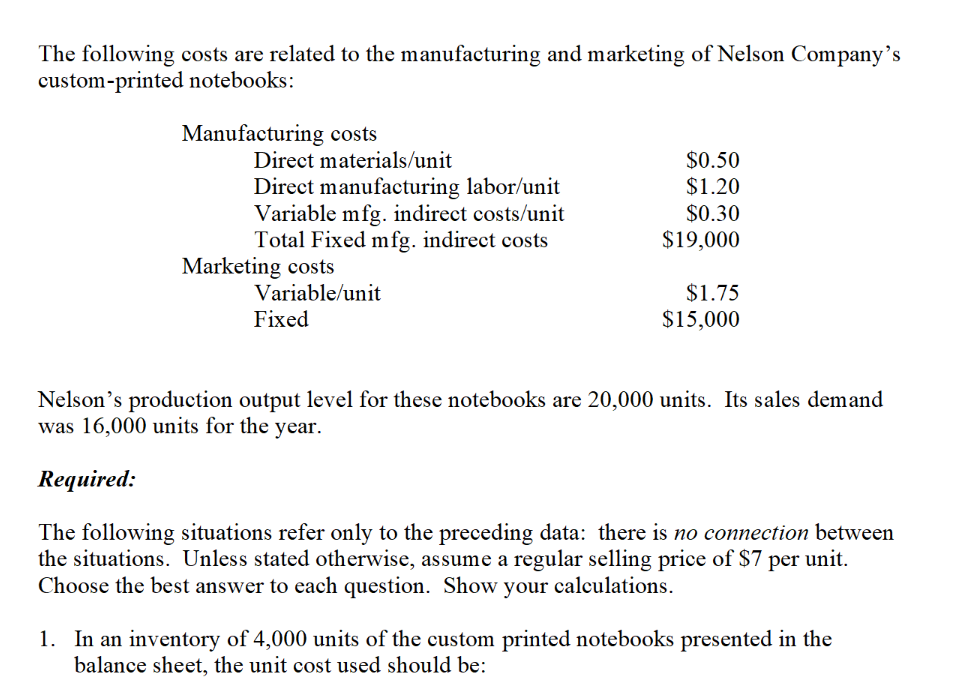

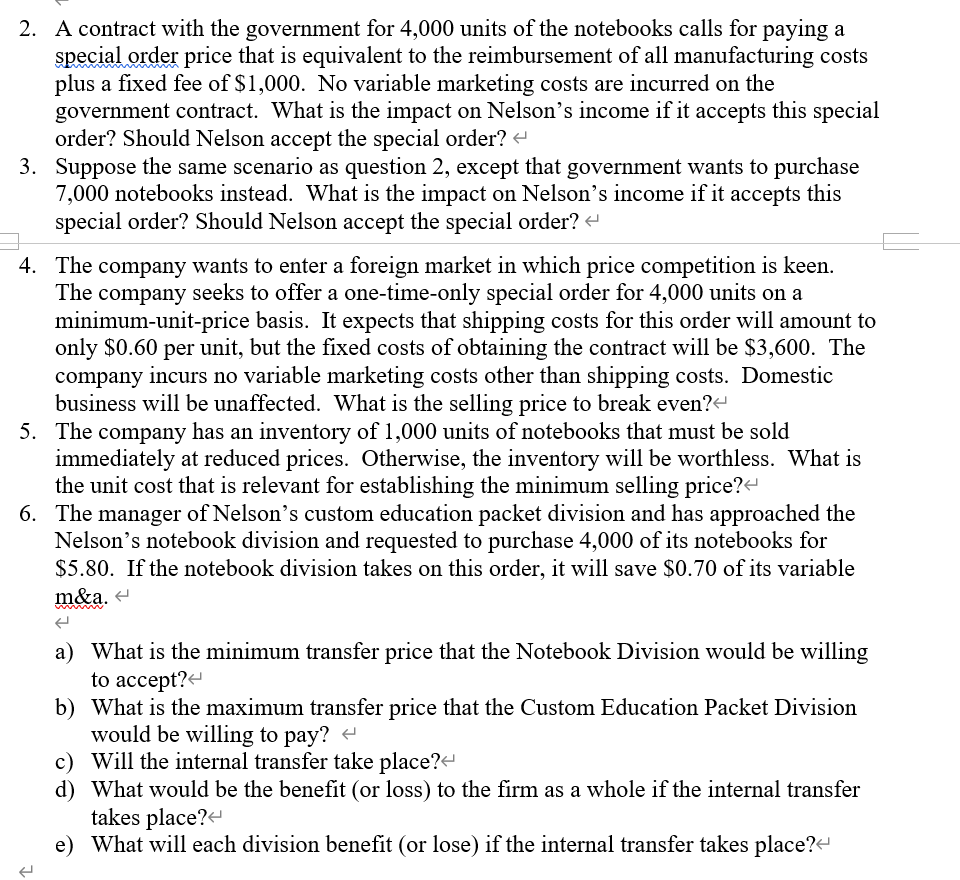

The following costs are related to the manufacturing and marketing of Nelson Company's custom-printed notebooks: Manufacturing costs Direct materials/unit Direct manufacturing labor/unit Variable mfg. indirect costs/unit Total Fixed mfg. indirect costs Marketing costs Variable/unit Fixed $0.50 $1.20 $0.30 $19,000 $1.75 $15,000 Nelson's production output level for these notebooks are 20,000 units. Its sales demand was 16,000 units for the year. Required: The following situations refer only to the preceding data: there is no connection between the situations. Unless stated otherwise, assume a regular selling price of $7 per unit. Choose the best answer to each question. Show your calculations. 1. In an inventory of 4,000 units of the custom printed notebooks presented in the balance sheet, the unit cost used should be: 2. A contract with the government for 4,000 units of the notebooks calls for paying a special order price that is equivalent to the reimbursement of all manufacturing costs plus a fixed fee of $1,000. No variable marketing costs are incurred on the government contract. What is the impact on Nelson's income if it accepts this special order? Should Nelson accept the special order? 3. Suppose the same scenario as question 2, except that government wants to purchase 7,000 notebooks instead. What is the impact on Nelson's income if it accepts this special order? Should Nelson accept the special order? 4. The company wants to enter a foreign market in which price competition is keen. The company seeks to offer a one-time-only special order for 4,000 units on a minimum-unit-price basis. It expects that shipping costs for this order will amount to only $0.60 per unit, but the fixed costs of obtaining the contract will be $3,600. The company incurs no variable marketing costs other than shipping costs. Domestic business will be unaffected. What is the selling price to break even? 5. The company has an inventory of 1,000 units of notebooks that must be sold immediately at reduced prices. Otherwise, the inventory will be worthless. What is the unit cost that is relevant for establishing the minimum selling price? The manager of Nelson's custom education packet division and has approached the Nelson's notebook division and requested to purchase 4,000 of its notebooks for $5.80. If the notebook division takes on this order, it will save $0.70 of its variable m&a. a) What is the minimum transfer price that the Notebook Division would be willing to accept? b) What is the maximum transfer price that the Custom Education Packet Division would be willing to pay? 4 c) Will the internal transfer take place? d) What would be the benefit (or loss) to the firm as a whole if the internal transfer takes place? e) What will each division benefit (or lose) if the internal transfer takes place