Answered step by step

Verified Expert Solution

Question

1 Approved Answer

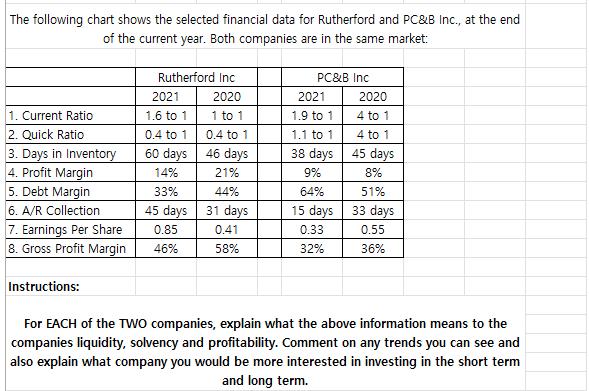

The following chart shows the selected financial data for Rutherford and PC&B Inc., at the end of the current year. Both companies are in

The following chart shows the selected financial data for Rutherford and PC&B Inc., at the end of the current year. Both companies are in the same market: Rutherford Inc PC&B Inc 2021 2020 2021 2020 1. Current Ratio 1.6 to 1 1 to 1 1.9 to 1 4 to 1 2. Quick Ratio 0.4 to 1 0.4 to 1 1.1 to 1 4 to 1 3. Days in Inventory 60 days 46 days 38 days 45 days 4. Profit Margin 14% 21% 9% 8% 5. Debt Margin 33% 44% 64% 51% 6. A/R Collection 45 days 31 days 15 days 33 days 7. Earnings Per Share 0.85 0.41 0.33 0.55 8. Gross Profit Margin 46% 58% 32% 36% Instructions: For EACH of the TWO companies, explain what the above information means to the companies liquidity, solvency and profitability. Comment on any trends you can see and also explain what company you would be more interested in investing in the short term and long term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the financial data for Rutherford Inc and PCB Inc and discuss their liquidity solvency and profitability Rutherford Inc Current Ratio The current ratio measures the companys ability to pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dbf52ea4c5_962727.pdf

180 KBs PDF File

663dbf52ea4c5_962727.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started