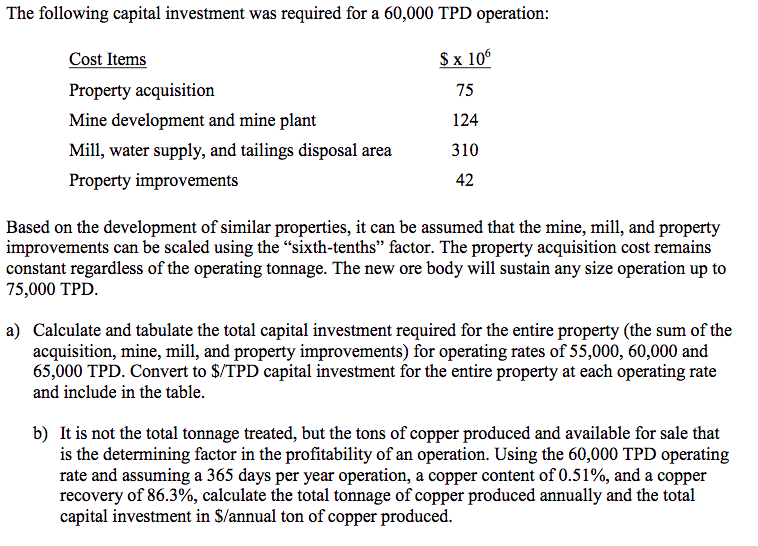

The following capital investment was required for a 60,000 TPD operation:Cost Items$ x 106Property acquisition75Mine development and mine plant124Mill, water supply, and tailings disposal area310Property

The following capital investment was required for a 60,000 TPD operation:Cost Items$ x 106Property acquisition75Mine development and mine plant124Mill, water supply, and tailings disposal area310Property improvements42Based on the development of similar properties, it can be assumed that the mine, mill, and property improvements can be scaled using the sixth-tenths factor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started