Answered step by step

Verified Expert Solution

Question

1 Approved Answer

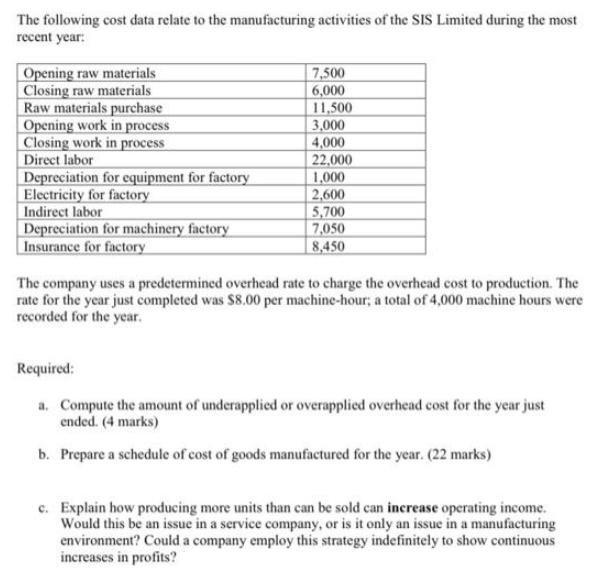

The following cost data relate to the manufacturing activities of the SIS Limited during the most recent year: Opening raw materials Closing raw materials

The following cost data relate to the manufacturing activities of the SIS Limited during the most recent year: Opening raw materials Closing raw materials Raw materials purchase Opening work in process Closing work in process Direct labor Depreciation for cquipment for factory Electricity for factory Indirect labor Depreciation for machinery factory Insurance for factory 7,500 6,000 11,500 3,000 4,000 22,000 1,000 2,600 |5,700 7,050 8,450 The company uses a predetermined overhead rate to charge the overhead cost to production. The rate for the year just completed was $8.00 per machine-hour; a total of 4,000 machine hours were recorded for the year. Required: a. Compute the amount of underapplied or overapplied overhead cost for the year just ended. (4 marks) b. Prepare a schedule of cost of goods manufactured for the year. (22 marks) c. Explain how producing more units than can be sold can increase operating income. Would this be an issue in a service company, or is it only an issue in a manufacturing environment? Could a company employ this strategy indefinitely to show continuous increases in profits?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Actual overhead Depreciation for equipment for factory 1000 Electricity for factory 2600 Indirect labor 5700 Depreciation for machinery facto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started