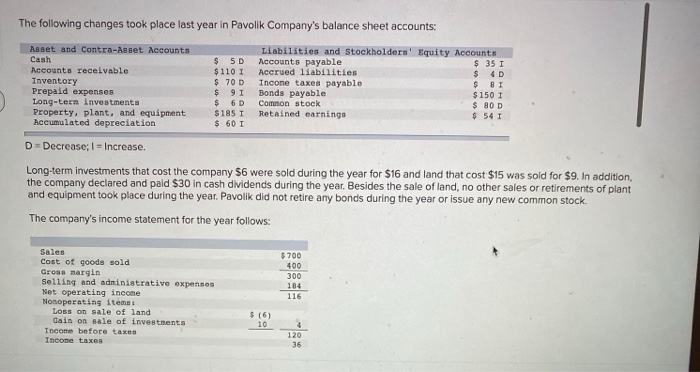

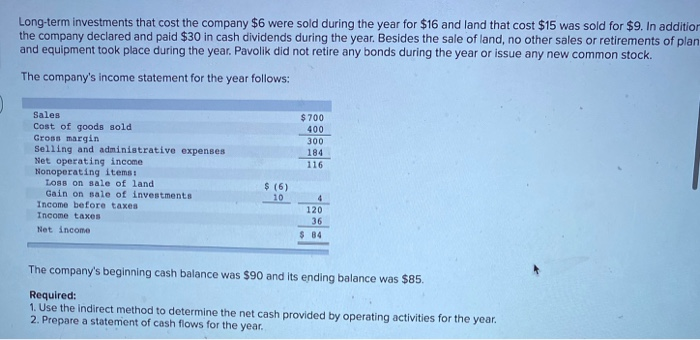

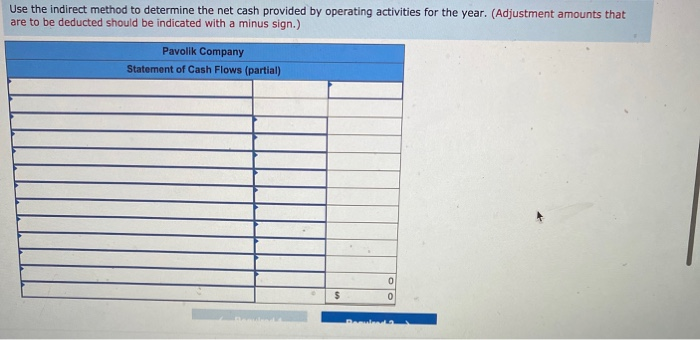

The following changes took place last year in Pavolik Company's balance sheet accounts: Asset and Contra-Asset Accounts Cash Accounts receivable Inventory Prepaid expenses Long-term investments Property, plant, and equipment Accumulated depreciation $ 5D $110 1 $ 70 D $ 91 $ 6D $185 1 $ 60 1 Liabilities and Stockholders' Equity Accounts Accounts payable $ 35 1 Accrued liabilities $ 4D Incone taxes payable $ BI Bonds payable $150 1 Common stock $ 80 D Retained earnings $ 54 1 D = Decrease; 1 - Increase. Long-term investments that cost the company $6 were sold during the year for $16 and land that cost $15 was sold for $9. In addition, the company declared and paid $30 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plant and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company's income statement for the year follows: Sales Cost of goods sold Gross margin Selling and adninistrative expenses Net operating income Nonoperating items Loss on sale of land Gain on sale of investments Income before taxen Income taxes $700 400 300 184 116 $ (6) 10 120 36 Long-term investments that cost the company $6 were sold during the year for $16 and land that cost $15 was sold for $9. In additior the company declared and paid $30 in cash dividends during the year. Besides the sale of land, no other sales or retirements of plan and equipment took place during the year. Pavolik did not retire any bonds during the year or issue any new common stock. The company's income statement for the year follows: $700 400 300 184 116 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Loss on sale of land Gain on sale of investments Income before taxes Income taxes Net income $ (6) 10 4 120 36 $ 84 The company's beginning cash balance was $90 and its ending balance was $85. Required: 1. Use the Indirect method to determine the net cash provided by operating activities for the year. 2. Prepare a statement of cash flows for the year. Use the indirect method to determine the net cash provided by operating activities for the year. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Pavolik Company Statement of Cash Flows (partial) 0 $ 0 Prepare a statement of cash flows for the year. (List any deduction in cash and cash outflows as negative amounts.) Pavolik Company Statement of Cash Flows Operating activities: Investing activities: 0 Financing activities: 0 Beginning cash and cash equivalents Ending cash and cash equivalents $ 0