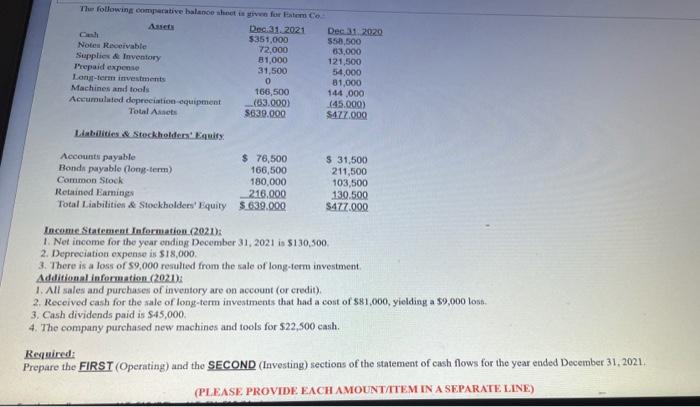

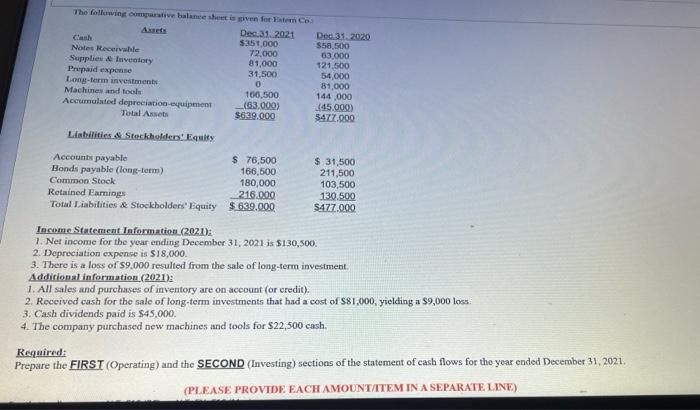

The following comparative balance sheet is given for Extem Co Assets Dec.31.2021 Dec.31.2020 Cash $351,000 $58,500 Notes Receivable 72,000 63,000 Supplies & Inventory Prepaid expense 81,000 121,500 31,500 54,000 Long-term investments 0 81,000 Machines and tools 166,500 144,000 Accumulated depreciation equipment Total Assets (63.000) (45.000) $639.000 $477.000 Liabilities & Steckholders' Equity Accounts payable $ 76,500 $ 31,500 Bonds payable (long-term) 166,500 211,500 Common Stock 180,000 103,500 Retained Earnings 216.000 130.500 Total Liabilities & Stockholders' Equity $.639.000 $477.000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021) 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000, yielding a $9,000 loss. 3. Cash dividends paid is $45,000. 4. The company purchased new machines and tools for $22,500 cash. Required: Prepare the FIRST (Operating) and the SECOND (Investing) sections of the statement of cash flows for the year ended December 31, 2021. (PLEASE PROVIDE EACH AMOUNT/ITEM IN A SEPARATE LINE) The following comparative balance sheet is given for Extern Co Assets Dec.31.2021 $351,000 Cash Dec 31, 2020 $58,500 Notes Receivable 72,000 63,000 81,000 121,500 Supplies & Inventory Prepaid expense Long-term investments Machines and tools 31,500 54,000 0 81,000 166,500 144,000 Accumulated depreciation-equipment Total Assets (63.000) (45.000) $639.000 $477.000 Liabilities & Steckholders' Equity Accounts payable Bonds payable (long-term) Common Stock $ 76,500 166,500 $ 31,500 211,500 180,000 103,500 Retained Earnings 216.000 130.500 Total Liabilities & Stockholders' Equity $.639.000 $477.000 Income Statement Information (2021): 1. Net income for the year ending December 31, 2021 is $130,500. 2. Depreciation expense is $18,000. 3. There is a loss of $9,000 resulted from the sale of long-term investment. Additional information (2021): 1. All sales and purchases of inventory are on account (or credit). 2. Received cash for the sale of long-term investments that had a cost of $81,000, yielding a $9,000 loss. 3. Cash dividends paid is $45,000. 4. The company purchased new machines and tools for $22,500 cash. Required: Prepare the FIRST (Operating) and the SECOND (Investing) sections of the statement of cash flows for the year ended December 31, 2021. (PLEASE PROVIDE EACH AMOUNTATEM IN A SEPARATE LINE)